Gold or Silver – Which is the Better Bet Right Now?

A while back I wrote about the gold-to-silver ratio and why silver was the better bet.

It’s played out as expected so far in 2025.

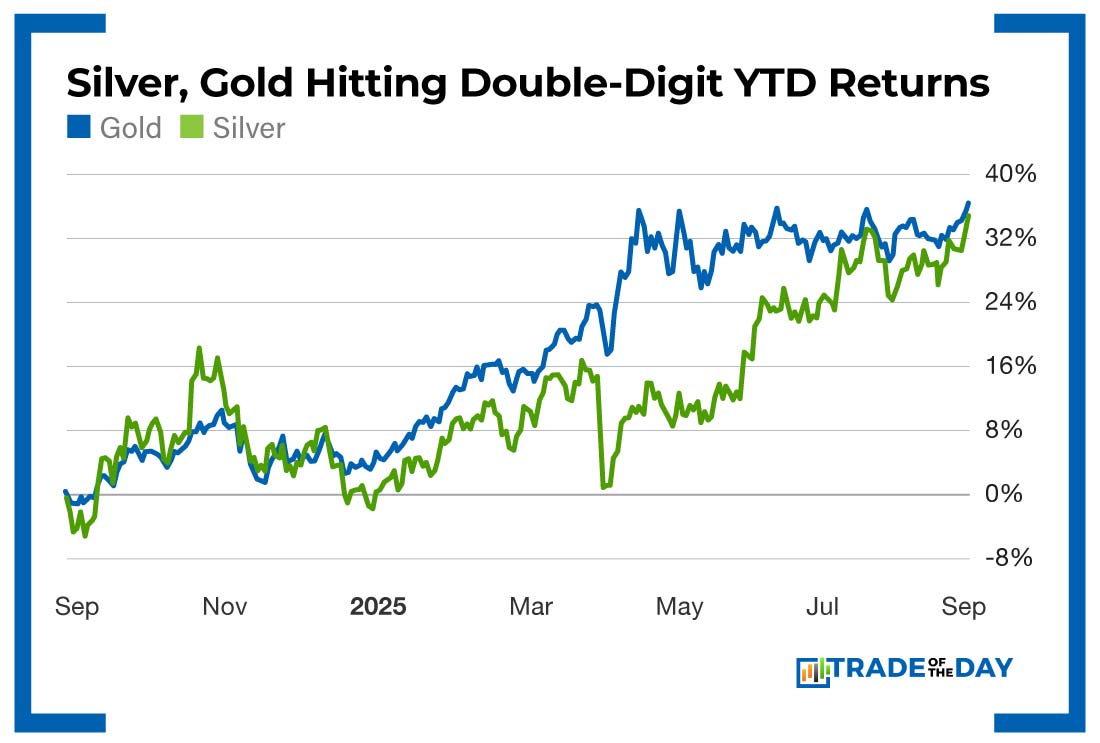

Silver has outperformed gold year-to-date. At the time of this writing, the white metal is posting 42% YTD gains vs. Gold’s 36%.

But overall, both precious metals are posting their strongest performance in seven years.

Why the Gold-Silver Ratio Matters

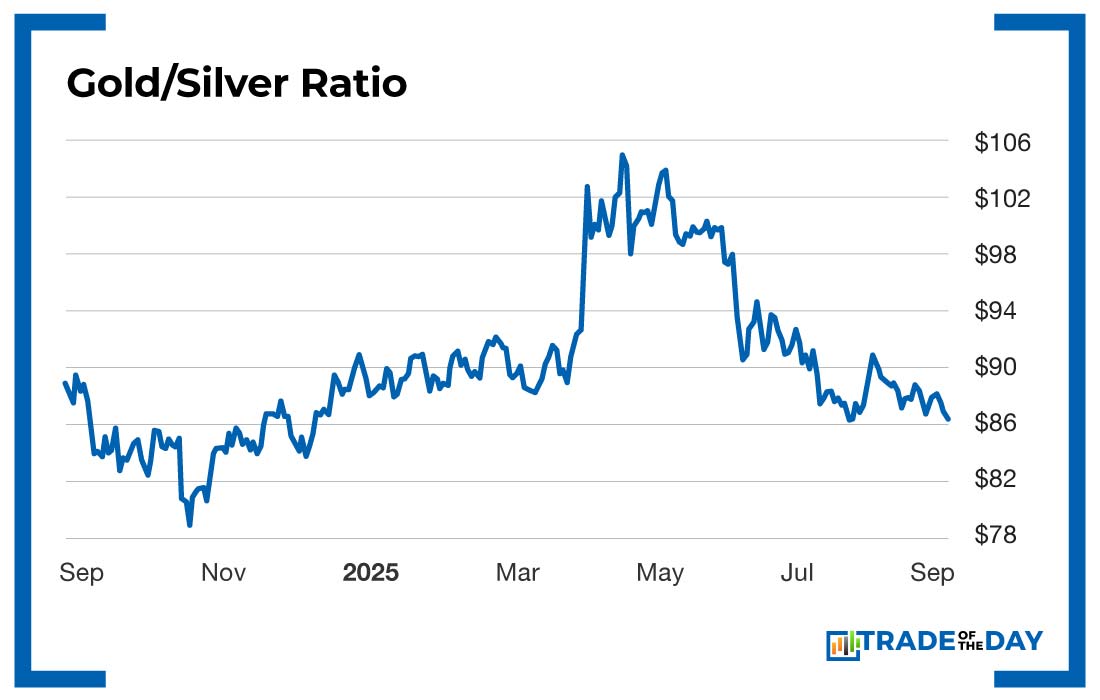

The gold-silver ratio (GSR) is simply the number of ounces of silver it takes to buy one ounce of gold.

For example, if gold is $2,000/oz and silver is $25/oz, the ratio is: 2000/25 = 80, meaning one ounce of gold costs the same as 80 ounces of silver.

For centuries, the gold-silver ratio hovered around 15:1 (close to its natural occurrence in the earth’s crust). Modern times usually see it much higher (60–90:1), because silver is cheaper relative to gold.

A high ratio (e.g., 80–100) often suggests silver is undervalued relative to gold. A low ratio (e.g., 30–40) suggests silver is expensive compared to gold.

Some traders use the gold/silver ratio to decide when to swap between metals:

If the ratio is high → sell gold, buy silver.

If the ratio is low → sell silver, buy gold.

Plus, since gold and silver respond differently to inflation, interest rates and industrial demand, the ratio helps investors balance exposure between the two metals.

Gold is seen mainly as a monetary safe haven. Silver has both monetary and industrial uses. When the ratio widens, it can reflect stress in the economy (gold being favored). When it narrows, it can signal industrial demand and growth (silver being favored).

In short: the gold-silver ratio is a relative value measure that investors use to gauge which metal might be cheap or expensive, helping guide allocation and timing decisions.

Here’s the current gold-silver ratio as of today: It’s approximately 86.2. Meaning you need about 86 ounces of silver to buy 1 ounce of gold. The long-term average since the 1970s sits around 65:1. During volatile periods like the COVID-19 pandemic in 2020, the ratio peaked near 105:1.

How We’re Taking Advantage in The War Room

Based on the current ratio, silver remains the better value, historically speaking.

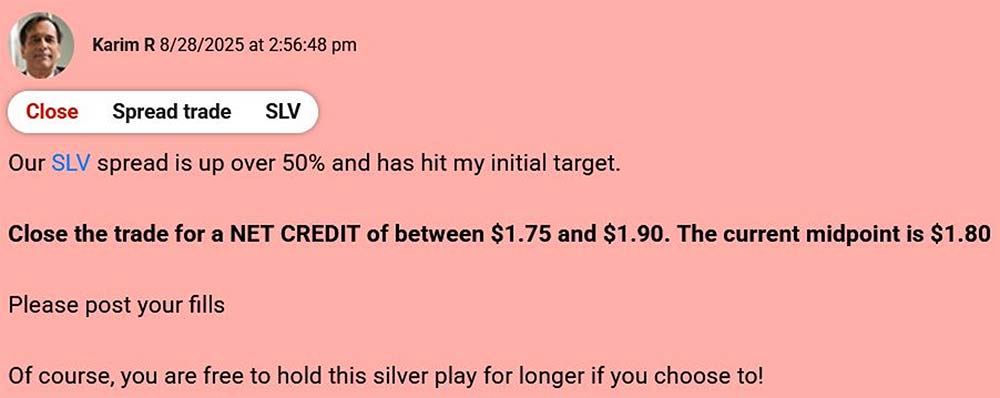

However, with so much gain this year, we have traded silver successfully in The War Room.

I recently closed out a short-term play for close to a 50% gain in 47 days, outperforming the metal over the same period.

I used a spread trade to lower costs and increase upside simultaneously.

We will be looking to get back into a similar silver play on a pullback – and here’s how you can start taking advantage too…

![]()

YOUR ACTION PLAN

With gold and silver each posting their strongest performance in seven years, I recently unveiled a special way to play gold that nobody else is talking about.

Click here to login and receive the latest updates on that trade.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026