3 Unique Ways to Play This Historic Melt-Up

Earlier this week, I asked this question in The War Room…

How long can this melt-up last?

The answer…

A lot longer than anyone expects.

This prompted me to introduce a new strategy – a strategy I’d like to share with you here, right now in today’s Trade of the Day.

It goes like this…

Let’s assume for a moment that we are indeed close to a “blow-off top” in the markets.

If that’s the case – then why don’t we really lean into it?

In other words, let’s play some stocks that can really amplify a final blow-off rally.

What could that group look like?

Well, look no further than the group of high short interest stocks.

“Short interest” is the number of shares that have been sold short – but have not yet been covered (or closed out).

So it’s logical to conclude that stocks with a high short interest are ones that the majority of investors are bearish on (meaning they think these stocks will go down).

But here’s the interesting part…

When investors get overly pessimistic, that can often lead to the exact opposite effect.

You see, abnormally large short interest could actually lead to a very sharp price increase.

It may sound counterintuitive – but it’s an event known as a “short squeeze.”

A short squeeze is a situation where a heavily shorted stock moves higher, which then forces the short sellers to close out their short positions – thus adding even more to the upward trajectory of that stock.

And right now, based on where the market is trading, I think that we could see many of these short squeeze situations taking place.

Here’s how you can capitalize…

Earlier this week, I ran a scan for high short interest stocks – and here are three that came to my attention:

- Peloton: 47 million shares short

- Match Group: 31 million shares short

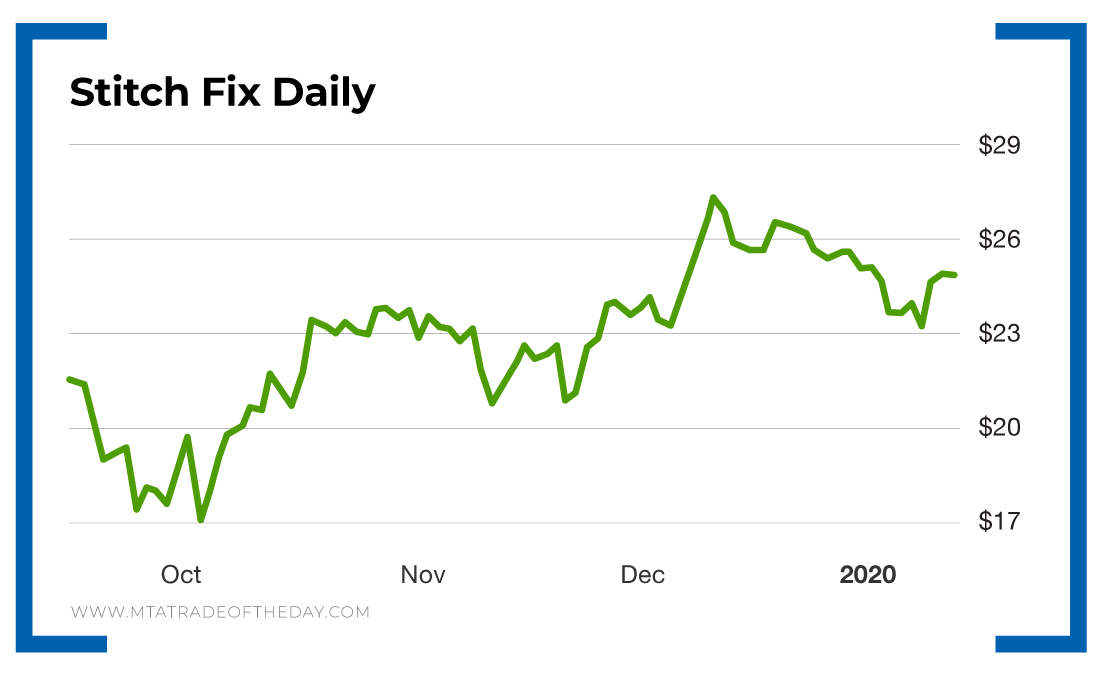

- Stitch Fix: 23 million shares short.

Action Plan: I’m sure longtime War Room members would recognize all three names – as we’ve successfully played them all before.

Going forward, if the markets want to continue zooming higher, then it now makes sense to track these high short interest names – because amplifying the final blow-off move could be a lucrative trading tactic in the weeks ahead. To experience this trading strategy, and more, join me in The War Room today!

More from Trade of the Day

Palantir Is About to Collapse. Again.

Feb 13, 2026

How I’m Playing the Dollar’s 10% Drop

Feb 12, 2026

My Complete Checklist for TPS Trades

Feb 10, 2026