Everyone Overlooked This Luxury Retail Battle

Lost in the 24/7 coronavirus coverage is the odd, strange and completely uncertain takeover story that’s now playing out between two of the most extreme luxury retailers in the world.

I’m going to detail the entire situation for you below, which could lead to an extremely lucrative moneymaking opportunity in the very near future.

I find this story so incredibly interesting because you don’t typically see a situation in which the highest of the high-end retailers find themselves squabbling about price.

That’s for the price-conscious shoppers at Walmart and Target, right?

In this case… wrong.

In fact, as you’ll see below, two retailers squabbling about price is exactly what you have right now – and it could get ugly.

It’s truly a crazy story – with a very uncertain ending.

If War Room members play it correctly, they could be in line for a big profit.

Here’s the scoop…

Tiffany & Co. (NYSE: TIF) and LVMH (OTC: LVMUY) have found themselves in a very tough spot.

Last November, Bernard Arnault, chairman and chief executive of LVMH agreed to buy luxury jewelry retailer Tiffany & Co. for $16.2 billion.

For Tiffany & Co., this equates to around $135 per share.

But now, thanks to the global complications of the coronavirus, investors are getting worried that the deal will actually not go through as agreed.

You see, as Tiffany & Co. temporarily closed several critical retail outlets, including its iconic flagship Fifth Avenue store in New York City, the company’s shares started to sink.

As the shares fell, Bloomberg reported that LVMH was considering buying Tiffany & Co. shares on the open market – for a far cheaper price than what it agreed to back in November.

But then, LVMH said that it would not buy Tiffany shares on the open market – further complicating the complexity of the entire arrangement.

As I’m sure you know, since the agreement formed in November, the outbreak of the coronavirus has brought an abrupt end to luxury spending – first in China, then in Europe and now here in the U.S.

In the event of a global recession, which looks all but certain at this point, Bernstein analyst Luca Solca estimates a fall between 25% and 30% in U.S. luxury jewelry sales.

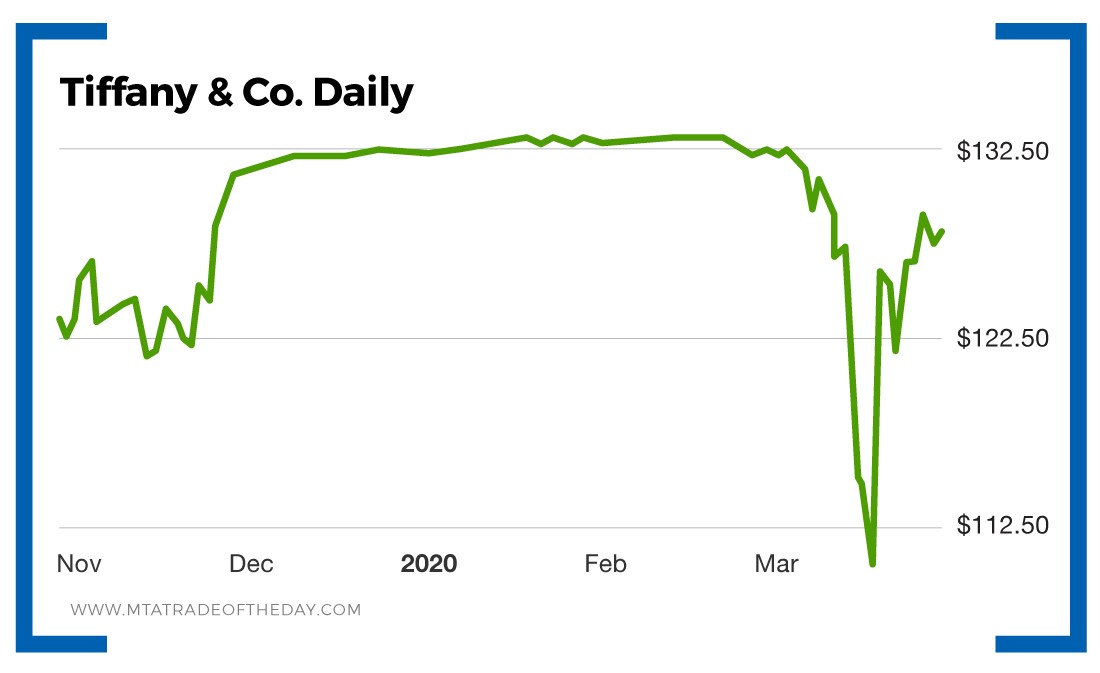

So even though Tiffany & Co. has a $135-a-share offer, it traded down to a low of $111 earlier this week – only to bounce right back up after releasing fourth quarter 2019 results.

Before the opening bell on March 20, the luxury jewelry and specialty retailer reported adjusted earnings of $1.80 per share, which came in better than the estimates of $1.77.

Net sales of $1.4 billion grew 3% on a year-over-year basis, which also surpassed the $1.36 billion expectation.

But remember, those sales came from the 2019 fourth quarter report, well before the coronavirus was even a blip on anyone’s radar. In fact, those sales included Christmas sales, which are always strong.

Take a look at this drop and pop on Tiffany & Co. in the month of March…

Action Plan: Was the recent bounce truly reflective of Tiffany & Co.’s current position?

I don’t believe so.

In fact, I think this upside move is a gift that War Room members can short.

Or – given the massive element of uncertainty that the deal will actually close – you could think about a strangle play to capture a big move on either side.

Either way, this is certainly an interesting situation for you to keep a close eye on. I know that we’ll be tracking it inside The War Room.

Join me in The War Room for full trading instructions delivered in real time!

More from Trade of the Day

Just Like That… The Tariff Drama Fizzles

Jan 22, 2026