Ford vs. Chevy? The Winner Is…

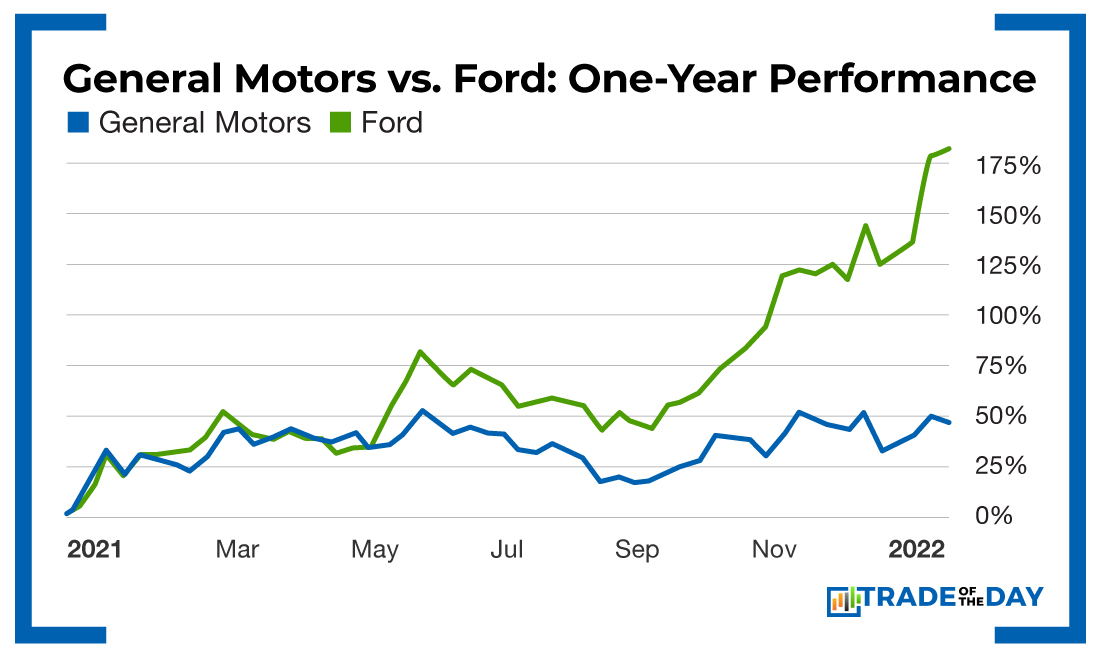

This may come as a surprise, but Ford (NYSE: F) has beaten the pants off General Motors (NYSE: GM) since the beginning of 2021.

Let’s step back a minute.

At the beginning of 2021, GM’s market cap was around $80 billion. Today, it is $88 billion.

At the beginning of 2021, Ford’s market cap was less than $50 billion. Today, it is $100 billion after reaching a multiyear high yesterday.

That is a massive outperformance.

In fact, GM is now a better value than Ford, trading at a discount and a lower price-to-earnings valuation as well.

Both are downright cheap as far as future potential is concerned, especially when compared with Tesla (Nasdaq: TSLA), which is valued at a whopping $1 trillion (today, anyway).

Ford has taken the lead over GM and outperformed both GM and Tesla following several key developments.

- Last year, Ford divested from several foreign operations that were losing money.

- New management is focused on the electric vehicle sector.

- Ford’s Lightning pickup truck is garnering thousands of orders every month, despite not even being up for sale yet.

- It isn’t as impacted by chip shortage issues as other automakers.

Investors love low-priced stocks, and when Ford was trading for around $11, it was cheap.

I recognized this back in 2020 and 2021. War Room members racked up winner after winner on Ford with short-term trades.

But in dollar terms, the biggest win on Ford came from our Trade of the Day Plus readers.

Back in 2021, I made Ford my top pick in Trade of the Day Plus – and at Investment U, a conference I spoke at in Florida last spring.

Since then, shares have more than doubled. Just yesterday, a War Room member wrote in with this testimonial:

Michael K. 1/13/2022 at 11:05 a.m.

In at $11.44, out at $25.47 for 123% gain. Thanks, Karim.

War Room members who played my shorter-term strategies last year had this to say:

Scott G. 12/16/2021 at 9:33 a.m.

Ford Dec 17 2021 20 Call – in $0.45, out $0.90. Thanks, Karim, for that comment this AM!

Rick R. 10/8/2021 at 10:19 a.m.

Big shout out to Karim! After you suggested Ford as a good LEAP-style option, I jumped in Jan22 C at $1.34. Just sold half my positions at a 103% gain and am now playing with the remainder with house money. Nice double, Karim. Thanks!

That’s just a sampling from the past few months!

Action Plan: Where do we go from here? Will Ford continue to power higher? The answer is yes, but not without a pullback or two, and that is what you should be looking for. For less than $20, Ford is a buy. But it’s catch-up time, and GM might actually be the better buy on a pullback. Regardless of what stock is ripe for the picking, we’ll cover it each Wednesday in Trade of the Day Plus! Join us now!

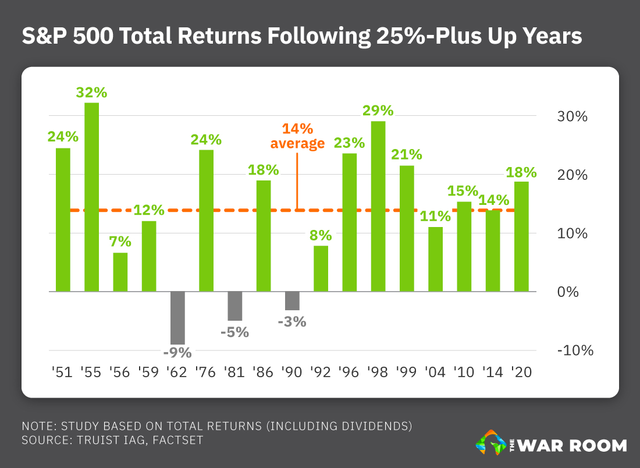

Friday Fun Fact: Since 1950, the S&P 500 has produced an average annual return of 14% following a year where it delivered a 25%-plus gain. As you can see below, over the last 70 years, the S&P 500 hit 25%-plus returns 17 times. And 14 of those times, stocks saw a positive return the following year. That means there is an 82% chance (according to history) that stocks will finish 2022 with gains.