Goldman’s Sneaky $2 Billion Secret

Editor’s Note: It’s a fact that early investors score the biggest profits. We’ve all heard of the incredible gains made by early investors in Uber… Snapchat… Netflix… and more. It used to be that regular folks couldn’t get in on these opportunities… that they were reserved for only the world’s richest. But now anyone with as little as $100 can invest right alongside those elite investors for a shot at creating generational wealth.

Our good friend Andy Snyder, the founder of Manward Press, is here to tell us about the exciting developments in the private-equity sector… and why now is the perfect time to start investing in the space.

And he’s just uncovered a small, private tech disrupter that investors can get in on today… with the potential for 100X gains in the next five years. It’s a tiny company that’s poised to fix the No. 1 problem in an $84.5 trillion industry. Details here.

– Ryan Fitzwater, Associate Publisher

There was a secret tucked inside an earnings report from the banking sector this month.

It reveals a suspicion many investors had. They thought the big banks may have been doing something sneaky.

And now there’s proof.

I’m going to blow their secret wide open. Better yet… I’m showing readers how to get in on it.

This is huge.

Big Profits

Buried deep inside the earnings report from Goldman Sachs (NYSE: GS) earlier this month was word that the company had turned a corner in a very profitable sector of the market. It’s a sector you’ve heard about – and probably even dreamt about – but I’m certain 99% of readers have never touched.

You see, the folks at Goldman lost a lot of money in the stock market last quarter. Add up all the wins and subtract all the losses, and you’ll have to write down the sum in red ink. The big bank lost $500 million in publicly traded stocks.

But all was not lost.

Goldman has a secret weapon… a weapon so powerful that it brought $2 billion worth of profits to the company in the last three months.

While its foray into publicly traded stocks (which it is actively working to reduce, by the way) dwindled, its private stock holdings surged in value.

“Good for them,” readers will say. “But I can’t get access to private stocks.”

Ah… nay, nay.

You can.

And if you’re smart… you will.

The Secret’s Out

Whether the wonks at Goldman like it or not, their secret is out. The lights have come on, and we can see who’s in bed with whom.

Better yet… now we can hop in too!

Over the last few years, the rules that once kept most investors out of private equity have loosened significantly. In fact, a major change to the law – which was almost entirely missed by the mainstream crowd – has created a tremendous opportunity.

And if you know me… I’m not about to miss any chance to show readers how to sneak in and grab some profits – even if the big boys think we’re stepping on their toes.

I’ve just revealed my latest research. It’s a way to get into the best private deals – just like Goldman Sachs – for as little as $100.

I’m very excited about it (click here to check it out), but right now… back to Goldman’s little secret.

Immense Growth

The bank added more than $100 billion to its private-equity investments last year. It now has well over $400 billion in private deals.

But, again, few folks know what it’s up to.

“Private equity is a bit of a black box for Goldman Sachs and other big banks in the business,” says Putnam Investments’ Ellen Hazen. “There’s not been a lot of transparency or disclosure.”

In fact, Goldman first laid out the details of this rather clandestine business only in January of 2020. It’s grown immensely since then.

And now we know why.

It’s hugely profitable.

While the company lost a boatload of cash in the public stock market… it more than made up for it in the “private” market.

But here’s the thing… the private market is no longer private.

Anybody with $100 can now get in.

And whether the white-shoe crowd likes it or not, that’s exactly what I want you to do.

So click here to check out my latest research on the explosive growth in this sector (plus the one company that I think has the potential for 100X gains)… and to see how everyday investors can get a chance at building generational wealth.

Be well,

Andy

Fun Fact Friday

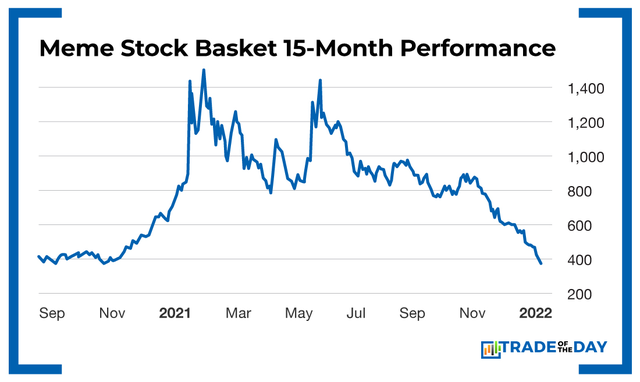

Just like that, the meme-stock craze of 2021 is over. As you can see from the chart, the top basket of meme stocks has now retraced all the way back to its 2020 starting point. YIKES! Without question, the decline in meme stocks has been relentless. When will the bleeding stop? And more importantly, will any meme stocks emerge in 2022 that are worth betting on? Stay tuned. We’ll have some insights and ideas for you in the coming weeks that you DO NOT want to miss.

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024