How to Turn an FDA Panic-Sell Into 25% Profits in 5 Days

I have to admit something…

When Corcept Therapeutics (CORT) hit our Gift Gap scanner on January 22, I had absolutely no clue what this company did.

Never traded it. Never researched it. Complete blank.

But here’s the thing about Gift Gap trades… that doesn’t matter.

When you see a perfect setup, you see it. And this was one of the cleanest I’ve spotted all year.

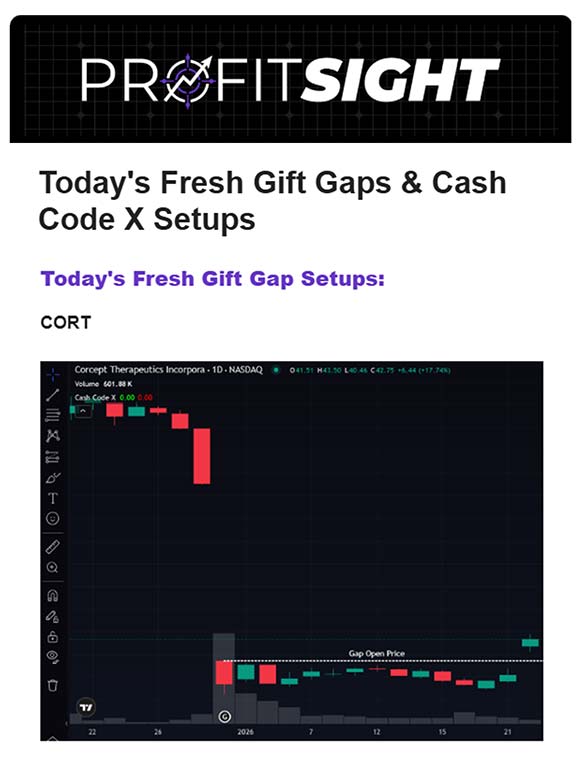

This Gift Gap scanner alert that we emailed out looked exactly like this…

That gap showed up after the FDA declined to approve Corcept’s drug for rare hormonal disorder.

While investors panic-sold… I saw something different: a fundamentally strong company getting hammered by an overreaction.

Here’s what the crowd missed while they were selling…

Corcept’s Q3 revenues jumped to $207.6 million from $182.5 million year over year. Management reaffirmed their $800 million to $850 million full-year guidance. They’re sitting on $524 million cash – enough runway to weather any clinical setbacks.

The FDA said “not yet” to one drug. The market acted like they said “never” to the entire company.

That gap from $70 down to $35? Pure emotional selling creating our gift opportunity.

The Gift Gap Setup That Triggered Our Alert

December 31: FDA drops a complete response letter on Corcept’s Relacorilant treatment for Cushing’s syndrome. The stock craters from $70 to $35 in panic selling.

January 22: Our scanner flags the oversold bounce setup at exactly the right moment.

My take: Strong balance sheet plus emotional overreaction equals textbook Gift Gap trade.

So I issued the trade to our members, even though I couldn’t pronounce “Relacorilant” if my life depended on it.

The Results Speak For Themselves

We entered around $35. The current price is nearly $44. That’s 25% in less than a week.

I issued the “take profits” alert last week, and our members banked another winner.

But here’s what gets me excited… We’re only halfway to filling that entire gap back to $70.

This is why I don’t need to know everything about a company’s pipeline to make money. I just need to recognize when the market is handing out gifts – and grab them before everyone else wakes up.

![]()

YOUR ACTION PLAN

Could I reload CORT as it continues filling this gap?

Absolutely. I’m tracking this situation closely because the setup that got us in hasn’t changed – strong fundamentals meeting emotional selling creates our bread-and-butter opportunities.

Sometimes the best trades come from companies you’ve never heard of. This CORT winner proves it.

More from Trade of the Day

Just Like That… The Tariff Drama Fizzles

Jan 22, 2026