Did Your Fund Panic This Week?

This week was rough on Wall Street – even rougher than it looks on the surface.

The Nasdaq Composite is down more than 11%. That’s a correction.

Look a little deeper, and you’ll see that the majority of stocks in the Nasdaq are down more than 20%, with a huge swath down more than 40%.

Folks, that is not just a correction. That is a crash.

You can bet the crash is putting a hurt on mutual funds that bought the highfliers of 2021.

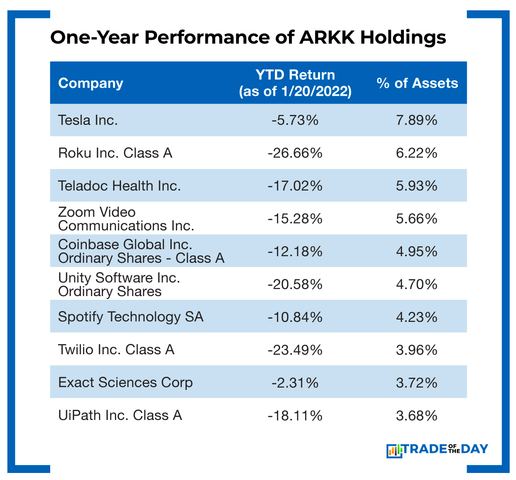

Take the Ark Innovation ETF (NYSE: ARKK), for example. It is down more than 50% from its 52-week high.

Imagine that, an ETF down more than 50% in one year.

What are Ark’s top holdings?

Well, it’s a “who’s who” of tech giants that had been all the rage post-pandemic.

The ETF’s largest and arguably most overvalued holding, Tesla, is just starting to feel the pain.

It could get worse – much worse.

The phrase “nowhere to hide” is gaining credence if you’re heavily invested in tech.

However, that’s the way it’s always been.

Tech is growth, and growth does great until it stops. Then it falls off a cliff.

Action Plan: When tech is getting slaughtered, you need to do four things.

- Start buying select technology stocks that are getting pummeled along with the highfliers.

- Make the shift to value. Look for companies with solid fundamentals and earnings.

- Look at what your fund WAS holding in November of last year, not today. That will tell you whether the managers were taking too much risk.

- Finally, you need to tune in to The War Room for real-time analysis. While most were panicking this week, Bryan calmly led members to 45%-plus gains using the ProShares UltraShort QQQ ETF (NYSE: QID) which shorts the Nasdaq 100. In The War Room, we win – in any market.

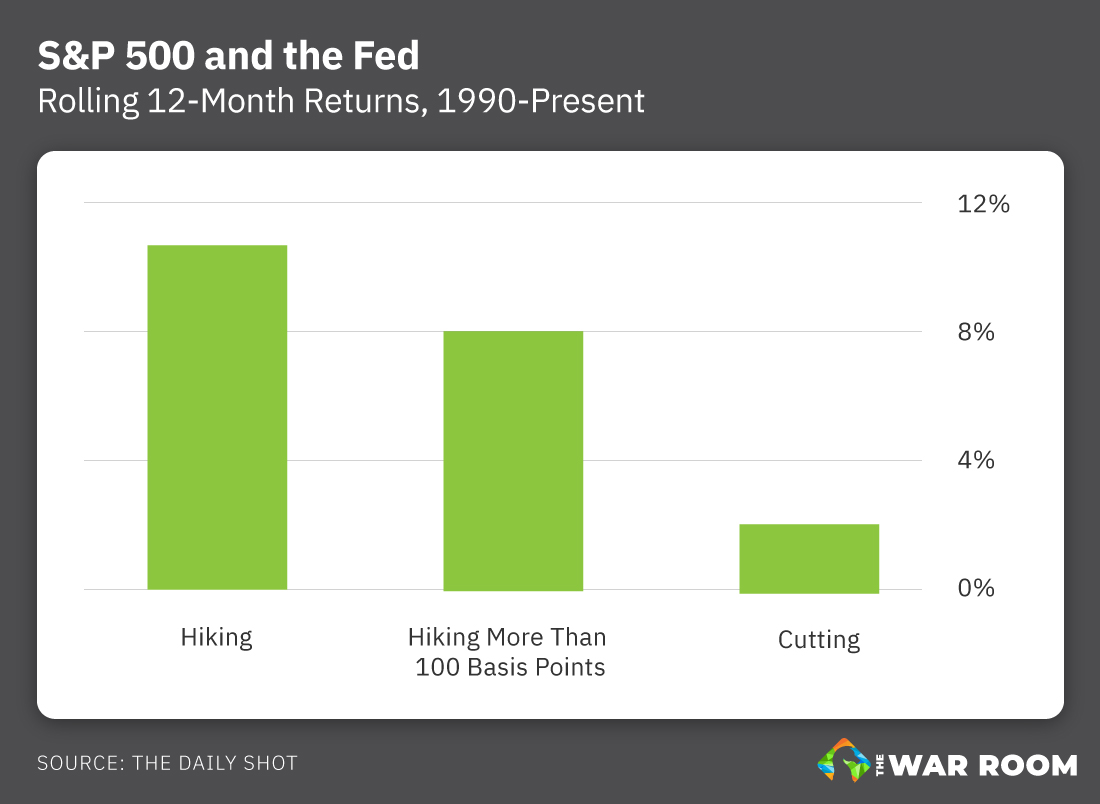

Fun Fact Friday: Don’t let the recent sell-off turn you into a permabear. Since 1990, over a one-year horizon, rate hikes have been better for stocks than rate cuts. For now, keep hunting for quality and value – history says you’ll come out ahead.

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024