The 2 Best Defense Plays Your Money Can Buy

Today’s message is simple…

Right now, we have the combination of a major market sell-off and tensions between Russia and Ukraine that are getting worse by the day.

When you add them both together, it’s clear that now is the time to reallocate your portfolio in the defense/aerospace sector.

What’s the best way to do that?

I believe there are two superior ways to get exposure to the entire sector – all in one shot.

The first play is more conservative.

It’s the iShares U.S. Aerospace & Defense ETF (BATS: ITA).

Here are the ETF’s top 10 holdings.

- Raytheon 19.71%

- Boeing 18.63%

- Lockheed Martin 5.55%

- Teledyne 5.01%

- L3Harris Technologies 4.83%

- General Dynamics 4.73%

- Northrop Grumman 4.51%

- TransDigm Group 4.47%

- Textron 4.26%

- Howmet Aerospace 3.51%

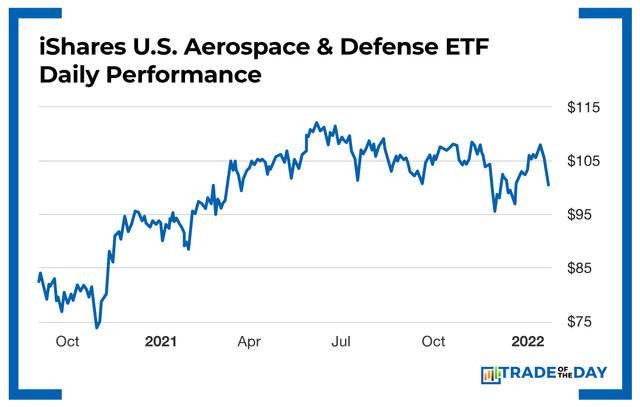

And here’s a chart showing its recent performance:

For $100 per share, you get a basket of the market’s top aerospace and defense companies.

The second play is more speculative.

It’s the Direxion Daily Aerospace & Defense Bull 3X Shares ETF (NYSE: DFEN).

This is a defense fund that invests 80% of its assets into financial instruments and securities that track the performance of the aerospace and defense industry of the U.S. equity market.

It moves at a rate of 3X the defense/aerospace sector and could represent a cheap but highly leveraged way to get positioned in the entire sector.

Action Plan: With a confrontation between Russia and Ukraine looking more inevitable by the day (which would most certainly be met with some sort of U.S. response), I believe that having some exposure to the defense/aerospace sector makes a lot of tactical sense.

Depending on whether you’re a conservative investor or a speculative trader, I’ve offered two options above that’ll fit your risk-tolerance profile.

How did we play this in The War Room? Join us today to find out – and to claim 322 winners guaranteed over the next year!

Monday Market Minute

- The Energy Select Sector SPDR Fund (NYSE: XLE) is worth monitoring due to inflationary pressure. It offers exposure to best-of-breed companies like Exxon Mobil (NYSE: XOM), Chevron (NYSE: CVX), EOG Resources (NYSE: EOG) and ConocoPhillips (NYSE: COP). Tracking.

- Defense stocks look ready to run, as a Russian invasion of Ukraine seems inevitable. A conservative play would be the iShares U.S. Aerospace & Defense ETF (BATS: ITA).

Last week, we noted in The War Room that a huge number of stocks had already crashed. This is not the time to be selling quality. If you are positioned properly and have cash on hand, opportunities abound. Join us in The War Room now to seize them!