Buffett Buys Barrick Gold… Should He Buy This Instead?

Warren Buffett is arguably the most successful investor of our time. But lately, people have been doubting the wisdom of the Oracle of Omaha.

He took a bath in airline shares, selling when they collapsed at the outset of the coronavirus pandemic. Then his bank stocks took a dive when interest rates plunged and bad debt reserves soared thanks to the huge spike in unemployment.

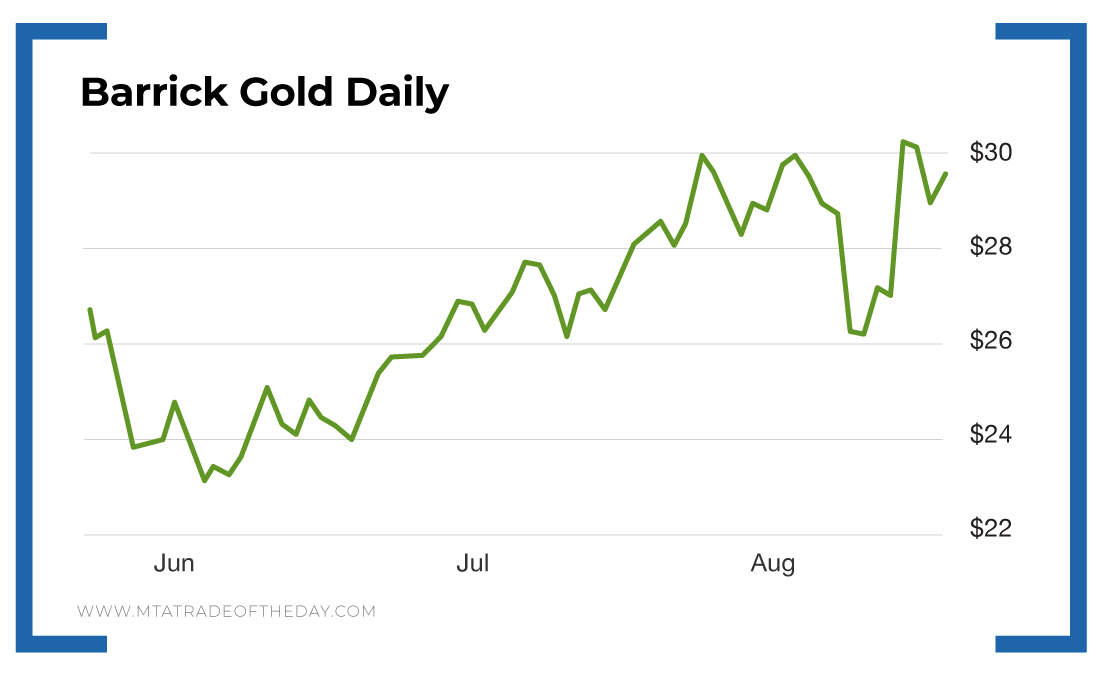

But what investors have forgotten is that his biggest position by far, Apple, is about to break the $2 trillion valuation. That’s definitely not peanuts when you own 250 million shares and counting. So when he made a big purchase – close to $600 million worth of Barrick Gold (NYSE: GOLD) shares – the market took note.

Barrick Gold is not new to War Room members. I first recommended it back in May of 2019 when it was trading for less than half the current price. Members made money then and several more times since on both short- and long-term plays on the precious metals sector.

When Buffett made his buy, we had no less than three positions in the metals sector. One of them, the Direxion Daily Gold Miners Index Bull 2X Shares (NYSE: NUGT), is a favorite short-term trading vehicle that Bryan uses to play the trend. After the Buffett news went public, members made close to 200% on that short-term trade.

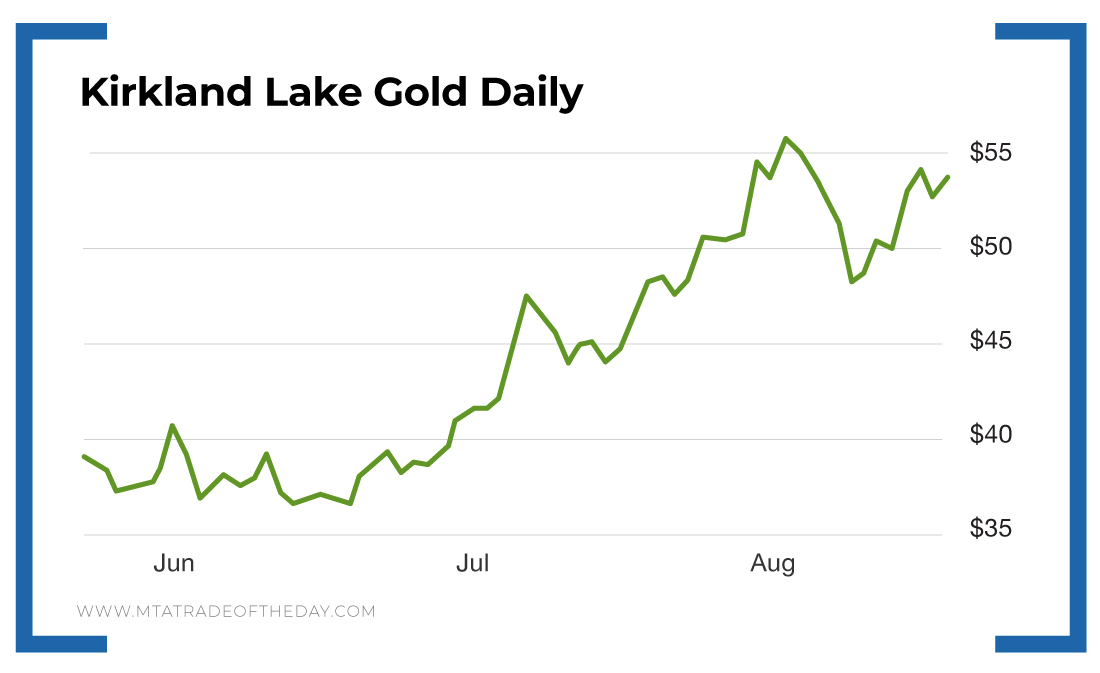

Our other positions also moved higher on the news, which brings me to Kirkland Lake Gold (NYSE: KL), the company Buffett should have bought. Members have made money on this pick several times.

This time, members own a vertical call spread on Kirkland Lake Gold and are up nicely after just a couple of weeks. They bought in at the low point of the recent correction.

Kirkland Lake Gold has a much better growth profile than Barrick Gold’s. It’s a midtier producer with one of the lowest cost structures in the business, as well as some of the highest-grade mines in the world.

The company is valued at around $14 billion, which makes it about a quarter of Barrick Gold’s market cap. It doesn’t produce as much gold and silver as Barrick Gold, but it’s growing its production and reserves at a much faster rate.

For War Room members, Kirkland Lake Gold is a better bet than Barrick Gold. It offers them two things…

- More upside thanks to its growth profile and topflight management team

- A nice acquisition target for none other than a company like Barrick Gold or the other metals giant, Newmont Gold. I’ll take that bet anytime!

Action Plan: If you want to be in the thick of the precious metals sector with long-term and short-term trades, then The War Room is the place to be!

Bryan and I have logged 31 wins in that space alone since May 2019… more than a year before Buffett made his bet!

So what are you waiting for? Join me in The War Room now!

P.S. You asked… and we listened. Get ready for our new service, Trade of the Day Plus, where you’ll receive one trading pick a week straight to your inbox! We’ll not only send you our top picks but also update you each week and monitor the positions throughout the entire holding time! Be on the lookout for our new service coming this September!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024