Bank Shatters Income Record

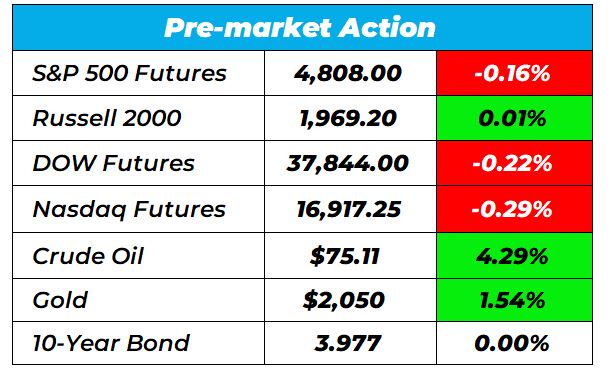

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures were down on Friday after a volatile week. Expectations of the Federal Reserve being done hiking interest rates in 2024 are still in place after faster-than-expected inflation data on Thursday. Also, oil saw a 4% surge following the launch of joint military strikes by the US and its allies against Houthi rebels in Yemen.

Our Lead Technical Tactician Nate Bear made a play an oil play on Marathon Petroleum Corporation yesterday in Daily Profits Live.

Click here to unlock Nate’s trades.

Here’s a look at the top-moving stocks this morning.

UnitedHealth Group Incorporated (NYSE: UNH)

UnitedHealth Group Incorporated (UNH) is down 4.58% premarket after its latest earnings report. The healthcare company’s earnings per share (EPS) for the quarter ending December 31, 2023, was $5.98, representing an 11.99% increase from the same quarter last year. This beat has placed UNH in a strong position compared to its competitors in the industry, with a higher earnings growth and positive market sentiment.

JP Morgan Chase & Co. (NYSE: JPM)

JP Morgan is up 1.76% in premarket trading. The banking giant reported $49.6 billion in annual net income, which was the most ever in American history for a bank. It blew away all rivals, including Bank of America (BAC) by $23 billion and Wells Fargo (WFC) by $30 billion. However, analysts don’t expect the bank to earn as much in 2024 as it did in 2023, dropping estimated profits to $45 billion.

Earnings season provides major catalysts for several stocks to go up or down. The problem is it’s tough to know if a stock will go higher or lower on earnings. However, our Lead Technical Tactician Nate Bear has a strategy that involves making trades on ONE TICKER immediately AFTER earnings for maximum potential profit.

Click here to get access to Nate’s next ONE TICKER trade on Wednesday, January 17.

Bank of America (NYSE: BAC)

Bank of America is down 0.72% premarket after showing its revenue fell 10% to $21.99 billion according to its latest earnings report. Analysts expected $23.7 billion. Overall, the nation’s second-largest bank earned $3.14 billion, down 56% from $7.13 billion a year earlier.

Wells Fargo (NYSE: WFC)

Wells Fargo is down 1.51% premarket despite seeing a 9% rise in profits. Its revenue was dragged down by a historic settlement with the Consumer Financial Protection Bureau over allegations that Wells Fargo’s loan and deposit products harmed millions of customers.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026