Airline Earnings Report: How to Play Q3

Editor’s Note: Have you claimed your free mobile membership yet?

Before beginning today, I wanted to make sure you’re aware of our newest feature: Our Trade of the Day Instagram page. And today – you’re invited to join us – for free! Just go here and click “Follow.” And that’s it – you’re in!*

Yes! Join Trade of the Day Instagram for Free

On this page, Karim and I will post charts, videos, and even some funny and entertaining memes – most of which you won’t get from these typical Trade of the Day emails. You’ll get fresh, new content – available wherever you go. You’ll love it. So take a quick second and follow us now!

*If you don’t already have an Instagram account, you’ll need to create one.

This week is “gut check time” for the top U.S. airlines…

Tomorrow before the open, Delta Air Lines (NYSE: DAL) will report earnings.

Then Wednesday after the close, United Airlines (Nasdaq: UAL) will follow suit.

Over the last three earnings cycles, both names have dropped – all three times.

Specifically…

- Delta Airlines moved down 5%, 5.7% and 1%.

- United Airlines moved down 4%, 8% and 7%.

So as we head into these sector-moving reports, traders (like us) are asking…

How can we play this?

In my view, no matter which direction the airline sector moves headed into this week’s earnings, the answer lies with the U.S. Global Jets ETF (NYSE: JETS).

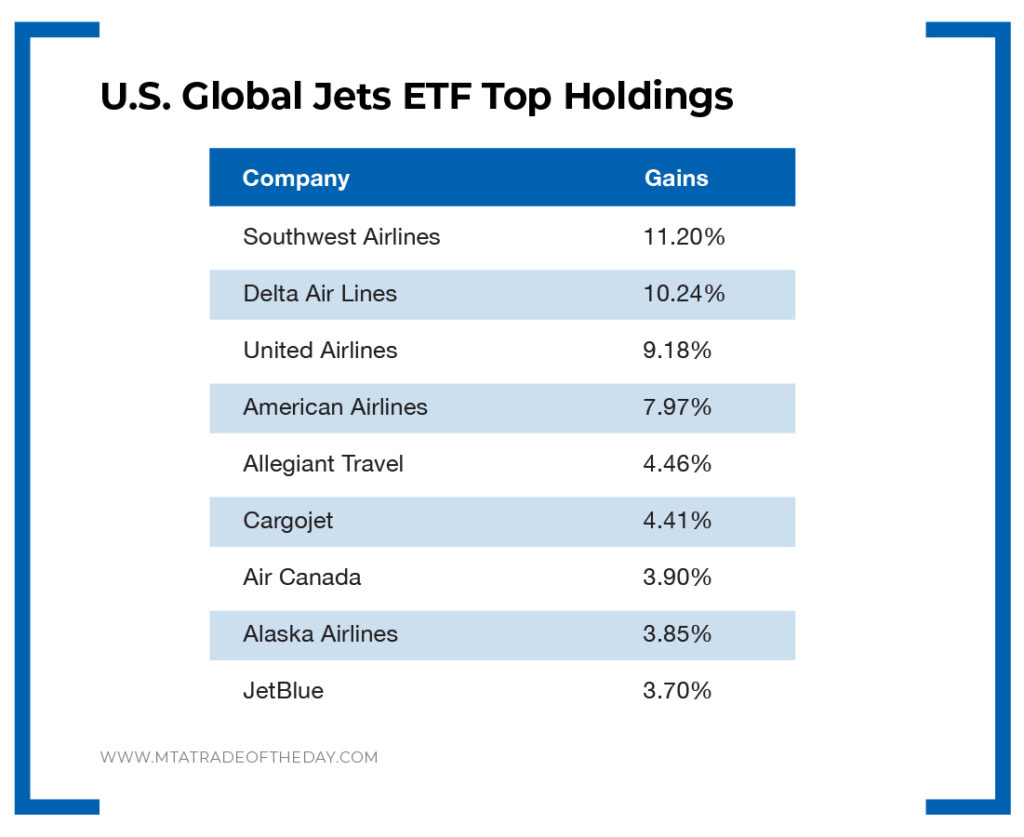

First and foremost, the U.S. Global Jets ETF is the only exchange-traded fund dedicated solely to the airline industry.

First and foremost, the U.S. Global Jets ETF is the only exchange-traded fund dedicated solely to the airline industry.

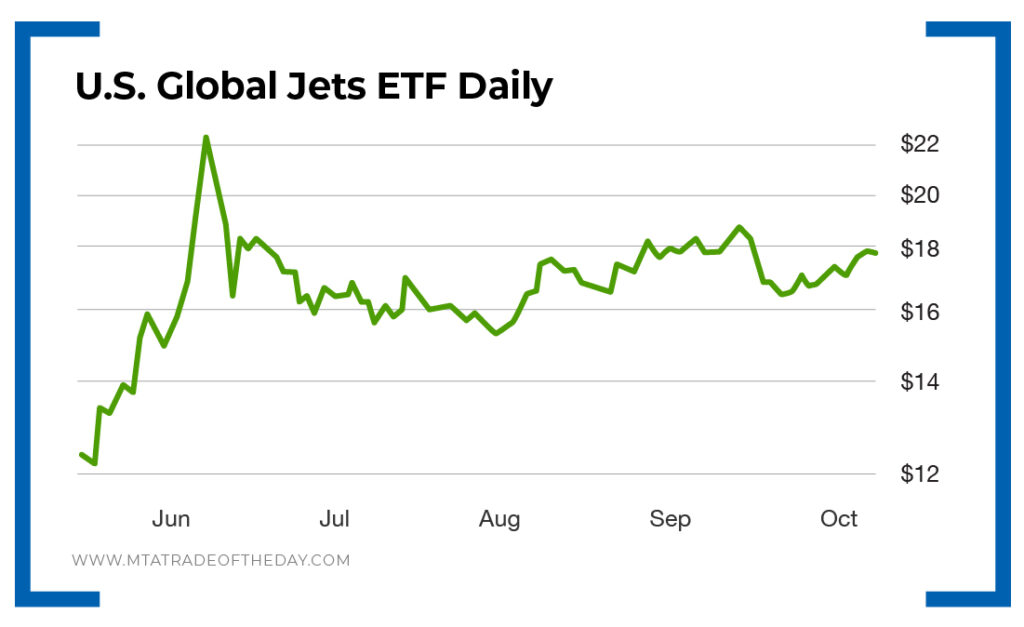

For basically $18 per share, you get exposure to a collection of the top airline stocks on the entire market.

For basically $18 per share, you get exposure to a collection of the top airline stocks on the entire market.

So here’s the thinking…

Say the airline sector turns south on poor earnings from Delta and United. In this case, I’d advocate scooping up the U.S. Global Jets ETF on the dip. After all, you know a stimulus package will eventually come, which will help get this group through this difficult period.

Say the airline sector bounces on surprisingly strong earnings from Delta and United. In this case, I’d also advocate for getting some exposure to the U.S. Global Jets ETF, as this would signal that the market is encouraged by the future recovery of this sector group.

Action Plan: No matter what happens this week, establishing a position in the U.S. Global Jets ETF offers a strong risk-reward balance going forward. But let me be clear: Unlike our typical War Room trades, which could happen fast, this play carries a longer-term time frame.

This is a play on an eventual airline recovery, which could be a year out. If we get a stimulus package – or even a COVID-19 vaccine – the airlines will recover. And we can all agree that they’re not going away. So buying at these lows represents a savvy move – if you have the patience to wait it out.

P.S. THE WAIT IS ALMOST OVER! Get ready… because Trade of the Day Plus is ready to launch! Every week, Bryan and Karim will give you their very best pick with unique entry and exit signals straight to your inbox – all in a fun, engaging video. This is something that Trade of the Day members have been asking for – and it’s about to launch any day now. Be ready because we want you to be first in line. It’s all coming to you… very, very soon!

More from Trade of the Day

Nov 1, 2024

This ONE Strategy will be Key during Election Week

Oct 31, 2024

Crypto Mining Play’s Election Setup

Oct 30, 2024