We’re About to Reload on This $13 Stock

Pro Traders don’t trade hundreds of ticker symbols.

Knowing the ins and outs of that many businesses is impossible. And trying to individually trade that many stocks is a loser’s game.

Instead, we track a handful of stocks. This allows us to have a deeper understanding of those companies’ business models, financials, management teams and technical trends.

This is a core secret to winning in trading.

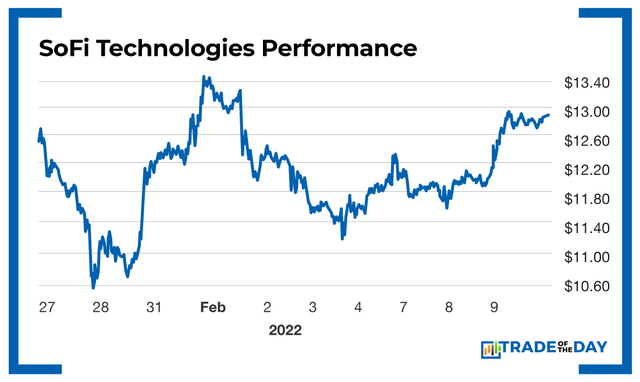

For example, one stock Bryan and I have both been tracking and trading (with great success) is fintech leader SoFi Technologies (Nasdaq: SOFI). In our real-time trading platform – The War Room – we’ve traded the stock nine times at a 100% win rate.

Just yesterday, I closed out a SoFi play for gains of 25.58% in nine trading days. It was a pre-earnings play. But SoFi won’t report earnings for a few weeks – so what gives?

Well, before I get into that, this is what some members had to say about our two-week play:

Dale B. 2/9/2022 at 11:19 a.m.

In at $1.36, out at $2.16 for a 59% return… Great call, Karim!

Robert D. 2/9/2022 at 11:19 a.m.

SOFI diagonal spread – in at $1.68, out at $2.15, +28% profit in less than 2 weeks. Thanks, Karim, for a marvelous trade!

T.Doug 2/9/2022 at 11:29 a.m.

30% profit in this market – I’ll take it!!! Thanks, KR!

Those are just a few of the dozens of members who cashed in. Despite the fact we rung up gains of 25% to 59% using a strategy called a “diagonal spread,” the stock itself went up “only” 12%.

And here’s what’s important for you to know as a Trade of the Day reader…

I don’t believe SoFi is done just yet. We closed out early because I think SoFi will pull back before earnings if the market has a bad day or two. Then we’ll likely reload.

SoFi just picked up a bank – yes, the company bought a bank. And by doing so, it’s gained access to all the financial products a bank offers.

So what, you say? There are hundreds of banks.

True, but there aren’t hundreds of online financial technology (fintech) platforms that are growing like crazy and are especially popular with the under-40 crowd.

SoFi is one of them and a leader in the space. Its journey is just beginning, and I think a longer-term holder could see shares double from current levels.

But before that happens, you have to know how to play it and when to play it. Should you buy LEAPS (long-term equity anticipation securities), buy the stock, do a put sell, do a covered call, do a spread…

Action Plan: We have the answers for you every day in The War Room. So if you want to know the right time to reload on SOFI, join us now and become part of the crowd that rings the register more than 76% of the time!

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024