Chip Demand Grows…

Attention Traders: It’s Thursday and our Head Trading Tactician Bryan Bottarelli has a special bonus video for you. Today he’s talking about an important method that will teach you how to trade stock and options in real time to grow your confidence. Click the image below to learn more.

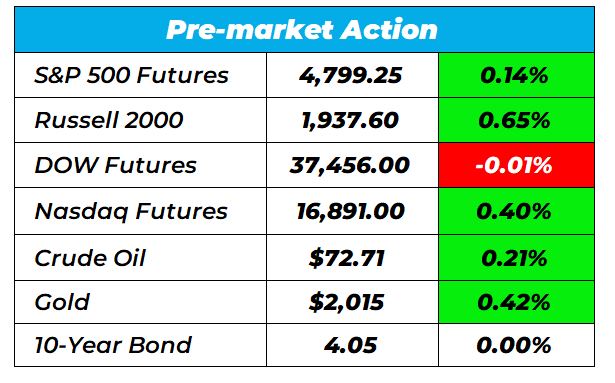

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures gained on Thursday. Traders are coming to grips with the idea that interest rate cuts could be delayed beyond the first quarter. Now the focus shifts to earnings as several tech companies report today (more on those below.)

As we get further into earnings season, it’s crucial to know one specific strategy that could help you make gains in the market regardless of the stock’s direction. Our Head Trading Tactician Bryan Bottarelli uses a simple trading method that allows him to make one trade for potential gains in less than 24 hours.

Click here to learn how Bryan’s overnight trading strategy works.

Here’s a look at the top-moving stocks this morning.

Taiwan Semiconductor (NYSE: TSM)

Taiwan Semiconductor is up 7.98% in premarket trading after the chipmaker gave a bullish forecast. The chip foundry giant predicted more than 20% revenue growth in 2024, fueled by demand for artificial intelligence chips.

Boeing (NYSE: BA)

Boeing is up 1.15% in premarket trading after the airline maker received a big order for more MAX Jets. Boeing secured orders for 150 total planes, which was a boost considering the stock had been struggling due to safety and grounding issues.

For more information on this developing story and how Karim and Bryan are playing it, check out yesterday’s edition of Trade of the Day Plus.

Advanced Micro Devices (Nasdaq: AMD)

Advanced Micro Devices is up 3.03% premarket. The boost came as demand for its EPYC processors grows. The company will report earnings on January 30, 2024 and expectations are high. Revenues are projected to hit $6.11 billion, a 9.2% increase from the previous years. Plus the current Zacks rank of #2 (buy) is further bolstering investor optimism.

Yesterday Our Lead Technical Tactician Nate Bear closed a 94.40% winner on AMD in Daily Profits Live in 1 trading day.

Click here to start following along with Nate’s trades in real time.

Plug Power (Nasdaq: PLUG)

Plug Power is down 16% in premarket trading. This drop came after the company filed for a potential $1 billion share offering. Investors are concerned about the dilution of shares and the potential impact on the company’s value. Over the last two years, Plug Power’s stock has declined over 88%, indicating ongoing challenges and investor skepticism about the company’s financial strategies and market position.

Discovery Financial Services (Nasdaq: DFS)

Discovery Financial Services is down 10.59% premarket after reporting a significant decrease in fourth-quarter profit, primarily due to increased provisions for bad loans. The company’s profit for the quarter fell 62%, with net income dropping to $388 million, or $1.54 per share, compared to $1.03 billion, or $3.74 per share, a year earlier. This decline was largely attributed to a higher provision for credit losses, which increased to $1.91 billion from $883 million the previous year.

Draftkings (Nasdaq: DKNG)

DraftKings is DraftKings Inc. (NASDAQ: DKNG) is up 3% in premarket trading due to several factors. For one, it received positive analyst sentiment with an average brokerage recommendation leaning strongly towards a buy. It’s also seeing increased confidence from institutional investors, notably a 7.7% stake increase by the Bank of New York Mellon Corp. Lastly, the sports betting giant announced a partnership with TUMS® and comedian Desus Nice for the TUMS® Prop Bites.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

The one retailer laughing at tariff headlines

Feb 25, 2026

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026