Why You Should Bet on DraftKings

DraftKings (Nasdaq: DKNG) is positioning itself to be the leader in online betting and iGaming. This is a $23 billion market in the U.S. alone and a multiple of that globally.

IGaming covers everything from sports betting to casino games and everything in between.

Whether you want to bet on the winner of the Nathan’s Hot Dog Eating Contest or the winner of the first baseball game when the season starts, you can do it now or will be able to very soon (based on where you live) on the top online gaming platform.

State by state, the barriers to online gaming are coming down, which has opened a long runway for companies like DraftKings.

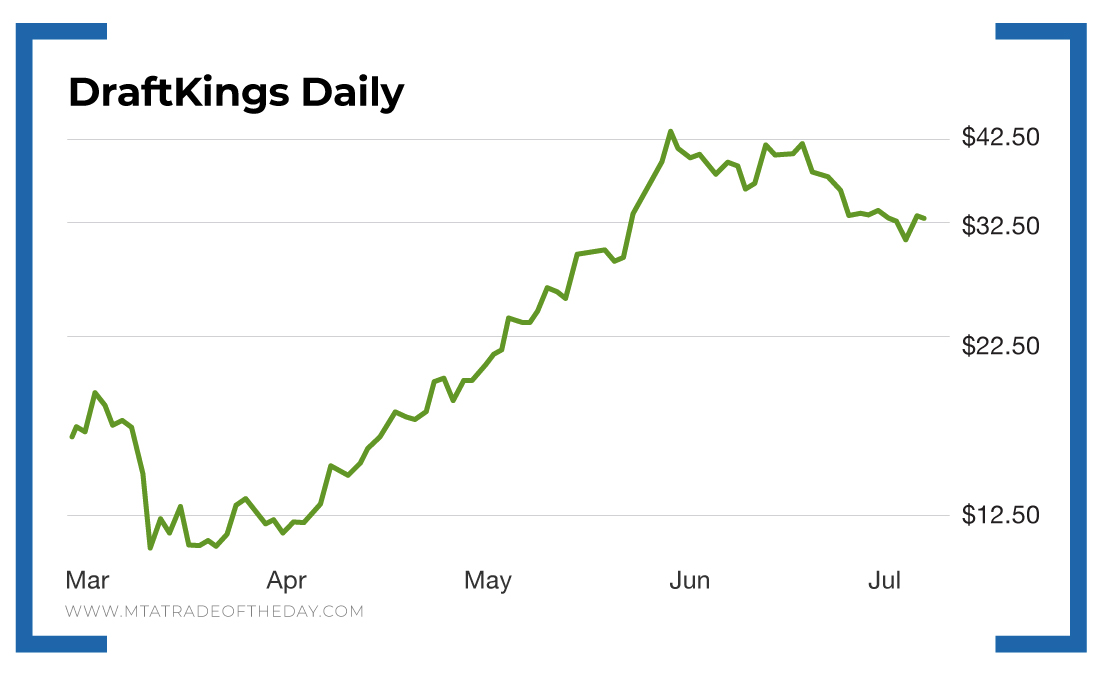

The company officially became public earlier this year through a special purpose acquisition company (SPAC) and has seen its shares triple since March before coming back down to just a double.

But there are more blue skies ahead for DraftKings. Right now, the shares are trading lower based on the lack of clarity about when pro sports and the fantasy leagues that accompany them will get in gear. The COVID-19 pandemic is making things much harder to predict. And Wall Street hates uncertainty.

However, that uncertainty provides opportunity for you to begin to build a position in DraftKings at current levels and even at lower levels if the shares trade lower.

The reason you want to bet on DraftKings is not for what happens today, but for what could happen in the future when the economy finally does open and catches its stride. And this company is sitting on a pile of cash… $450 million, to be exact, with no debt. That gives it the staying power to outlast the pandemic.

There are three ways to play this…

- You can buy the shares trading in the low $30s and plan on making two or three buys at $30, $25, and $20 to average your cost lower if the shares trade down or if there is a correction in the market.

- You can control the shares with Long-Term Equity Anticipation Securities (LEAPS) options. DraftKings has options going out to 2022 – more than 18 months until expiration. They are expensive, so you may want to use a spread trade.

- One of my favorite strategies is to use a put sell to try and pick up the shares for a lot less than the current price or get paid for trying.

You can even do a combination trade, where you sell puts to generate cash to buy the LEAPS. It’s an advanced strategy, but if your goal is to own the stock cheap or profit if the shares go higher, you can let the market do the heavy lifting for you!

Action Plan: Not sure which trading strategy to try above? In The War Room, we’ll give you the exact strategy and strike prices in real time.

This will allow you to take advantage of opportunities like DraftKings… So what are you waiting for? Join me in The War Room today!

More from Trade of the Day

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026

Are the Banks Destroying Your Savings?

Feb 16, 2026

Palantir Is About to Collapse. Again.

Feb 13, 2026