Bitcoin or Sh#tcoin?

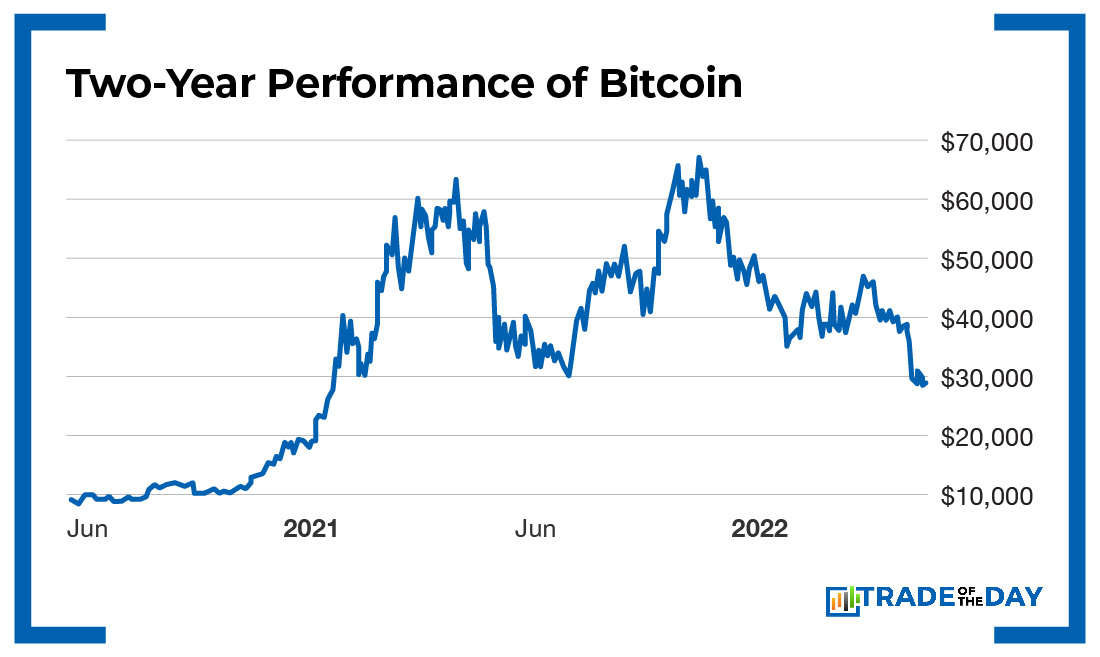

It’s estimated that over 40% of Bitcoin owners are underwater in a study by Glassnode. They are the ones who loaded up in November of last year.

But that pales in comparison to the nearly 100% of stablecoin holders who were holding Terra. This infamous “stablecoin” was anything but, and it plunged to almost zero before it was suspended.

This leads me to the remaining cryptos – thousands of tokens, many more remaining “stablecoins” and those coins paying you double-digit interest rates.

If you’ve been around for a while, you know that things that are too good to be true often are.

This is no different. A ton of money printed by the government flooded the crypto market, and the same gamblers who thought GameStop was worth $400 were plowing their cash into cryptos.

Then, shady operators seeing all the interest created even more “sh#tcoins” out of thin air. Even a fake coin that the creator called a satire on cryptos, Dogecoin, went ballistic. And Elon Musk, the “god” of everything, pontificated his support of Dogecoin just before calling it “a hustle” on a Saturday Night Live appearance in May 2021. Dogecoin has since fallen from $0.64 to less than $0.10 and is likely worth even less if the coin’s creator is to be believed!

So let’s get back to Bitcoin – the big kahuna.

I have owned some Bitcoin in the past and traded in and out of it profitably, even though I probably know as much about it as those who claim to know more.

What I do know is that the asset looks very precarious on a chart, and that is what I want to share with you. Based on the chart of Bitcoin, it is in serious trouble if it falls below $27,000. It is above $28,800 right now after dropping to just over $28,000.

How precarious, you might ask?

Well, a sustained break under $27,000 could take it down to… wait for it… $10,000 or thereabouts. Of course, it will take time – or maybe it won’t. And that’s where I will be waiting to buy in again.

Action Plan: So if you are a holder, hodler or trader of crypto, it’s time to check your position size, as the last thing you want is to join the 40% who are already down.

Fun Fact Friday

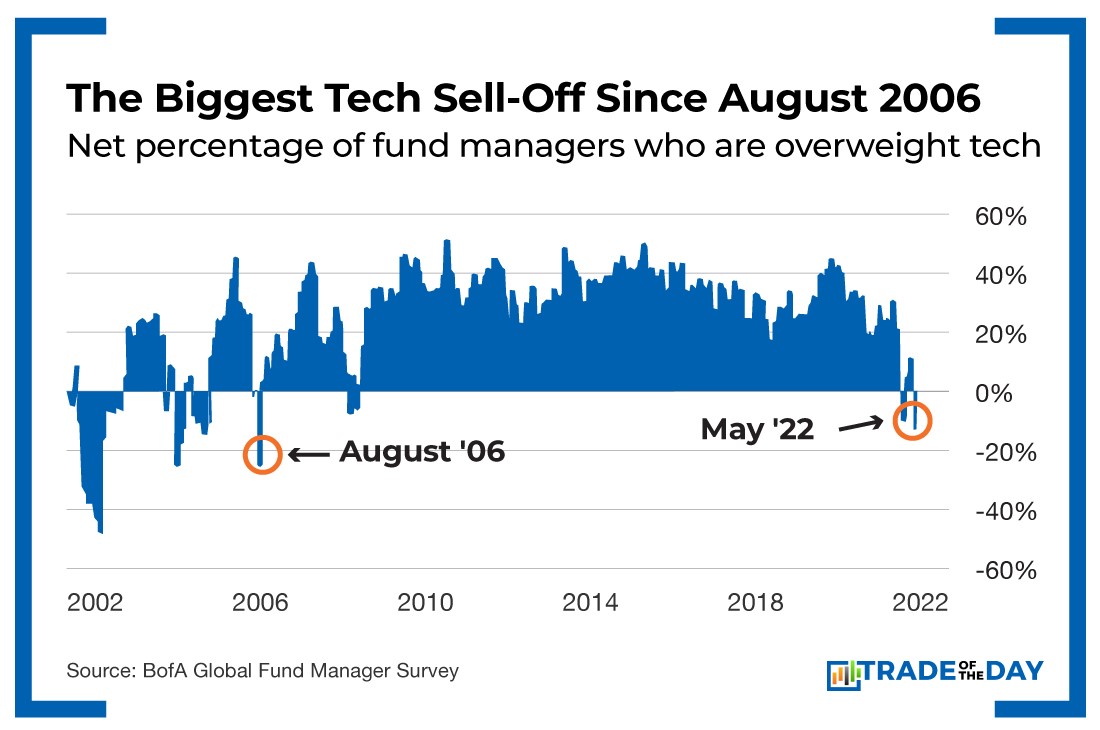

The tech sell-off has been rough. As a result, fund managers haven’t been this underweight tech since 2006. And while most tech investors are crying, we are ringing the register in The War Room. We’ve hit five double-digit wins for an 83% win rate using a unique inverse exchange-traded fund. And using our leveraged strategy, we are capturing 10X returns when tech stocks tank. If you want to start winning when markets drop, unlock The War Room here.