How I’m Playing the Dollar’s 10% Drop

The stated goal of the U.S. government is to weaken the U.S. dollar in order to boost exports.

It’s not a bad policy. I saw firsthand on my recent trip to Europe, where everything cost about 10% more than it did last year.

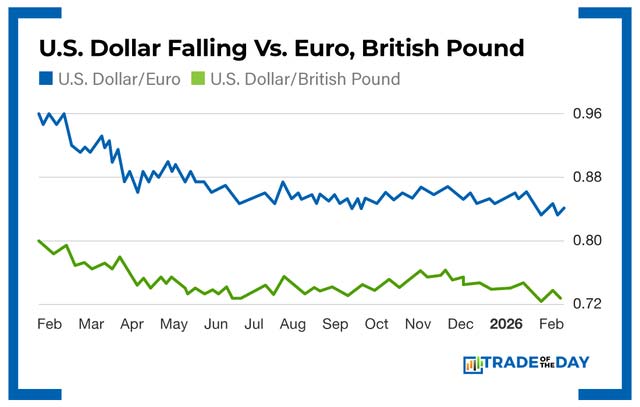

This also tracks the move in the dollar, which is down 10% versus the euro and British pound.

For a few of our holdings, like Rolls Royce (RYCEY), this has meant an automatic 10% boost in U.S. dollar share prices since the shares are denominated in pounds.

But there’s another angle to the dollar weakness…

The Crocs Play

Today in The War Room, I recommended members jump into CROX using a spread I engineered.

Ugly is back in style – not necessarily here in the U.S., but overseas.

Here’s what CROX reported on its latest earnings call…

- North America revenues decreased 7.4% to $436 million

- International revenues increased 14.1% to $332 million (11.0% on a constant currency basis)

This is a powerful signal. U.S. dollar weakness is driving international sales higher, along with the fashion trend favoring their products.

I expect this dynamic to strengthen this year and into next year.

Why? The U.S. is embarking on a weak dollar/low interest rate policy. The newly nominated Fed Chairman is widely expected to pursue lower rates, working in tandem with a Treasury Secretary who wants a weaker dollar.

With the dollar weakening, you should focus part of your portfolio on companies that sell a lot overseas.

Those companies include…

- Procter & Gamble (PG)

- Kimberly Clark (KMB)

- Deckers (DECK)

- Crocs (CROX)

- Just about every U.S. conglomerate that derives a big chunk of sales overseas.

And, if you are planning that European vacation… get going sooner than later. Your dollar will stretch further now than it will in six months.

![]()

YOUR ACTION PLAN

Trends like the weaker dollar are what Bryan and I follow every week in Monument Trend Advisory. Our next livestream is Tuesday at 2 p.m. ET.

More from Trade of the Day

My Complete Checklist for TPS Trades

Feb 10, 2026

This Stock Just Won the Super Bowl

Feb 9, 2026

The Latest Signal for Playing Silver’s Crash

Feb 6, 2026