Did Financials Just Call a Bottom?

This is exactly why it pays to follow companies that host an investor day…

In the company’s investor day presentation today, JPMorgan Chase (NYSE: JPM) CEO Jamie Dimon raised the bank’s outlook for NII, which stands for net interest income.

Specifically, the banking giant said that it now expects its 2022 NII to come in around $56 billion, which is $3 billion above the guidance it provided just a month ago.

Wall Street Translation: The recent market storm clouds may soon dissipate.

In response, shares of JPMorgan Chase began a premarket rally that extended into the afternoon.

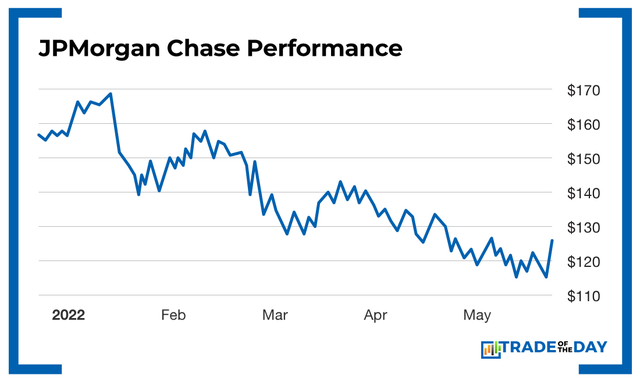

Prior to this bounce, shares of JPMorgan had hit a new 18-month low and were down 25% year to date.

This raises the question…

Did JPMorgan (and in turn other financials) just call the market bottom?

Judging from the five-month chart below, JPMorgan still has a lot of work to do in order to reverse its latest downside move.

Pushing back above its 50-day moving average (around $129) would be a strong first step.

But recoveries take time, and they have to start with some form of positive trigger catalyst. This just might be it.

Action Plan: Wall Street desperately needed some good news – and today, JPMorgan delivered. With so many oversold stocks – especially in the financial sector – there are many strong ways to play this, including Goldman Sachs (NYSE: GS), Wells Fargo (NYSE: WFC), Citigroup (NYSE: C), Bank of America (NYSE: BAC) and others. If you want to get plugged into our trading community and see exactly how to trade these moves in real time, you’re invited to join us in The War Room.

Your invitation awaits you HERE.

Monday Market Minutes

- EA in Play! The video game website Kotaku reported that Electronic Arts (Nasdaq: EA) has recently pursued a merger with NBCUniversal and also has held potential acquisition talks with Walt Disney (NYSE: DIS), Apple (Nasdaq: AAPL) and others. Tracking.

- GameStop Goes Crypto! The video game retailer GameStop (NYSE: GME) went up 2% after announcing it has launched a digital asset wallet to allow gamers and others to store, send, receive and use cryptocurrencies and nonfungible tokens (NFTs) across decentralized apps.

- Freelance Fallout: Upwork (Nasdaq: UPWK) went down 6% after RBC Capital Markets analyst Brad Erickson initiated coverage of shares with a “Sector Perform” rating and a $21 price target.

More from Trade of the Day

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024