Understanding Put Selling With Advanced Micro Devices

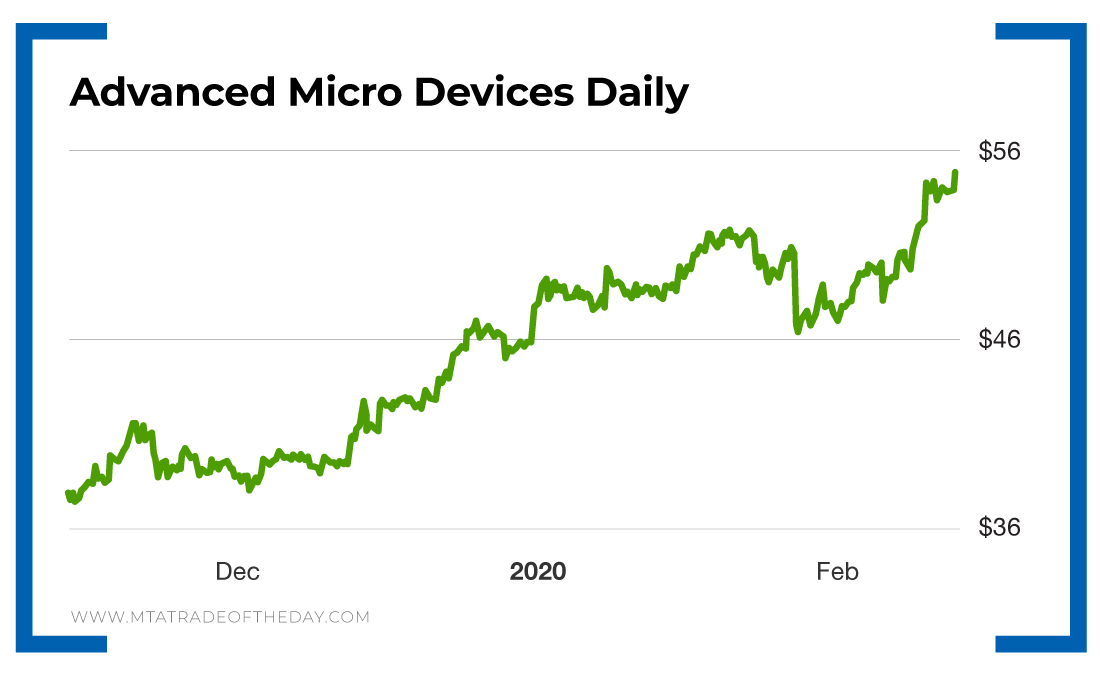

Last week, War Room members closed out a put sell position on Advanced Micro Devices (Nasdaq: AMD) for gains between 33% and 45%, depending on their entry prices.

These gains occurred in just seven days!

While seven days seems like an eternity compared with some of our other trades that we’ve closed out of in a matter of minutes or hours, something makes this trade and others like it very, very different.

We recognize that we have every type of investor in The War Room, from green recruits to seasoned generals… which is why we have adopted a mentality of making every type of trade available, from stocks to options.

Along the way, our green recruits pick up an education in investing while making trades in real time.

Not every investor in The War Room has clearance to do each strategy. But we are averaging more than a trade a day, so there are plenty of opportunities to go around.

Most of the trades are simple options trades…

But every once in a while, we change it up and offer a trade that requires an extra bit of due diligence, like our recent, more sophisticated put sell with Advanced Micro Devices.

Let me set the table first…

Answer this question: Would you place a trade if you knew that you’d have a 90% to 95% chance of that trade being a winner?

Of course you would.

And that’s the very basis behind this strategy…

I scan for – and recommend – only trades that have an 80% to 95% probability of being winners.

How do I do that?

Let me explain…

Think about it. If Advanced Micro Devices does not fall 60% in seven days, you’re going to walk away with a double-digit profit.

That’s essentially what happened with our put sell trade and why I liken it to the safety of a certificate of deposit (CD). It’s not 100% safe like a CD, but when you have a situation where a blue chip stock must fall 60% in seven days before you lose a dime, then you’re getting close.

My friends, that is exactly how put selling works in The War Room. Instead of chasing the big whale and risking the boat, we like to go fly-fishing close to shore.

Now, don’t get me wrong, we go whale hunting with our other strategies and do it very well. But put selling is a different animal. It requires knowledge beyond simple buying and selling.

When you sell a put, you are saying that in return for cash now, you will buy the stock later, but only if the stock falls below a certain price (the strike price).

So there is risk… but the way we do it in The War Room is very different, and it’s why we have not had a single loss to date.

Action Plan: While others are hoping that a stock won’t go down a percent or two, we are making the bet that a stock won’t go down 20% or 30% – or, in the case of Advanced Micro Devices, 60%. I use a sophisticated probability strategy and understand the characteristics of time value as it relates to options – when I apply this to recommendations, our members will win most of the time.

Our goal is for our members to get in, take a small win and get out, a sniper profit strategy. And if we are disciplined about it, as we are in The War Room, the winners will roll in. So join me in The War Room today, and let’s start seeing the winners roll in together!