Buy This Stock for $12 Less Than the Insiders Paid

You may consider them hideously ugly…

Or you may consider them practical, convenient and surprisingly stylish…

But whatever your opinion, plastic shoemaker Crocs (Nasdaq: CROX) has been one of the most impressive turnaround stories in recent years.

As you read this, Crocs are being sold in 85 countries throughout the world – including in 193 outlet stores, 107 retail stores, 373 company-operated stores and 73 kiosks/stores-within-stores.

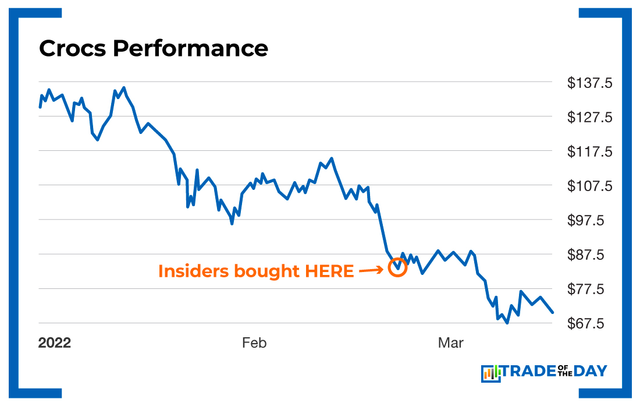

Back in February, Crocs reported strong fourth quarter earnings, but a weak outlook spooked investors, which triggered a sell-off.

Year to date, Crocs shares are down 50%, far outpacing the 10% decline of the S&P 500.

However, it’s worth noting that two Crocs insiders recently stepped up and bought millions of dollars’ worth of shares.

- First, Director Doug Treff bought $1.5 million worth of shares for around $84.13 per share.

- Then, Chairman Thomas Smach bought $986,000 of shares for around $82.88 per share.

Before these purchases, neither insider had bought Crocs stock on the open market for years.

Action Plan: With shares now trading around $70, you can own Crocs at a $12-$14 discount relative to what the insiders paid – which could be the deal of a lifetime. Research firm Baird has an “Outperform” rating on the stock and a $200 price target. Even if shares recover to only half of that, buying today for $70 could represent a timely entry.

P.S. Have you signed up for $500 Friday?

Today, we’re kicking off a weeklong series that explains our trading strategies and methodologies. It’s totally free to sign up, and you’ll receive one new trading lesson each day. They’ll be short – but powerful – lessons that detail exactly how we successfully navigate the markets and trade in real time. And Friday, March 18, will be the big day…

That’s when you’ll receive a live trade recommendation that we guarantee will make you $500 in cash premium. Best of all…

As a loyal Trade of the Day reader, you have the opportunity to jump to the front of the line and sign up for our “$500 Friday Challenge” – TOTALLY FREE.

Click HERE to Skip the Line and Sign Up for $500 Friday – Totally Free

Here’s our full training schedule for this special week (you can rewatch these sessions at your leisure):

- Monday, March 14, 1 p.m. ET: Options 101: How We Trade for Daily Gains (Intro to Calls and Puts)

- Tuesday, March 15, 1 p.m. ET: Overnight Trades: Setting Up a LIVE Trade in Real Time

- Wednesday, March 16, 1 p.m. ET: LEAPS: Play Your Favorite Stocks With Less Money Down

- Thursday, March 17, 1 p.m. ET: Cluster Buying: Following Insiders for Profits

- Friday, March 18, 1 p.m. ET: Your $500 LIVE Trade Recommendation

Click HERE to Skip the Line and Sign Up for $500 Friday – Totally Free

Monday Market Minutes:

- With stagflation a major fear, the Global X Lithium & Battery Tech ETF (NYSE: LI) is a great proxy for electric vehicle plays and high oil prices. It holds names such as Tesla (Nasdaq: TSLA) and Albemarle Corporation (NYSE: ALB). It also tends to benefit when inflation expectations are heating up and growth expectations are cooling – both of which are occurring right now. Tracking.

- Lockheed Martin (NYSE: LMT) shares gained 1.6% in the premarket period after sources told Reuters that Germany would purchase up to 35 fighter jets from the company. If this trend continues, the basket of aerospace/defense plays we’re holding with April expiration via the Direxion Daily Aerospace & Defense ETF (NYSE: DFEN) will be in great shape. War Room members have been profiting from DFEN trades even in the current volatile markets. Click here to get in on the action.

- Karim has already used put selling to hit an unprecedented 58 trade win streak… and he’s offering to show YOU how to pocket $500 in cash premium (GUARANTEED) this Friday with a LIVE trade recommendation.

Click Here To Sign Up For The $500 Friday Challenge (It’s 100% FREE!)

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024