Is Warren Buffett Sending a Smokescreen Here?

Earlier this year, Warren Buffett announced he was stepping down as Berkshire Hathaway CEO at the end of 2025.

Buffett is arguably the greatest investor of our time, with Berskhire valued at more than $1.07 trillion as of today.

So this was obviously big news.

But I believed Buffett wasn’t quite done yet.

In fact, I revealed my top trading candidates for “Buffett legacy trades” in Trade of the Day last month.

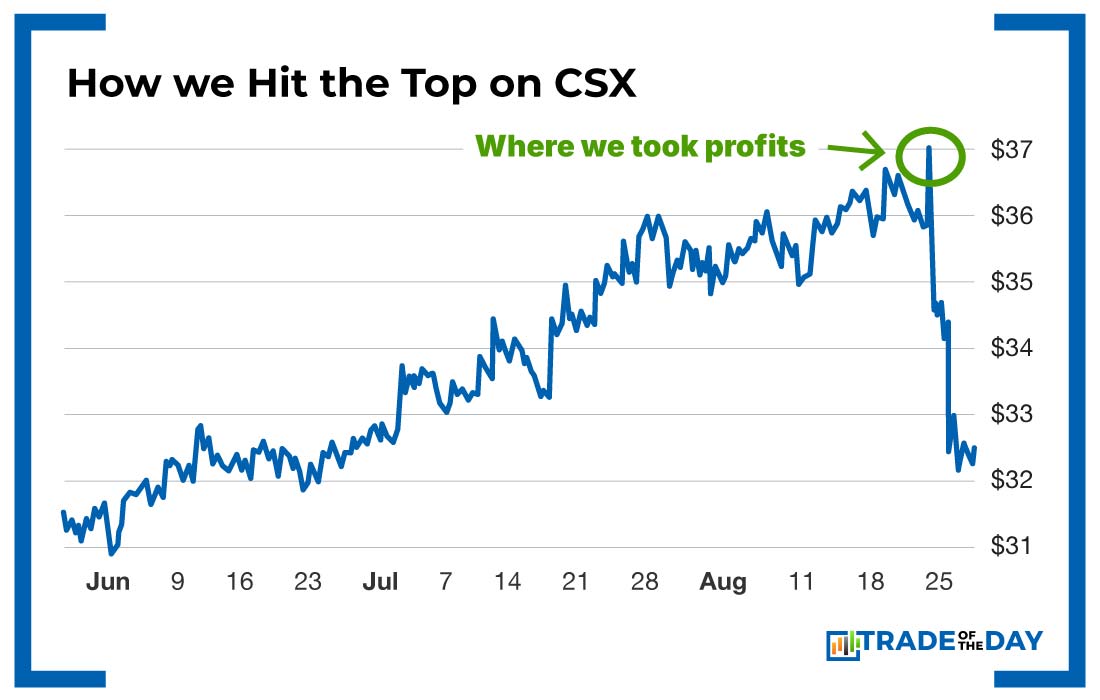

One of those picks was railroad group CSX Corporation (CSX).

I had previously read that Buffett was interested in acquiring a railroad company before he rode off into the sunset.

So with that catalyst in mind, I put out a trade on CSX in Catalyst Cash-Outs on July 29.

How we traded CSX for a 33% winner in Catalyst Cash-Outs

One thing that separates Catalyst Cash-Outs from other trading services is Karim and I like to exit out of a position when it’s profitable.

Then, we look to get back in at a better entry point if the catalyst remains in place.

CSX is a good example of this…

Here, we got positioned ahead of a catalyst (Buffett’s potential CSX trade) and took a 33% winner in less than a month.

|

Now, take a look below at where CSX is trading right now…

|

We top-kicked CSX perfectly, selling around $37. Now its gone all the way down to $32.

This gives us another potential entry point.

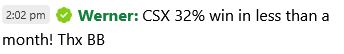

Cash-Outs Members profit on CSX trade…

Several Cash-Outs members were in on the CSX trade, which we opened on July 29 and closed on August 19 (21 trading days).

Here’s what a few members had to say…

|

|

Why CSX $32 mark could be entering another buy zone…

We put out the CSX trade as a “Buffett legacy speculation.”

The stock moved up, and we took the 34% gain.

But now, I believe there could be another runup for CSX.

As you saw in the chart, the stock has dropped pretty precipitously over the last few days.

Here’s why it dropped…

In a recent news article, Buffett said that “he wasn’t sure if he really wanted to buy a railroad.”

This led to the plunge back to around $32.

So here I am thinking…

“Is this a smokescreen? Did Uncle Warren pretend he’s not interested in CSX to drop it down $5 to get it at the level he’s comfortable buying at?”

I wouldn’t put it past him, and I think there’s more to his story than possibly meets the eye.

Aside from Buffett’s misleading, there are also several “buy” upgrades form Deutsche bank and TD Cowen on CSX. Plus Citigroup has it at a $40 price target.

So I’ll be keeping an eye on CSX for another potential trade.

![]()

YOUR ACTION PLAN

With Buffett’s potential smokescreen on CSX, I’ll be keeping an eye out for another speculative trade in Catalyst Cash-Outs.

Next week we also have the JOLTS report on Wednesday, which sets up perfectly for our ODTE trading strategy. Plus we have the ADP report coming on Sept. 4.

Click here to get all our catalyst trade alerts in realtime.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026