Risk-off Rotation + Technical Reset = Leveraged Opportunity

Gold and the US Gold Fund (GLD) are preparing for what has become one of the most reliable rallies in the market over the last three years and there’s a simple strategy to 10X its returns.

Another strong rally in gold is building as investors and analysts wrestle with the idea that stocks are heading for a correction due to a potential bubble in the AI industry.

Whether correct or not, those doubts are causing the first significant sentiment shift to a risk-off condition since the market’s “Tariff Tantrum” in April 2024, a welcome development for the Gold Bugs.

What is “Risk Off”?

A risk-off situation in the stock market happens when investors ditch high-growth, high-risk assets and rotate into safe harbor assets. That money flies into “safe” assets like treasuries and gold.

The move is usually triggered by fear, recession signals, geopolitical tension, Fed tightening, or a breakdown in market internals.

Looking back over the last month, we’ve watched as the market has struggled to digest all these factors.

The reaction to a risk off move is simple. Spike in volatility and defensive sectors like consumer staples and dividend yielding stocks take the lead.

In short, it’s a warning that the market is bracing for a larger impact.

What Does This Mean For Stocks?

In general, we’ve already seen a lot of damage from the shift to risk off.

Industries like quantum computing, nuclear and eVTOL were all the rage over the summer as investors were in speculation – or risk on – mode.

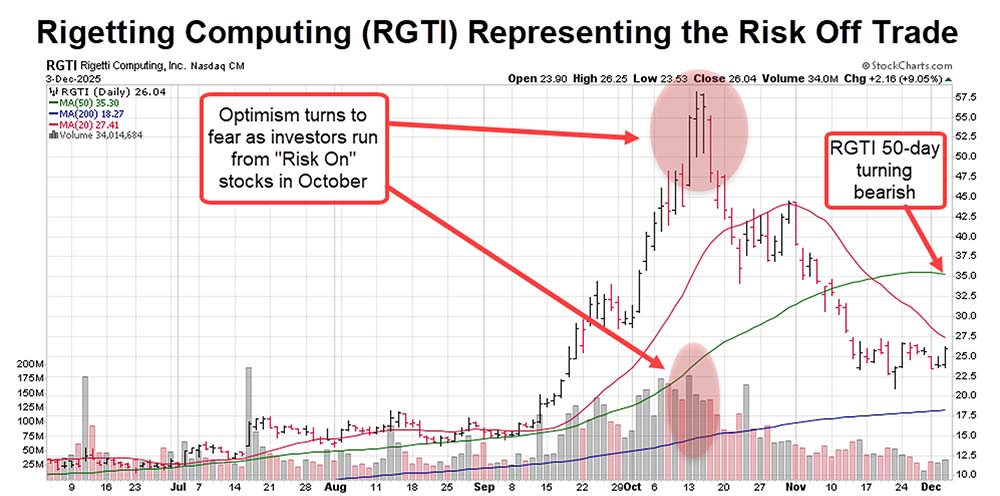

Names like Joby Aviation (JOBY), Oklo Inc. (OKLO) and Rigetti Computing (RGTI) more than doubled as investors saw opportunities to speculate on the next wave of opportunities in the market.

The excitement seen towards these stocks was a bit of a warning sign from a sentiment perspective as investors tend to get “over their skis” with excitement near short- or long-term tops in stocks. You know, the whole Warren Buffett “Be fearful when others are greedy, and greedy when others are fearful”

As is normally the case, the wild speculation turned to uncertainty in October as murmurs of an AI bubble shifted investor sentiment from speculative driven to safety. This led to the Risk Off trade engagement clearly notable in Rigetti Computing’s chart below.

As a result, stocks are now walking on eggshells as investors await the Fed’s decision on December 10, but let’s be frank… is the Fed going to save stocks right now? Not likely.

What Does it Mean for Gold?

A risk-off rotation is one of the strongest catalysts for gold. It forces capital out of high-beta assets and into vehicles with proven defensive strength.

Gold benefits immediately: no counterparty risk, no balance-sheet assumptions, and historically strong performance during periods of tightening financial conditions.

Add weakening dollar confidence, rising recession signals, and central-bank accumulation, and the risk-off flow becomes a structural tailwind. In short, when markets de-risk, gold becomes the trade.

Gold’s Technical Analysis Says a Breakout is Pending

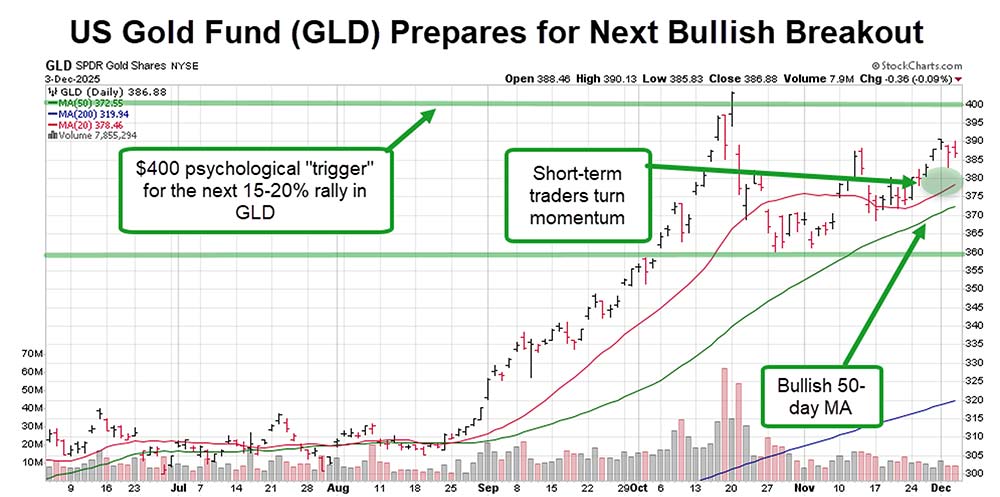

The technical backdrop for GLD remains firmly bullish as momentum, trend strength, and trader psychology are all aligned in favor of higher prices.

The recent 10% drop reset short-term sentiment and brought shares back to key support at $370, not through it. Corrections like this are considered “healthy” and part of a long-term bull market cycle as short-term traders take the opportunity to lock in profits.

We’ve seen five healthy corrections or consolidations over the last two years, each proving to be a short-term pause in what is otherwise the strongest long-term rally, tallying up more than 150% of gains since 2023.

Here are the technical details:

- 20-Day Moving Average ($377): GLD’s 20-day moving average – what I refer to as the “Trader’s Trendline” just turned bullish on November 25. This tells us that the short-term momentum is building towards a breakout.

- 50-Day Moving Average ($373): This trendline has been in a strong bullish trend since early September and has yet to waiver. Historically the GLD shares have a 67% chance of moving higher each day that the 50-day remains in its current trend. Vegas would kill for those odds!

- Volume Profile: Trading volume on the GLD shares is now increasing after a quiet period following the crescendo of activity at the October highs. This is another indication that the crowd is starting to accumulate gold-related investment again.

- Potential breakout price trigger ($400): Round numbers act as powerful support and resistance because traders anchor decisions around simple levels – example: “I’ll buy it if it gets back to $50.” We saw $400 act as resistance for the GLD shares in October, now a break through that psychological ceiling will trigger a new raly as investors chase prices even higher.

Bottom Line

Gold’s rare 10% pullback was a “Healthy Correction” which was needed to refresh the rally and allow investors a chance to buy at a discount to the recent highs. That pullback has coiled the spring for another shot higher as we head into the New Year.

Investors looking to leverage gold’s continued rally should check out long-dated call options on the underlying U.S. Gold shares (GLD). These options are a value from the perspective of time premium given the GLD’s extremely low historical volatility and strong trend.

Following the trends of the last two year, I’m expecting to see another rally that will target a $460 – $475 price target for the US Gold Fund (GLD). The rally should occur within the next three months as continued uncertainty and the “Fear of Missing Out” attract investors to another fast and aggressive move higher.

How Do You Trade the Rally in the U.S. Gold Fund?

Let me start by disclosing that I am currently long the GLD shares using an options strategy like what I detail below.

The simplest way to play it is to buy and hold the US Gold Fund (GLD). Each share of this widely held exchange traded fund (ETF) represents a fractional ownership interest in a pool of physical gold bullion.

GLD Shares are trading 60% higher in 2025 and remain an attractive alternative to buying physical gold based on the ease of trading and relatively low costs.

Investors looking to leverage the move in GLD shares may consider long-dated options as an attractive approach.

This strategy provides time to allow the long-term bullish trend to play out on GLD shares while offering leveraged returns of more than 10 times those of the ETF alone. The strategy is a relatively basic options alternative requiring level 2 approval from your broker.

My current options strategy: Buying (to open) the June 18, 2026 GLD $390 call, currently trading at $2,530 per contract.

According to Black Scholes pricing model, that option would be worth $8,503 (or more if GLD hits my $470 target before March 1, 2026, a return of 236%.

At expiration – on June 18, 2026 – that same $470 target price would command an intrinsic value of $8,000, a return of 216% compared to roughly 20% for the standard buy-and-hold GLD position.

Here are the comparisons of the returns on investing in the US Gold Shares versus leveraged returns using the option detailed above. Note the 10X-plus leveraged return of the options.

![]()

YOUR ACTION PLAN

Of course, as always, please make sure you understand the risks of options trading. Leverage cuts both ways. This options strategy should be employed along with a reasonable exit strategy based on any unforeseen technical breakdown in the GLD shares.

For my purposes, a break below the ETFs 50-day moving average – currently at $372.55 – would act as a stop for the trade.

Stay tuned for more information on my next FREE LIVE TRAINING session in Monument Traders Live (probably on Wednesday, December 10th).

Also we will be posting clips from those sessions on our new YouTube channel.