Rebranding Sends This Stock Soaring…

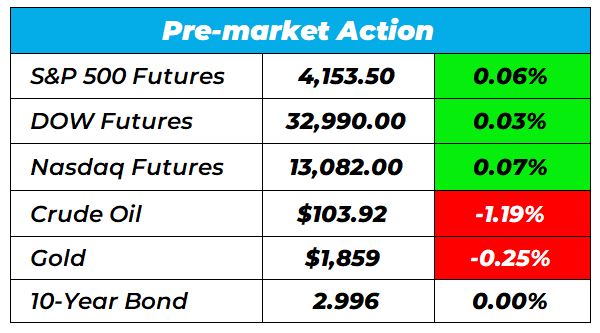

Good morning Wake-Up Watchlisters! While you’re sipping that blonde roast coffee you’ll see stock futures edged higher Tuesday. Investors are bracing for another volatile session due to the Federal Reserve’s policy decision tomorrow. The CME Group’s Fedwatch is pricing a 99.8% chance of a 50 basis point hike on Wednesday.

With so much uncertainty surrounding the markets, we want you to be prepared. That’s why we’re offering a FREE one-week subscription of The War Room. Here you’ll get all our insights and trades to help you make gains even in a tough 2022 market. We’ve made over 1200 winning trades since inception, and we’re guaranteeing 322 winners for members in their first 12 months. Click here to unlock those trades.

Here’s a look at the top-moving stocks this morning.

Hyatt Hotels Corp. (Nasdaq: H)

Hyatt Hotels is up 9.04% premarket after company unveiled its newest lifestyle brand, Caption by Hyatt, for the summer of 2022. The new hotels will combine the design and comfort of an upscale lifestyle brand with the flexibility of a select service property. They plan to expand this brand globally through 2024, with spots in Shanghai and Tokyo. Plus with travel picking back up as COVID-19 restrictions are lifted, Hyatt is a stock to keep an eye on.

Devon Energy (NYSE: DVN)

Devon Energy is up 5.40% premarket after the company surpassed quarterly earnings of $1.88 per share, beating the Zacks Consensus Estimate of $1.74 per share. Devon Energy shares have added about 32.1% since the beginning of the year versus the S&P 500’s decline of 13.3%. Devon Energy is looking strong.

Louisiana-Pacific Corp. (NYSE: LPX)

Louisiana-Pacific Corporation is up 3.24% premarket ahead of first-quarter earnings results. The company benefited from increased focus on the Siding business and rigorous cost-control efforts. Last quarter, the company’s earnings and revenues topped the Zacks Consensus Estimate by 20.4% and 17.3%, respectively. Louisiana-Pacific Corp. is a stock to keep an eye on.

Chegg (NYSE: CHGG)

Chegg is down 36.23% premarket as the company deals with issues of enrollment, the economy and now inflation. The educational platform slashed its full year profit outlook in earnings on Monday. The company sees full year adjusted operating profits of $220 million to $235 million compared to $260 million to $270 million previously. As inflation continues, many students will likely choose earning money over learning, making Chegg a volatile stock.

Head Trading Fundamental Tactician Reveals His Secret Stock Blueprint

Do you struggle to know which company to invest in? Our Head Trading Fundamental Tactician Karim Rahemtulla reveals his ‘6-criteria stock blueprint’ in this article. By the end you’ll know exactly which metrics to look at before investing your hard-earned money. Click here to read the article.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team