Deere Runs Higher

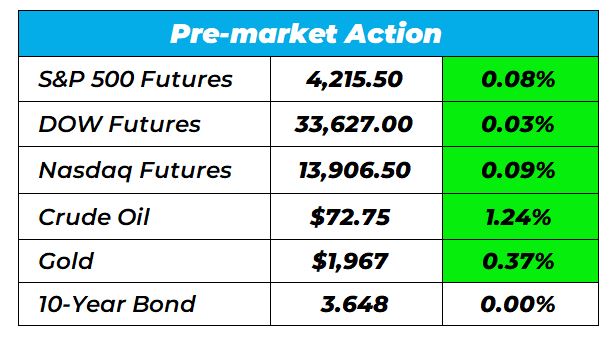

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures went up on Friday. The news came on optimism surrounding a potential debt ceiling agreement in Washington led to a widespread stock market rally across Europe and Japan. President Joe Biden expressed confidence in Congress’s ability to act in time to prevent a default during a call from Japan, as House Speaker Kevin McCarthy and Senate Majority Leader Chuck Schumer made preparations for upcoming votes on a bipartisan deal.

The markets are up for now, but 2022 was a tough year. That’s why value stocks that will stand the test of time are crucial to consider right now. Our Head Fundamental Tactician Karim Rahemtulla has been pounding the table on what he’s calling “The Last Great Value Stock” for over a year now. Jefferies analyst Chloe Lemarie raised the company’s price target to over 20% and shares are already 100% above where they were last September.

Click here to unlock this under $2 value stock before it’s too late.

Here’s a look at the top-moving stocks this morning.

Deere & Co. (NYSE: DE)

Deere is up 5.35% premarket after investors anticipated the release of the industrial equipment maker’s second-quarter earnings. Analysts predict that Deere will report a per-share profit of $8.59, reflecting a 26% increase compared to the previous year, along with a 23.3% rise in revenues to $14.83 billion. The company’s outlook for the current fiscal year, ending in October, includes a net income forecast ranging from $8.75 billion to $9.25 billion, attributed to improved pricing power for agricultural equipment and growing global demand.

It’s no secret that higher demand for farm equipment could lead to more energy demand to run the equipment. Our friend Marc Lichtenfeld has been telling readers about an alternative investment strategy outside of the stock market that takes advantage of this recent oil and gas surge. Few people have heard of it, but some of the world’s smartest investors like Warren Buffett and billionaire Ken Griffin are already investing.

Foot Locker (NYSE: FL)

Foot Locker is down 19.08% premarket after announcing its latest earnings report. During the first quarter, there was a 9.1% decrease in comparable-store sales, mainly due to macroeconomic challenges such as lower income tax refunds in the United States and changes in vendor mix, along with the repositioning of Champs Sports. Total sales also saw a decline of 11.4% to $1,927 million compared to the same period last year, or a decrease of 10% when excluding the impact of foreign exchange rate fluctuations.

One of the best ways to get a better idea of which direction a stock will go after earnings is to track insider buying (the legal kind). Our Head Fundamental Tactician Karim Rahemtulla uses state-of-the-art technology to track where insiders are putting their money, and we just positioned ourselves on an insider buying play in The War Room yesterday.

Click here to see how following the money could lead to gains as high as 2,250%.

Flowers Foods (NYSE: FLO)

Flowers Foods is down 3.12% premarket after the company reported quarterly earnings of $0.38 per share, surpassing the Zacks Consensus Estimate of $0.36 per share, indicating an earnings surprise of 5.56%. This compares to earnings of $0.44 per share in the same period last year. The reported figures are adjusted for non-recurring items. In the previous quarter, the company met the earnings expectations, posting earnings of $0.23 per share as anticipated. Flowers Foods has exceeded consensus EPS estimates in three of the last four quarters.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

A Boring Biotech That’s Too Cheap to Ignore

Feb 26, 2026

The one retailer laughing at tariff headlines

Feb 25, 2026

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026