499 S&P Stocks Moved Lower: We Owned the Only One That Went Up

You know the old saying…

There are bulls – there are bears – and there are pigs.

One of the three gets slaughtered.

But lately, CNBC has introduced a new animal into the mix – and it perfectly describes the massive jumping around that the major markets have been doing lately…

A kangaroo…

In a “kangaroo” market, the extreme daily ups and downs are as logical as a rubber bouncy ball that you throw inside a racquetball court.

I’m sure you’ve seen this market action with your own eyes over the last week.

As it looks right now, the second pandemic wave that we’ve been warning about is spilling into the markets – and that’s the root cause of the volatility.

States in the reopening process – such as Alabama, California, Florida, North Carolina and Texas – all reported a rise in new daily COVID-19 cases.

On Saturday, Texas and North Carolina reported a record number of virus-related hospitalizations.

Clearly, a second wave is here. As for trades, we want to be ready.

I have some ideas…

Just like you saw with the first wave, packaged goods companies became a safe haven for investors and traders alike. So it’s reasonable to think that a second wave could lead to a rush back into packaged goods companies – which once again makes the case for owning stocks like Hormel, Conagra, General Mills and Kellogg’s.

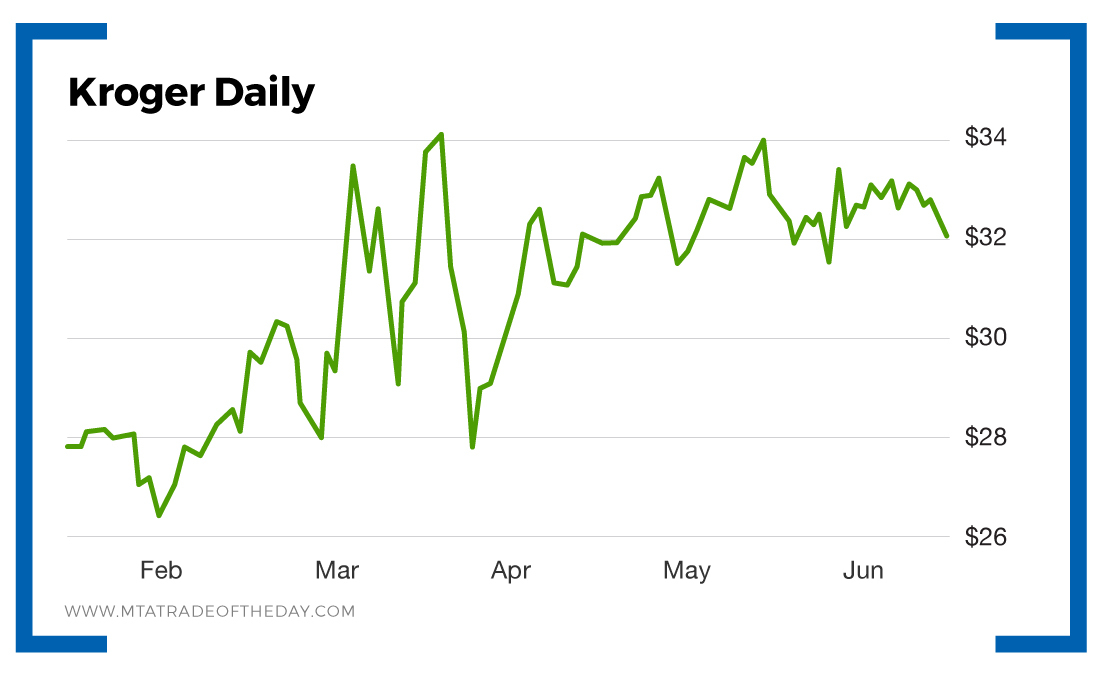

Right now, my favorite play among this group is Kroger (NYSE: KR).

Kroger operates 2,757 supermarkets in 35 U.S. states. Its food and drug stores sell both pharmaceuticals and groceries – plus pet supplies, fresh seafood, apparel, home furnishings, outdoor living furniture, electronics, automotive products and toys.

Action Plan: Last week, when the Dow lost 1,800 points in one single session, 499 stocks on the S&P 500 closed in the red that day.

What was the one and only stock that was green that day? You guessed it: Kroger.

And – what’s even better – War Room members were holding Kroger calls that day, which made them 12% on the same day that the major market averages were crashing 7% lower.

Was that dumb luck? Far from it.

In The War Room, we go to great lengths to position you in safe-haven plays that can be profitable – even if the markets are crashing. Kroger was last week’s example, and we have many others. If you want to start profiting off these names, you’re invited to join me in The War Room today! In the meantime, you may consider owning Kroger as a safety pick.

More from Trade of the Day

How to Read an Option Symbol Like a Pro

Dec 30, 2024

Dec 26, 2024

5 Proven Strategies to Grow A Small Account in 2025

Dec 23, 2024