“Coiled Spring” Follow-Up: This Pick BLASTED

On March 6, I posted an alert titled “A ‘Coiled Spring’ Effect Could Happen Soon.”

If you recall, that pick was based on the remarkable pricing power of Lululemon Athletica (LULU).

In that write-up, I argued that LULU’s chart reflected the pricing power narrative and ended with a simple call to action…

“I think LULU is primed for a breakout.”

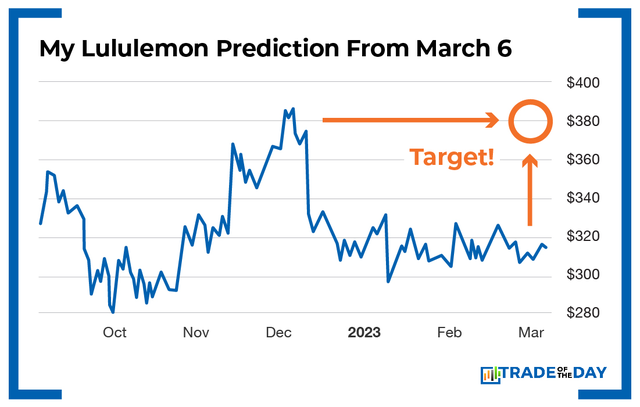

Specifically, back in early March, I broke it down like this…

As you can see, LULU broke above $380 in early December 2022 – only to fall down to a range between $300 and $310 for most of the 2023 calendar year. The longer LULU remains pinned between $300 and $310, the stronger the breakout will be when it finally happens. I call it a “coiled spring” effect. The more you coil a spring… the more aggressive and violent the breakout will be once the spring gets released. That’s precisely what I think is taking shape in LULU right now.

Here is the chart that I shared with you that day…

The recommendation couldn’t have been any clearer…

I predicted that when the trigger “uncoiled” the spring, it could send LULU back up to retest its December high of $380.

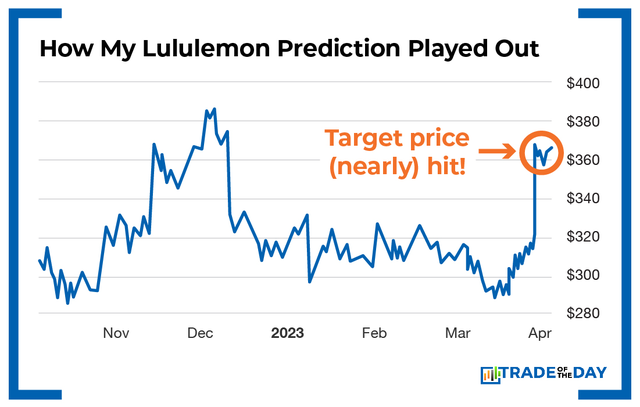

Last week, that’s precisely what happened.

Check it out…

As you probably heard, LULU released earnings last week – uncoiling the spring and blasting shares above $360.

Specifically, LULU recorded $2.8 billion in revenue in its fiscal fourth quarter ended January 29, a blistering 30.2% jump over the year-ago period.

What’s more, analysts now believe that LULU’s adjusted EPS will grow 19% annually over the next five years – almost twice the 11.2% projection for the apparel retail industry as a whole.

When you consider that LULU has a customer loyalty rate of 89%, it’s very clear why Wall Street loved this news so much.

In fact, Motley Fool called LULU an “unstoppable stock.”

And as a Trade of the Day reader, you heard it all here first.

![]()

YOUR ACTION PLAN

I hope you profited from this spot-on prediction.

But even if you missed this pick, consider this…

If this is what we’re offering you in our free Trade of the Day service, just imagine the picks you could get every Wednesday in our premium Trade of the Day Plus service. If this LULU pick is enough to put you over the edge and you’re ready to level up to Trade of the Day Plus and receive our top pick every Wednesday, then you’re invited to join us now.

Yes! It’s Time I Leveled Up to Trade of the Day Plus!

MONDAY MARKET MINUTE

- A Wild First Quarter. The S&P 500 just wrapped up a wild first quarter. And given everything we’ve seen so far in 2023, the results have been surprisingly strong. Despite the Federal Reserve continuing to raise rates and the fears about systemic issues in the U.S. banking system following the collapse of Silicon Valley Bank and Signature Bank, the S&P 500 gained 7% in the first three months of 2023. Who led the charge? The clear winner was none other than…

- Nvidia (NVDA). In the first three months of 2023, the chip maker blasted up 90.1% thanks to the proliferation of artificial intelligence technology driving demand for the company’s high-end semiconductors. Other high-flying stocks in the first quarter were META, TSLA, ALGN, AMD and GE.

- What Lies Ahead for the Second Quarter? Losses?? According to a new CNBC Delivering Alpha survey of about 400 chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money, nearly 70% of Wall Street investors now believe that the S&P 500 could see declines ahead. If that happens, we’ll focus on stocks that provide safety. Such as…

- Three “Fortress Dividend” Plays. Dividend stocks pay investors to wait out volatility. And three of the top names on this list are Procter & Gamble (PG), which pays a 2.5% dividend yield; Simon Property Group (SPG), which pays a 6.4% dividend yield; and Gilead Sciences (GILD), which pays a 3.6% dividend yield. All three are on my watchlist as we start the week.

- Takeover Coming for Pharma Group? Apellis Pharmaceuticals (APLS) was up 14% in premarket trading after Bloomberg reported the company is drawing takeover interest from larger drugmakers.