Are We in a Secret Depression?

I have something urgent to tell you…

The Ghost of Christmas Past is whispering into our ears right now.

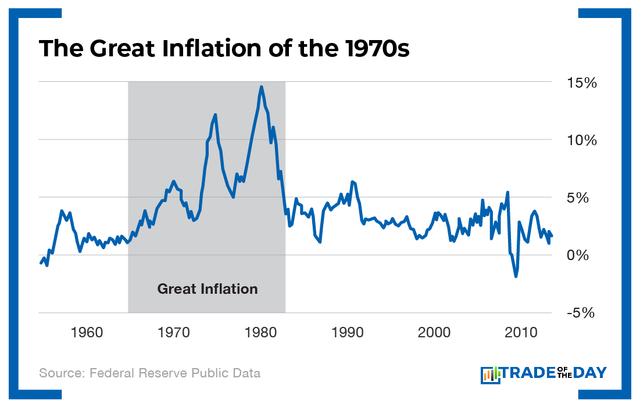

He bids us to hark back to the 1970s.

You might remember those days.

Jimmy Carter was the president.

Disco was popular.

And bell bottoms were a top fashion trend.

But there was also another big trend in the 1970s…

Inflation became a problem around 1972 or 1973 due to several factors (the Arab oil embargo being one of them).

And the worst part was…

This inflation lasted more than a decade.

It wasn’t until 1982 that inflation fell to 5% and long-run interest rates began to decline.

That’s 10 years of economic pain.

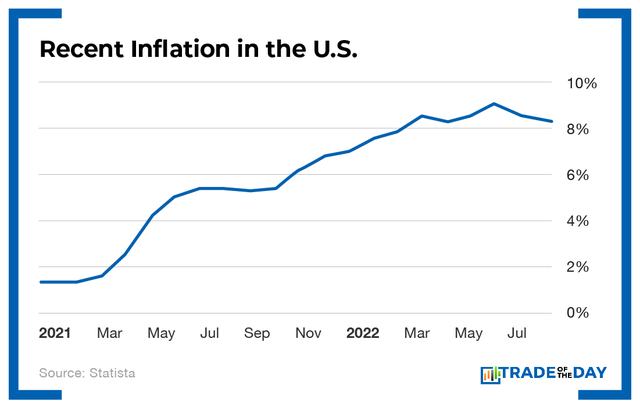

And if you look at the chart below… you’ll see that an eerily similar scenario is playing out today.

But there’s also another factor that made the 1970s an era of “secret depression.”

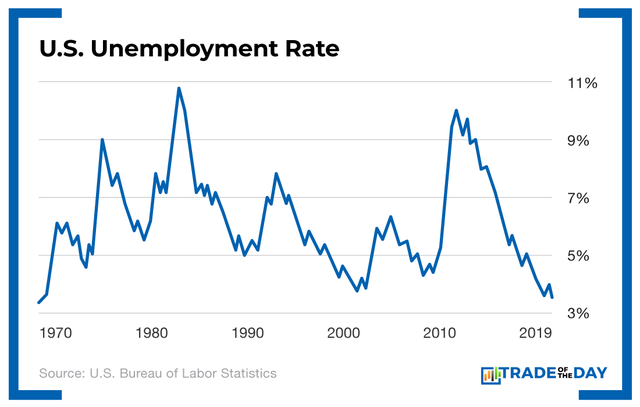

You see…. in addition to high inflation, the 1970s had high unemployment.

This combination of high inflation and low economic growth is called stagflation.

I won’t get into the details too much since stagflation’s a little complex.

But it’s basically a double whammy of economic pain. High unemployment means people have less money, and high inflation means their money has less and less value.

Stagflation is painful.

It’s difficult for people to plan their budgets from week to week because they’re struggling just to find jobs or to cut every cost possible.

There’s also the real fear people have of losing all their savings.

In short, it sucks.

And we actually have stagflation right now in 2022.

The only reason it’s not worse is…

Employment numbers are strong… for now.

The current national unemployment rate is 3.7%, down a full percentage point from a year ago.

To put that into perspective, the late 1970s saw inflation numbers near 11%.

That’s a big difference.

But here’s where it gets tricky.

The Federal Reserve is trying to raise interest rates to curb spending.

What it won’t tell you is…

It has a vested interest in making unemployment higher since that will cause inflation to go down.

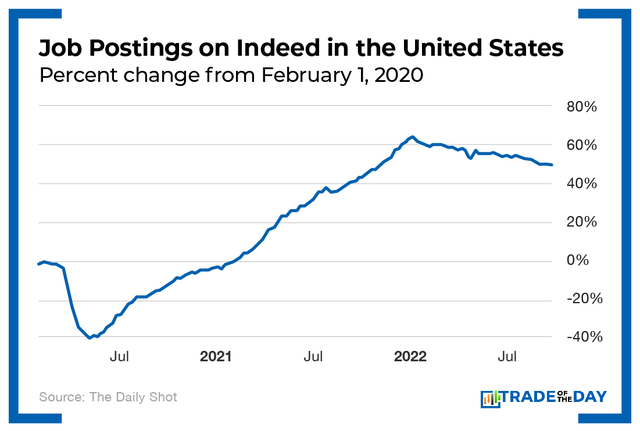

Take a look at the chart below.

You’ll see in the chart that job postings are already drifting lower after record openings last year.

But the rate of decline is not fast enough for the Federal Reserve.

Its goal is to get inflation below pre-pandemic levels, around 3.7%.

So higher unemployment actually helps the Fed’s cause.

For example, consider what Larry Summers, former Secretary of the Treasury and economic advisor to former President Barack Obama, said.

Larry Summers said all we need to solve inflation is a major spike in unemployment to 10%.

Yikes.

But the logic makes sense.

The fewer jobs there are, the less money people have to spend. So they’ll stop spending, and inflation will go down.

Unfortunately, even if inflation does go down, we don’t know how long it will take before we see the real benefits.

Remember, the 1970s inflation crisis lasted for 10 years.

Plus, with the crisis in oil due to the Ukraine-Russia conflict still going on – not to mention the supply chain issues in China due to strict COVID-19 policies – there’s still lots of uncertainty in the markets that could keep inflation around for a while.

If you add in a higher unemployment rate (like we’re currently starting to see), then we could see the dreaded stagflation all over again in 2023 and beyond.

In short, we could be in a “secret depression” for a while.

Action Plan: I know, this is not what you want to hear. But this isn’t all doom and gloom.

The truth is… there are always ways to make money through investing – even if traditional methods are failing us. That’s why now more than ever we’re exploring better ways to invest in the current markets. Right now, I’m telling investors about a simple $3 dividend paying asset that could help them in this worrisome time. Plus, I’m sharing four more super investment opportunities.

Click here to unlock this $3 alternative investment opportunity.