Cybersecurity Stock Rises After Buyout

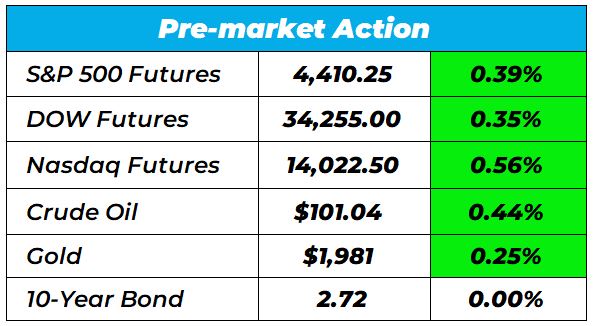

While you’re sending a hilarious deepfake to your friend (more on that in a minute) you’ll see stock futures are up slightly as the Consumer Price Index is showing signs inflation may have peaked. However, it’s not all rosy as the Russia/Ukraine conflict continues and high energy prices associated with that may keep bleeding into other areas.

Here’s a look at the top-moving stocks this morning.

KKR & Co. Inc. (NYSE: KKR)

KKR & Co. is up 5.75% premarket after announcing it plans to buy cybersecurity firm Barracuda Networks from its private equity owner Thoma Bravo, showcasing continued interest in cybersecurity businesses from buyout firms. The financial details of the deal haven’t been disclosed yet. Barracuda has grown into a business that generates $500 million in annual revenue since 2017. Keep an eye on KKR & Co. stock going forward.

Nucor Corp. (Nasdaq: NUE)

Steel Company Nucor Corp. is up 4.29% premarket after announcing it would construct a new rebar micro mill in Lexington, NC. This will be the steel company’s third rebar micro mill, with two others currently in Florida and Missouri. Nucor steel bar products contain 97% recycled content and shares of Nucor have surged 95.2% in the past year compared to a 20.7% rise in the industry. Nucor is looking strong right now.

AutoZone (NYSE: AZO)

AutoZone is up 3% premarket as the company recently reported strong financial earnings. Their strong earnings largely come from same-store sales growth, which grew 13.6% over the last quarter. Their stock is up 214% in five years and the share price has risen 16% in thirty days. AutoZone is a solid stock worth paying attention to.

Louisiana-Pacific Corp. (NYSE: LPX)

Louisiana Pacific-Corp is up 3.29% premarket as after boasting solid net profit margins. The company currently sports a Zacks Rank of 1 and has a VGM Score of A. The Zacks Consensus Estimate for Louisiana-Pacific’s 2022 earnings has been revised upward to $13.02 per share from $12.43 in the past seven days. LPX surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 13.3%. This is a stock on the upswing.

The energy sector has been one of our most rewarding investments in The War Room. Last month we closed five double-digit gains with one specific stock. These trades have helped us reach lighting-fast gains as high as 70% in six minutes. Click here to see more trades like these.

PayPal Holdings (NYSE: PYPL)

PayPal Holdings is down 2.08% premarket after longtime CFO John Rainey announced he’s leaving to join Walmart. This could signal a major push into the financial services for WalMart, however it’s clearly a loss for PayPal as Rainey helped build the company from a button on an eBay site to one that transacts crypto and owns a beast in Venmo. PayPal could be volatile going forward.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team