Newbie Options Trader Hits 2,548% Gain!?! Here’s How He Did It…

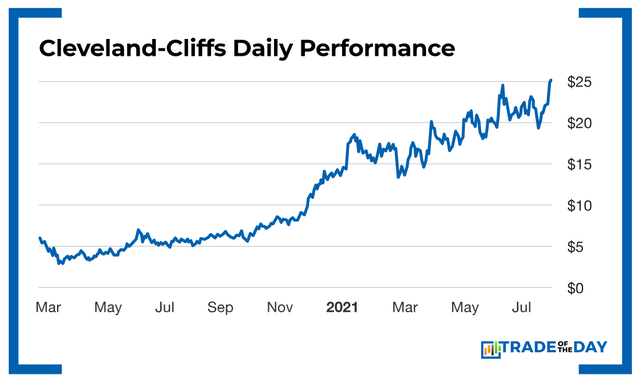

Back in March of last year, I spotted an unmistakable profit opportunity. The company was the steelmaker Cleveland-Cliffs (NYSE: CLF). I had been following Cleveland-Cliffs for years, so it’s no surprise that it was on my radar.

But on March 10, 2020, something special happened. A trade lined up that, frankly, was one of the best setups I’ve ever seen.

In fact, it was so good that one of our War Room members, George L., is up $181,000 on a $7,512 investment since March 2020 from this one pick alone. He’s not some superstar investor, either. In fact, it was one of his FIRST options trades!!! More on that in a minute.

First, a little detail on how I spotted this trade… because the signal I saw here is one you, too, can use to see big success in your trading.

What I saw was massive amounts of insider cluster buying… That’s when more than two executives or directors buy shares within a short period of time.

In Cleveland-Cliff’s case, over the months before I recommended the trade, director John Baldwin had bought up 346,181 shares… director Robert Fisher had picked up 353,626 shares… and chairman Lourenco Goncalves had loaded up with 3,565,597 shares!

When this many insiders are buying all at once, it’s one of the strongest signals that a big stock move is coming.

Keep in mind, Cleveland-Cliffs was coming off a couple of tough years. But it was turning things around, and the insiders knew it. Add in the pandemic – which pushed prices lower – and there was no question the stock was undervalued… really undervalued.

These insiders were primed to profit and so were we.

But instead of buying the shares outright, I told War Room members to enter the play using very cheap LEAP (long-term equity anticipation) options that expired in January 2022 – yes, almost a full two years from the time I made the pick. The stock was trading below $5 and the LEAP options were well below $1.

Here’s what I wrote:

Karim R. 3/10/2020 at 11:36 a.m.

Open CLF: It’s time to add the second half of your position to CLF. BUY TO OPEN the CLF Jan 2022 $7 (CLF JAN 2022 $7C) calls at a LIMIT price of $0.88 or lower. The spread is $0.81 by $0.91 – don’t fall for it. Work your way up from the bid and use the market weakness to your advantage. New members – if you want in on this trade, please do a search and read up on the rationale before acting and then decide if you want in or not.

Members like George bought in.

And then Cleveland-Cliffs, as we expected, started moving.

It went up… and up… and up some more.

At first, we didn’t know how much George was making – just that he was a happy camper!! We followed his posts over the next few months as he updated us on his results. Below is one from December 2020 when Cleveland-Cliffs had just broken above $12…

Here’s what George told our War Room members:

George L. 12/2/2020 at 10:23 a.m.

CLF has cleared 12$! My LEAPS from March are up 809%.

Wow, 809% – but no dollar figure! But what a gain!!

He wasn’t done, though. And remember, he was a newbie who had joined the War Room in late 2019 and had never done an options trade before joining!

In June 2021, George was getting antsy. Cleveland-Cliffs was moving higher – much higher, above $20. I would have been a little itchy too…

He was trying to decide how much profit to take. (Not a bad problem to have!)

Here’s what he said:

George L. 6/10/2021 at 10:11 a.m.

I’m conflicted over the CLF trade. On the one hand, I’m still holding $7 calls from one of Karim’s LEAP trades in March of 2020. Go CLF, go! On the other hand, I’ve seen so many retreats. There are a lot of mentions on the meme sites. So far, the overnight price gains are coming back.

But as it turns out, George held on. How do I know? Well, you can hear his story right here, in his own words!

Then came the big one – as if this wasn’t huge enough already.

Just over a month later, George wrote this:

George L. 7/29/2021 at 10:11 a.m.

Yeehaw! I still have CLF LEAPS from a Karim trade on 3/18/20. They’re up 2,548%!

“Yeehaw!” is right, buddy! Two thousand five hundred and forty-eight percent!! And it gets even better…

George held even longer than we did in our model portfolio and did even better! He showed us that his trade on CLF is up ONE HUNDRED AND EIGHTY-ONE THOUSAND DOLLARS ($181,000)!!!

And this is just one of many winners George has achieved.

When we talked to George, he showed us his trading records. Using War Room techniques, he was able to at one point increase his account from $160,000 to a peak of more than $2 million.

This was during a period of about three months!

We asked George to share his story with us on video – how he began trading as a total novice, his winners, his losers and what he learned that made him an ace trader in such short time.

We did this knowing that YOU could be the next George. After all, he’s just an everyday guy who loves to fish and go out on his boat from his humble home in the bayou of Louisiana.

I am not kidding – George is about as humble and quiet a guy as you will ever meet – as you’ll see in the video. But don’t let that quiet demeanor fool you. He made big gains. And you know what… he still has a bunch of those Cleveland-Cliffs LEAPS left in his portfolio.

I hope you’ll watch him tell his story because he learned so much as a newly minted options trader.

He’s had ups and downs for sure, but listening to someone who’s seen success like him can really help you get better and start seeing the results you want.

Action Plan: Don’t miss out on what could be the most important, life-changing video that you will ever see. Watch our interview right now!

Fun Fact Friday

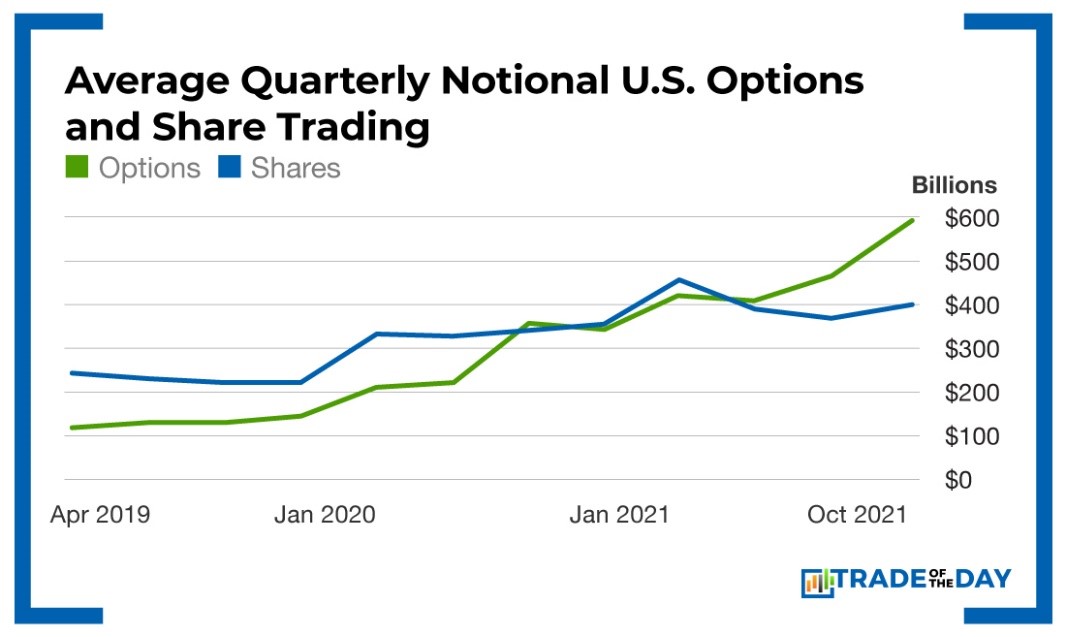

For the first time ever, options trading activity in on track to exceed that of the stock market. The average daily notional value of traded single-stock options has risen to more than $450 billion this year, compared with about $405 billion for stocks, according to Cboe Global Markets data. The options trading revolution is taking off! If you are missing out, join us here.

More from Trade of the Day

5 Sectors Set for Major Shifts if Harris Wins

Oct 18, 2024

Why Permian Resources Might Be The Next Big Play

Oct 17, 2024

How a Trump Presidency Could Affect Policy

Oct 15, 2024