Toy Company Spikes Amid Buyout Rumors

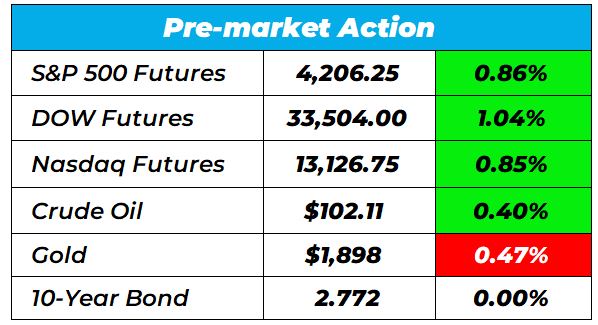

Good morning Wake-Up Watchlisters! While you’re sipping coffee and accidentally stepping on hot wheels cars (more on that below) you’ll see stock futures rose as dip buyers bought at some of the lowest levels in six weeks.

Here’s a look at the top-moving stocks this morning.

Mattel (Nasdaq: MAT)

Mattel is up 12.57% premarket as the famous toy company is in talks with equity firms Apollo Global and L Catterton about a potential buyout. The interest in acquiring the $7.8 billion company is preliminary, meaning the deal is still in its early stages. Keep an eye on Mattel going forward.

Enphase Energy (Nasdaq: ENPH)

Enphase Energy is up 8.10% premarket after setting a number of records in the first quarter of 2022. They finished with $441 million in sales – a new high. Gross margin also improved, and that led to a 40% net income increase from year-ago levels. Enphase also expects to keep up the momentum, with sales expected somewhere between $490 million and $520 million for the second quarter. Enphase has a lot going for it right now.

We’ve made some major gains in the energy sector in The War Room. As globalization shifts and countries start relying on their own energy reserves, there are plenty of buying opportunities to be had. Click here to unlock those trades.

Microsoft (Nasdaq: MSFT)

Microsoft is up 5.40% premarket after posting strong fiscal third quarter results due to cloud-related growth. The company reported $49.4 billion in revenue versus $49 billion expected. Overall, Microsoft’s Intelligent Cloud business saw revenue increase by as much as 26% year-over-year to $19.1 billion. This stock is looking strong.

VISA (NYSE: V)

Visa is up 5.16% premarket after the payment-technology giant easily exceeded earnings expectations. Clearly inflation and the Ukraine war haven’t slowed down spending, as Visa saw profits rise 21% during the second quarter. These profits were fueled by a large jump in spending on the company’s credit and debit card network. Visa is a stock to watch going forward.

NCR Corp. (NYSE: NCR)

NCR Corp. is down 19.76% premarket as war, COVID and inflation hit first-quarter earnings. Profits were lower than expected, so much so that the seller of automated teller machines scaled back its outlook for the full year. NCR came out with quarterly earnings of $0.33 per share, missing the Zacks Consensus Estimate of $0.64 per share. NCR Corp. is on the downtrend right now.

Head Trade Tactician Shows You How to Trade in Volatile Markets

Want to start trading but feel like your bank account is too small? Bryan Bottarelli, our Head Trade Tactician at Monument Traders Alliance, has a common sense video for you. In it he writes about the ‘5 Simple Trading Tips to GROW a Small Account.’ You won’t want to miss this one.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team