Trade This Major Takeover Immediately

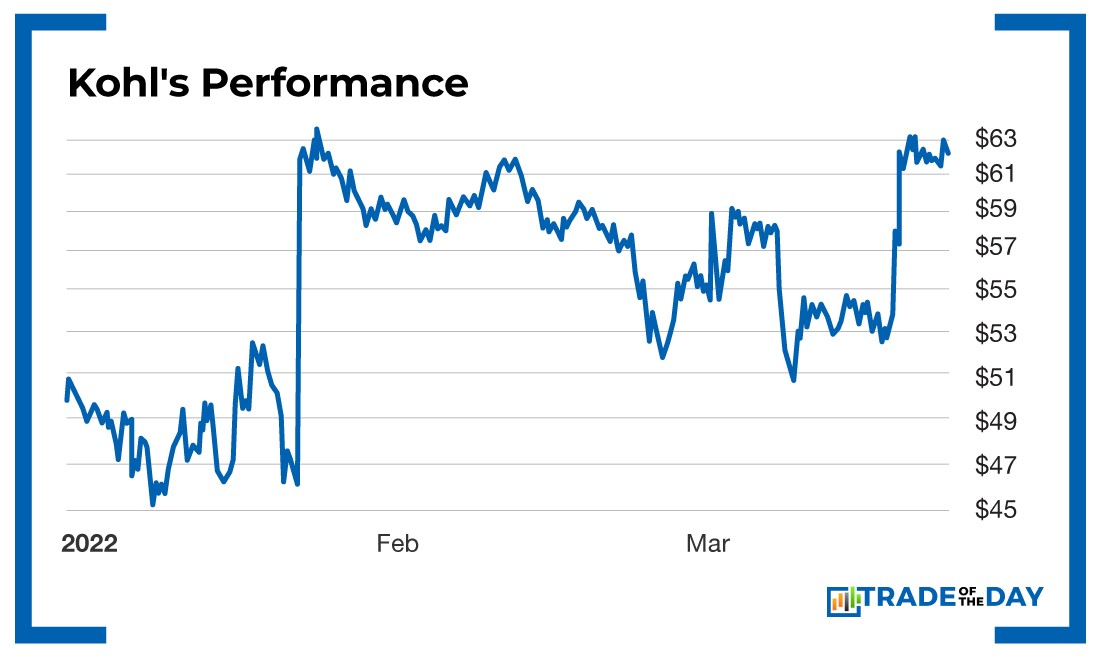

Last week, shares of Kohl’s (NYSE: KSS) blasted higher on the news that there’s a three-way bidding war to acquire the stagnant big-box retailer.

Kohl’s operates 1,162 big-box retail stores, along with 12 Fila outlets, throughout the United States.

Even after some savvy maneuvers with Amazon, shares have been stagnant and investors are getting antsy, which has led to some recent takeover chatter.

As you read this…

Private equity group Sycamore Partners…

Canadian department store operator Hudson Bay…

And private equity firm Leonard Green & Partners…

Are all in play as potential buyers, and the talks appear to be serious. All three of these groups have been legitimate leveraged buyout candidates in the past, which means that some sort of deal could be on the horizon.

As analyst Chuck Grom said, “Where there’s smoke, there’s fire.” I tend to agree.

So here’s what you need to realize…

If you’re Kohl’s and there are three possible suitors, you don’t settle for the first price.

Rather, you get everyone interested engaged in a bidding war.

In my opinion, if Kohl’s wanted to get acquired for $65 per share, that deal would’ve already happened. But to me, it seems like it could hold out and push its per-share premium as high as $80.

Action Plan: I just recommended a trade inside The War Room that would get you positioned for a handsome payday if Kohl’s agrees to be acquired – and I urge you to get into this trade immediately. If I’m Kohl’s and there’s a three-way bidding war, I hold out for $80 per share – and I see if the bidding goes higher and higher. If that happens, this new trade could explode.

Want to get this new trade right away? Click here to join The War Room. We’ve already generated a total return of 115.8% in 12 days despite high market volatility – and we’re just getting started.

Unlock these trades by clicking here.

Monday Market Minutes:

- Insider buying: Bumble (Nasdaq: BMBL) and SoFi Technologies (Nasdaq: SOFI) saw insider buying on Friday after the close. Tracking.

- Oil is spiking again, which has allowed War Room members to lock in another winner on the Energy Select Sector SPDR Fund (NYSE: XLE). It’s worth noting that XLE is the only sector ETF to post a gain so far in 2022. So dip buying is a strategy that’ll continue to pay off going forward.

- In times of market indecision – like we’re seeing right now – a strong tactical approach is to adjust our bias to trade a higher percentage of two-sided earnings plays. That way, we’re playing movement itself – whether up or down – rather than betting on its direction (which changes by the second).

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024