Fast Food Stock Beefs Up Amid Takeover Bid

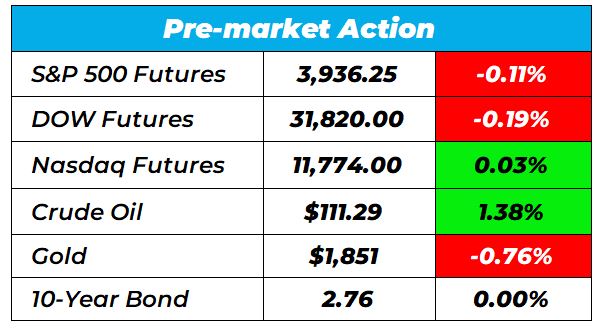

Good morning Wake-Up Watchlisters! While you’re munching on that baconator cheeseburger (more on that below) you’ll see stocks dipped Wednesday as markets proceed cautiously around the Federal Reserve’s May policy meeting. The Fed is likely to delivery 50 basis point rate hikes at consecutive policy meetings between now and September.

But despite the bearish market trends, we’re still trading like gangbusters in The War Room. Yesterday we closed on 5 double-digit winners despite a crazy day of market chop. Click here to unlock those trades.

Here’s a look at the top-moving stocks this morning.

Wendys (Nasdaq: WEN)

Wendy’s is up 11.56% premarket after activist investor Nelson Peltz said he was considering a takeover of the iconic restaurant chain. Peltz is the chair of Wendy’s board and has been an investor in the group for nearly two decades. Keep an eye on Wendy’s going forward.

Nordstrom (NYSE: JWN)

Nordstrom is up 8.99% premarket after the mall-focused retailer defied the sector’s recent gloom. Nordstrom had a narrower-than-expected first loss paired with a boost to its full-year profit forecast. The company also noted it hasn’t seen any impact on demand from the fastest inflation in forty years, and price increases have been largely absorbed. Nordstrom is looking strong.

Toll Brothers (NYSE: TOL)

Toll Brothers is up 3.61% premarket after posting solid second-quarter earnings. The company came in at $1.85 per share, beating the Zacks Consensus Estimate of $1.46 per share. This compares to earnings of $1.01 per share a year ago. Its latest report represents an earnings surprise of 26.71%. Toll Brothers is looking solid right now.

Reliance Steel & Aluminum (NYSE: RS)

Reliance Steel & Aluminum Co. is up 3.93% market as the company is about to trade ex-dividend in the next four days. The company’s next dividend payment will be $0.88 per share, on the back of last year when the company paid a total of $3.50 to shareholders. The consensus EPS estimate for its current year has also increased 3.6% over the last 30 days. This means Wall Street analysts expects the company to report better earnings than what they predicted earlier. Keep an eye on Reliance Steel going forward.

An Arbitrage Play On This Duopoly

You know the status of the market. But despite the laundry list of bearish news, there are pockets of strength you can capitalize on – if you know where to look. Our Head Trading Tactician Bryan Bottarelli shows you a big opportunity in the rental car sector. Click here to watch the video.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team