95% Win Rate Selling Puts (I Was Only Shooting for 80%)

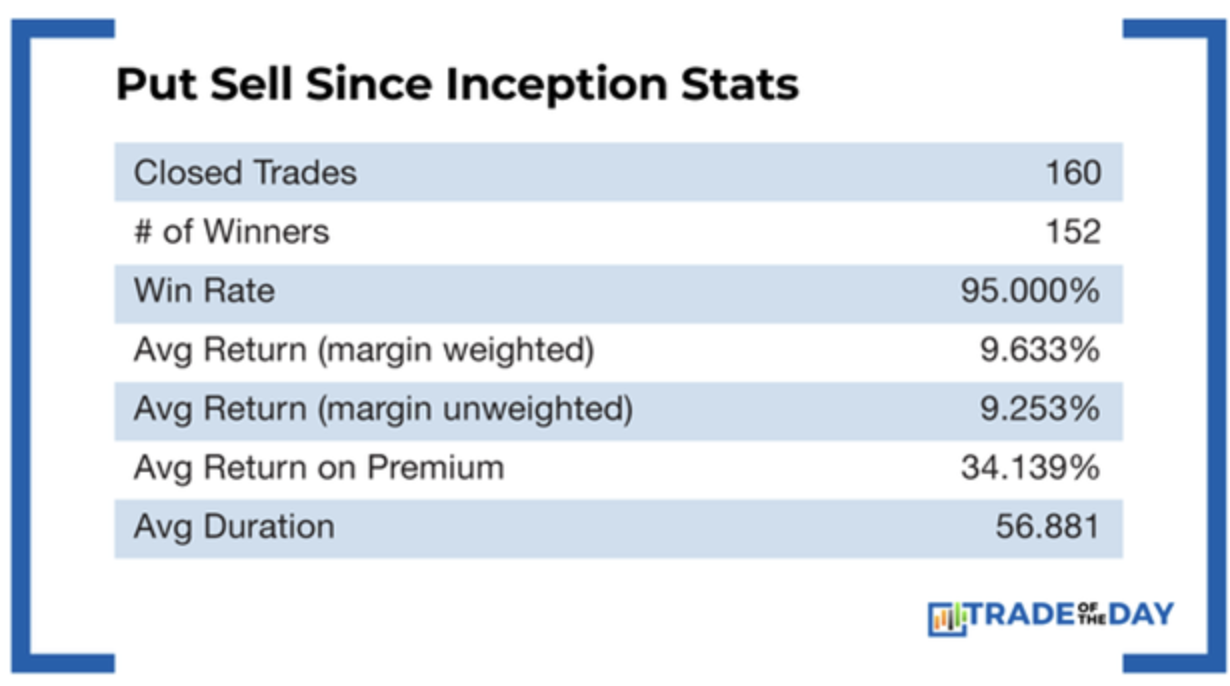

Since May 2019, I’ve been selling puts with a 95% win rate in the War Room.

I was only shooting for 80%, but here’s what I figured out…

When I sell puts, I’m not just collecting premiums – I’m positioning myself to buy stocks at 25% to 50% discounts to market price.

And here’s the thing most people don’t understand: in a bull market, those discounts rarely get hit. I keep the premium 95% of the time.

|

Bear markets make this strategy even better

But in a bear market?

Those price levels are 25% to 50% ON TOP of an already beaten-down price.

If I get put in a bear market, you can bet that stock is beyond cheap.

Look, I learned this the hard way.

In 2008, I watched my portfolio tank close to 50%. It was a paper loss, and I was fortunate enough to add to positions – made it back three-fold in the next five years.

But that feeling when you see your portfolio down 50%? That’s a feeling you never want to revisit.

That’s when I figured out this approach. The return on these put positions has been over 9% every 60 days.

The return on premium – the amount you pay when you buy back the puts versus what you received selling them – is over 34% in the same timeframe.

Here’s how I do it in the War Room

Here’s how I do it in the War Room, and how I recommend you do it too…

First, we only sell puts on companies we actually want to own.

You’re not just collecting a premium – you’re setting yourself up to buy quality stocks at massive discounts.

Second, we sell puts with the goal to cover that position before expiration, usually long before.

In a volatile market with a downward trend, we pick up more premium and have shorter holding periods. Less volatile, upward-trending markets give us fewer opportunities, but there are always sectors within the market that are volatile.

I look for that combination of volatility, premium, and expiration.

When we sell a put, the goal is buying it back when we hit 20% to 50% of the potential return.

If we sell a put for $1, we buy it back at $0.50 to $0.70. If it’s a $0.20 put, we may hold until expiration, sometimes taking 30% or 40%. But rarely do we hold beyond 50%.

We take advantage of time value when we sell LEAP puts. Time decay is one of the biggest factors in options pricing, and every day closer to expiration, that option loses time value.

Combined with our big discount built in, the option value can decrease quickly if the share price stays the same, goes up, or doesn’t drop much.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026