Why I Watch This Number So Closely

Editor’s Note: The goal of trading is to set yourself up for financial freedom, right?

But what do you do AFTER you start making money?

That’s what our Lead Fundamental Tactician Karim Rahemtulla is going over today at 4 p.m. ET during his FREE Big Tax Bill Training.

This event will teach you how to protect your gains and reduce tax liability.

It’ll also reveal how a sweeping new tax change could benefit active traders like you – if you structure things right.

The event is FREE and it’s TODAY at 4 p.m. so make sure you sign up soon.

– Ryan Fitzwater, Publisher

Yesterday the US Treasury issued $40 billion in Ten Year bonds.

Investor appetite was muted and they had to offer a higher yield to sell them all.

That’s bad news.

It means investors are asking for more rent for their money. After-all when you buy a treasury, you are renting your money to government for a period of time. And, the higher the risk, the more rent you ask for.

The auctions for short-term bills and bonds have been going well as there is less risk with less duration.

But, as duration increases, so does risk and the risk for the US is not default risk, but risk of fiscal mismanagement.

In other words, will the US get its deficit under control?

One way to measure this is how much you are willing to charge the government to lend it money. The more you charge, the worse off you think the situation is.

The government can combat this by enacting better fiscal discipline or issuing and roiling over short-term notes. But that is like taking out a variable rate mortgage instead of a fixed rate mortgage. It may look good today, but if inflation kicks in or rates don’t go down, you may end up paying way more.

The ten-year bond also sets the price for mortgages and other consumer debt. So, you could see a scenario where the Federal Reserve lowers short- term rates, but has little impact to your long-term borrowing costs.

People often think that the Fed sets interest rates – they do, but not long-term rates. The Fed decides short term rates, overnight rates for banks’ lending to each other. That rate is interpreted by the market as the rate for short term transactions.

The market (you and me and millions of other investors) set long term rates. If we think things are going the wrong way with the government spending or taxing policies or that we are uncertain of the economy ten years from now, it’s only logical that we will ask for more “rent” for the extra risk we perceive.

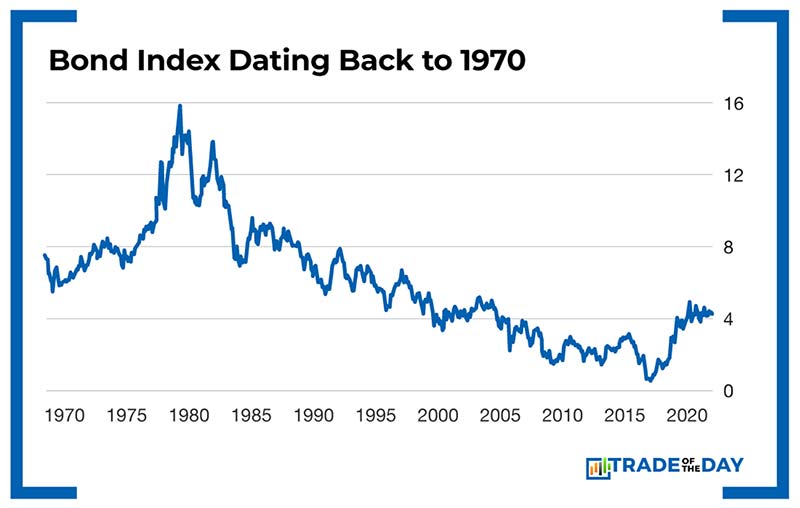

As you can see form the chart below, the rate is still historically closer to the low end, but when it revolts it ain’t a pretty sight!

The bond chart is the barometer for risk for the US economy and when it says pay me more, you need to pay attention.

![]()

YOUR ACTION PLAN

We have several deficit plays in The War Room right now.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026