The Whisper Number Wall Street Doesn’t Want You to Know

It’s earnings season again and we are ready for anything in the War Room. In fact, it’s our favorite time of year!

Christmas only comes once a year for those who follow the gift giving holiday. But, in our world, it comes four times a year: January, April, July and October!

Those are the four months when companies report quarterly earnings and aside from a major event, those can be the most volatile months in the market as investors react to quarterly data from companies and their outlook.

I would argue that the outlook is more important than the data being reported as it is forward looking and stocks are priced based on their future potential not what they did in the past. That’s why you can have a great earnings report yet the shares trade lower – the outlook was not as expected!

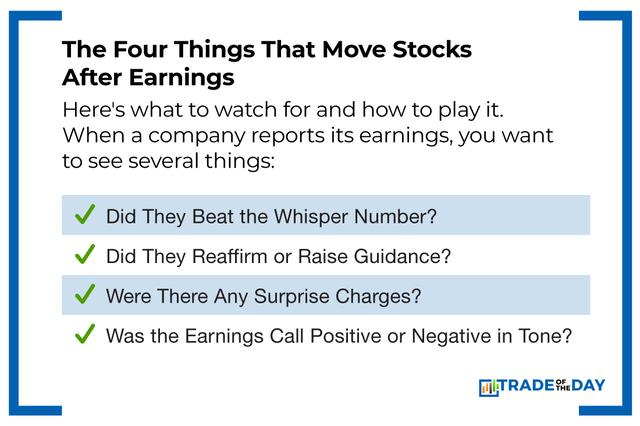

The Four Things That Move Stocks After Earnings

Here’s what to watch for and how to play it. When a company reports its earnings, you want to see several things:

1. Did They Beat the Whisper Number?

This is the analyst’s expectations for earnings. Now, here’s the thing about whisper numbers – they’re not the official estimates you see plastered all over Yahoo Finance or CNBC. Those are just the published numbers, okay? The whisper number is what the smart money is really expecting. It’s the number that gets passed around between institutional investors and analysts behind closed doors.

Why does this matter? Because if a company beats the “official” estimate but misses the whisper number, the stock can still tank. The market already priced in that whisper expectation. If they beat the whisper number, then the shares have the first ingredient to go higher.

2. Did They Reaffirm or Raise Guidance?

Guidance is management’s forecast for what they expect to earn in the next quarter or year. This is huge, okay? This tells you whether the CEO thinks business is getting better or worse. If they raise guidance, especially while also beating the whisper number, the shares are going higher. Period.

Think about it this way – you can have great past performance, but if the CEO says “we’re going to struggle next quarter,” investors are going to dump the stock faster than you can say “sell order.”

3. Were There Any Surprise Charges?

Sometimes an unexpected charge can be large enough to impact their financial position. These can be things like legal settlements, restructuring costs, or write-downs on bad investments. If there is a charge, you want to be sure it’s a one-time charge and not a recurring item.

The market hates surprises, especially expensive ones. But here’s the key – if it’s truly a one-time event, smart investors will look past it. If it’s something that’s going to keep happening, that’s a red flag.

4. Was the Earnings Call Positive or Negative in Tone?

Believe it or not, a poorly presented earnings call can deflate investor and analyst enthusiasm. I’ve seen CEOs completely bomb great earnings by sounding uncertain or evasive during the Q&A session. Conversely, I’ve seen mediocre results get a boost because management sounded confident and had clear answers.

The analysts on these calls are looking for any hint of weakness or strength in management’s voice. It’s not just what they say – it’s how they say it.

When Everything Aligns, Magic Happens

If everything checks out, the shares will likely go higher and if they really beat and guide higher, that is when you see those 20% plus moves in the share price. And those types of moves can result in 100% to 400% overnight gains for options that bet the right direction. Of course, if you placed a one way bet that was wrong, then you are out of luck.

Our War Room Strategy: Why Guess When You Can Cover Both Sides?

That brings me to the War Room. We have a plan to play the earnings season and make those monster gains, we’ve done it over and over again, REGARDLESS of the direction of the share price after earnings!

We take both sides of the trade based on our analysis of past moves. We know that the shares will likely move up or down post earnings – we just don’t know which direction and that goes for the vast majority of investors – professionals or others!

So, why guess the direction when we can bet on both directions? If there is a huge move we will make a ton of money on our two-sided options bet, usually overnight.

![]()

YOUR ACTION PLAN

And here’s the beautiful part – we don’t need a 20% move to win, we just need a move large enough to cover the cost of the trade. It can be as low as 5%. We look at past earnings moves as well as the implied volatility of the stock price (how much it is expected to move post earnings) to decide how much to risk and whether we should even enter the trade.

It’s the most exciting type of trade and arguably the most profitable short-term trade we make in the War Room.

And, we are gearing up for the season now.

You can join us by clicking here.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026