I Got the Cheese for Your Portfolio

Is it time to add some mac and cheese to your portfolio?

No, I am not talking about Kraft or Velveeta.

REITs, or real estate investment trusts, are companies that own and manage vast portfolios of real estate.

By law, they must distribute most of their income (90%) to shareholders in order to enjoy special tax benefits from the IRS.

REITs tend to do well in a low interest rate environment. They are seen as an alternative to low-yield dividend stocks and banks that pay a pittance on your money.

That means REITs get hit when interest rates move higher, as they are doing now.

But this also presents opportunities because as the price of REITs go down, their yields go up.

One REIT in particular caught my attention the other day. Its shares have plummeted from over $22 to under $8 in just one year.

It’s paying a serious dividend – around 8% based on the current payout. That’s the cheese!

The name of the REIT is Macerich, and its ticker symbol is – you guessed it – MAC.

It operates high-quality shopping centers, which doesn’t seem like the best bet in this economy. That’s why it’s perplexing that the insiders are piling in. What do they see? Are people still shopping? Is Macerich an acquisition target?

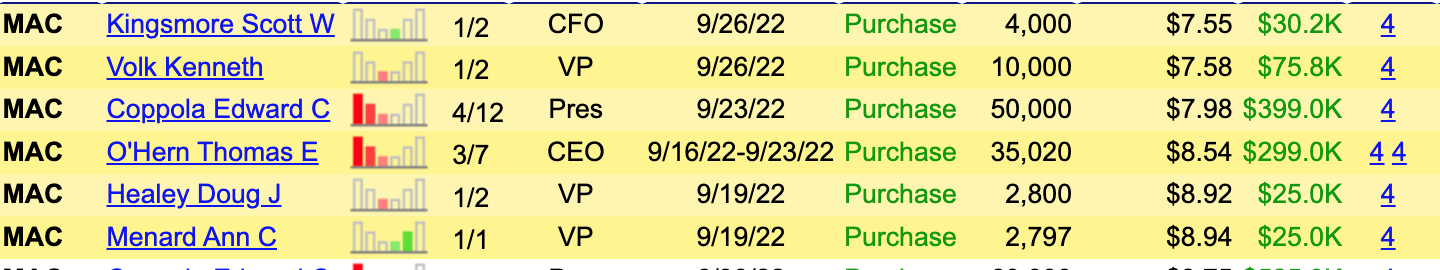

Insiders tend to buy their own companies’ shares when they know a thing or two about what’s coming down the pike. In this case, I am seeing the strongest of all insider signals, called cluster buying.

This is when multiple insiders, especially nondirectors, buy their own company’s shares on the open market at various prices. Check out the chart below, and you’ll see the roster of buyers and how many shares they’ve purchased over the past few days.

Macerich insiders either know something we don’t or are gluttons for punishment. That’s what makes this an interesting speculation. And since Macerich also has LEAP options, you can get in for a fraction of the cost of owning the stock – unless you are betting on the dividend too. Options holders don’t get paid dividends.

Action Plan: I find situations like this in real time all the time. And as soon as I see one developing, my readers get a note – without delay! If you want to be part of a group that is winning on 72% of their trades THIS YEAR… and start bringing in some serious cheese…

Then click here to start tracking these insider buys consistently for big potential gains.

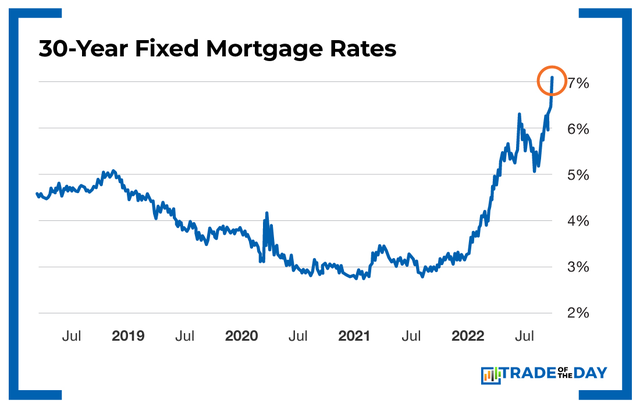

Friday Fact: 30-year fixed mortgage rates just hit 7%, according to the Mortgage News Daily Index. It’s no surprise. The Fed has made it clear it is going to raise rates until inflation is “under control.” To put this drastic change in rates into perspective, consider this… A $400,000 home loan (with 10% down) at a 2.85% interest rate – which you could have locked in a year ago – would cost a borrower $714,174 over the life of the loan. At 7%, that same loan would cost you $1,085,344 over the life of the loan. That is a 52% increase! And your mortgage payment on the higher rate would cost $1,000 more a month. This is one of the headwinds facing the housing sector, which we are tracking closely and trading on.