Wow Meta…

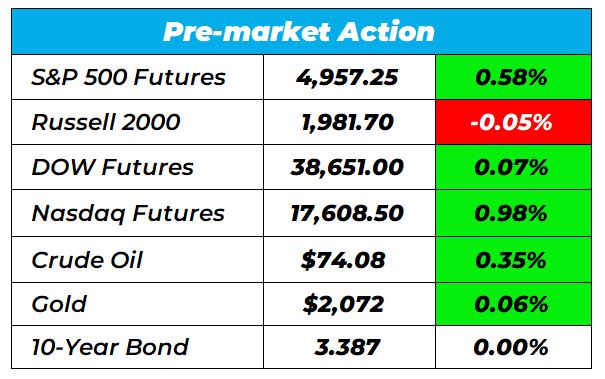

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures rose on Friday, driven by blowout earnings from big tech (more on that below). Keeping with the big theme, big oil also saw a boost, with giants Chevron and Exxon shares rising after both beat profit expectations. Next, investors will parse monthly jobs data which could offer clues into if/when the Federal Reserve will cut rates.

Here’s a look at the top-moving stocks this morning.

Clorox (NYSE: CLX)

Clorox is up 8% in premarket trading, propelled by its Q2 FY2024 performance that exceeded expectations. The company reported a significant year-on-year revenue increase of 16%, reaching $1.99 billion, and a non-GAAP profit of $2.16 per share, nearly doubling from the previous year. This robust financial performance reflects the effective execution of Clorox’s recovery plan and has positively influenced the market’s response to its stock.

Our Head Trading Tactician Bryan Bottarelli placed an overnight trade on CLX in The War Room yesterday.

Click here to unlock that trade.

Amazon.com, Inc. (Nasdaq: AMZN)

Amazon is up 6% in premarket, primarily attributed to its impressive holiday-quarter sales and the growing success of its AI-powered cloud business. The company reported a 14% rise in sales for the holiday quarter, surpassing expectations despite a challenging economic environment. This positive trend, bolstered by the company’s substantial investments in AI and cloud infrastructure, has led to upward revisions in price targets by several brokerages. Amazon also provided an optimistic revenue forecast for the current quarter, further boosting investor confidence.

Our Lead Technical Tactician Nate Bear opened a trade on AMZN this week on the notion that AMZN would go higher into earnings.

Click here to get all of Nate’s trades in Daily Profits Live.

Meta Platforms (Nasdaq: META)

Meta Platforms is up 16.96% in premarket, fueled by its announcement of a first-ever dividend and strong quarterly results. The tech giant’s robust financial performance, marked by a $40.1 billion revenue in Q4 and the launch of a $50 billion share repurchase program, significantly bolstered investor confidence. These moves, coupled with strategic investments in AI and the metaverse, positioned Meta favorably in the market, leading to a significant increase in its stock value.

Meta Platforms (Nasdaq: META)

Meta Platforms is up 16.96% in premarket, fueled by its announcement of a first-ever dividend and strong quarterly results. The tech giant’s robust financial performance, marked by a $40.1 billion revenue in Q4 and the launch of a $50 billion share repurchase program, significantly bolstered investor confidence. These moves, coupled with strategic investments in AI and the metaverse, positioned Meta favorably in the market, leading to a significant increase in its stock value.

Deckers (NYSE: DECK)

Deckers is up 9% in premarket trading following a stellar Q3 fiscal 2024 report. The company announced record-breaking revenue and earnings, with a remarkable 16% increase in revenue to $1.56 billion and a 44% boost in diluted EPS to $15.11. The impressive results are attributed to strong performances by the HOKA and UGG brands, driven by direct-to-consumer sales and high full-price selling. The company also raised its full fiscal year 2024 revenue guidance to approximately $4.15 billion, indicating a confident outlook.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

The one retailer laughing at tariff headlines

Feb 25, 2026

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026