Case Study: The Power of Spreads (Double-Digit Winner)

The last month we’ve seen typical summer weather events taking place throughout the United States.

Floods in Texas.

Hurricane systems forming in the Atlantic.

There was even a recent earthquake near Russia that triggered tsunami warnings across parts of Hawaii.

When summer hits – there’s greater chances of natural disasters.

And it’s why I recommend this seasonal play almost every year in The War Room – Generac (GNRC).

Generac (GNRC) provides the gold standard of power generators – and those unfortunate enough to lose power during natural disasters rely on them much more during this time of year.

I also like using spread trading on long-term stocks like GNRC so I can give myself time for maximum profit.

How Spreads Work

If you’re not using LEAP spreads, you really should take the time to explore this strategy.

Simply put, a conventional spread is the distance between two points. In the options world, it is the distance between two prices.

Think of it as buying insurance while also selling insurance at a different price point – the difference between these prices creates your spread.

A bull spread is the distance between two price points. So you pay $4 for the long call ($10 strike) and get $2 back for selling the short call ($16 strike) and the spread is $6 so your cost is $2 to make $6.

Recent Spread Case Study – GNRC

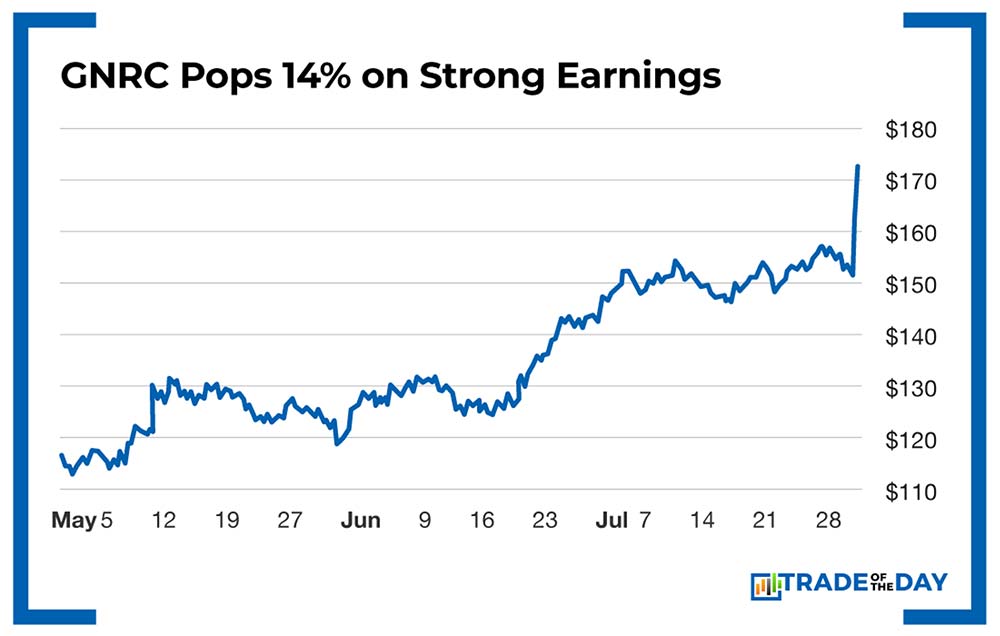

The calendar spread I opened back in February on GNRC gave me plenty of time to watch the stock move up as we got closer to hurricane season.

We were already up nicely heading into July.

Then today, GNRC turned in a strong earnings report and the company soared another 14% in one day.

This latest move allowed me the chance to close the spread trade for an 53% gain in 177 trading days.

Several War Room members were in on this trade.

Here’s what they had to say…

1Troubleshooter 7/30/2025 at 1:36:32 p.m.

GNRC call up 249%. Thanks

Tigerman1935$ 7/30/2025 at 1:37:27 p.m.

Karim thank you for gnrc in at $9 out at $28.

Pete678 7/30/2025 at 12:50:39 p.m.

In @ 8.15; out @ 18.3. Wonderful 124% gain in 4 months. I still have a left over 1/15/27 $175 contract on hand. The other half was closed with $414 gain back in early April. Thanks for teaching the new trading consideration. I also closed several 7/18 $125C contracts 2-3 weeks ago all with 200% to 367% gains.

![]()

YOUR ACTION PLAN

While spread trading might seem intimidating at first, it’s a valuable strategy that every serious trader should consider.

If you want to learn more about spreads, I’ll be walking Cashouts members through the entire strategy next week in MTA Live.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026