OPEX Week or Not – I Have a Chart That’s Flying High

This week is OPEX week.

If you’re unfamiliar with OPEX, it stands for “Options Expiration.”

It’s when a large volume of options and futures contracts expire on financial markets, usually on the third Friday of every month.

In my experience, OPEX week can be a frustrating environment for traders.

In fact, the last 4 consecutive February OPEX weeks have been bearish for the markets, and 2026 is no different. The S&P and the Dow were both roughly 0.3% yesterday, with the Nasdaq off about 0.4%.

When a week like OPEX flips indexes bearish, I always tell myself…

“I can’t control the indexes”

“I can’t make them do what I want.”

However, I can be patient and only trade chart setups I love, and there’s one group I’m watching that’s currently flying high despite OPEX frustration.

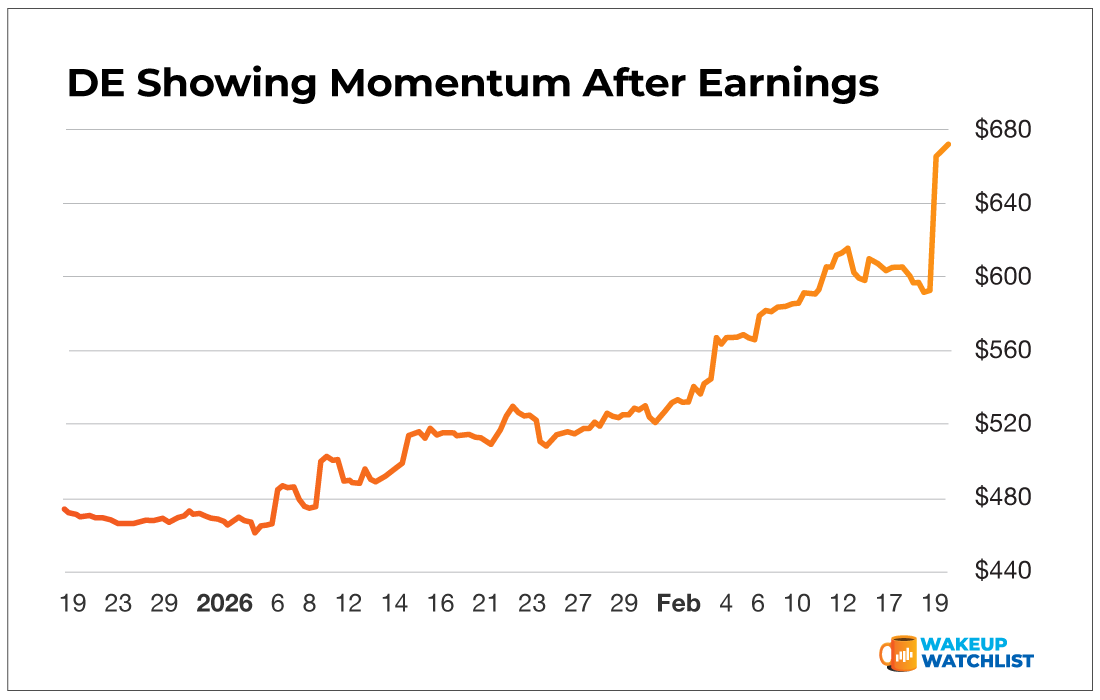

That ticker is Deere & Company (DE).

Here’s why I like DE right now.

DE crushed earnings yesterday. As you’ll see above, it’s spiking with a 13% pop.

With its upward momentum against a choppy market, DE is a prime candidate for what I call a “lotto” trade.

Every Friday, I look for lotto trades that capture short-term momentum of a company like DE. These trades have the potential to lead to fast gains.

Action Plan: DE crushed earnings and is currently sitting at all-time highs. At the time of this writing, it’s currently sitting around $680, but I’m thinking we could be over $700 today on a gamma squeeze situation.

If you want more trade ideas like DE, you can join in Daily Profits Live today. Here you’ll get access to all my livestreams, where you’ll trade alongside me each and every trading day.

More from Wake-up Watchlist

5 Trades. 5 Winners. Same Ticker.

Feb 18, 2026