Why Costco’s -1% Performance Makes It My Top Post-Shutdown Play

This morning, pre-market futures rallied across the board on news that our elected officials might actually be interested in doing their jobs.

The Senate passed the first step of a deal that could end the federal government shutdown, and as of midday, the stock market gains have held steady.

On the surface, the obvious plays are airlines (directly affected by government operations) and government contractors, which could see immediate relief when operations resume.

But I have an alternative approach…

A government reopening delivers a massive confidence boost to big box retailers like Costco (COST), Walmart (WMT), and BJ’s Wholesale (BJ).

Here’s the performance gap that caught my attention:

- Walmart: +21% over 52 weeks (crushing the S&P’s +12%)

- BJ’s: +2% over 52 weeks (clearly lagging)

- Costco: -1% over 52 weeks (the worst performer)

How can three of the nation’s top retailers show such dramatic performance differences?

And more importantly, is there a trade opportunity brewing?

Let’s dive into Costco’s fundamentals…

Net sales grew +8.3% over the first nine weeks of fiscal 2026, hitting $48.33 billion.

The US delivered 6.6% comparable sales growth, while Canada and international markets posted 6.3% and 7.2% respectively.

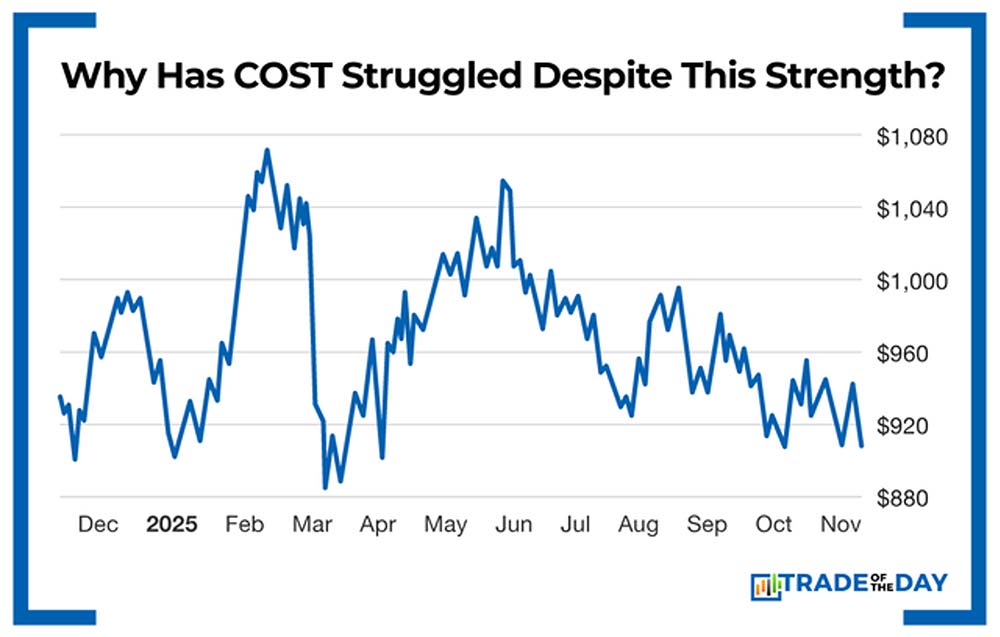

So why has COST struggled despite this strength?

A perfect storm that started with Hurricane Helene and East Coast port strikes, then rolled into tariff concerns and government shutdown fears. But is all the bad news now priced in?

![]()

YOUR ACTION PLAN

COST has found strong support at $900 dating back to early October. With the shutdown seemingly ending, consumer confidence should rebound heading into the holiday shopping season. I believe COST is primed for a run – starting now.