If Globalization Is Over, Buy These 2 Stocks

Larry Fink is one of the founders of BlackRock (NYSE: BLK), the world’s largest investment management firm.

As you read this, it has nearly $10 trillion under management.

So when Larry talks, investors around the world listen.

In his annual investor letter, which was released last week, Fink made a bold statement. He said…

“The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades.”

Of course, nobody believes that the global economy will turn on a dime. However, when it comes to globalization, it’s easy to see how the Russia-Ukraine war could trigger a situation where countries reprioritize where their resources originate from – and that could mean going back to local production.

As traders, let’s extrapolate from this a step further.

Consider this…

If Larry Fink is right – and globalization is indeed on the way to being de-emphasized – then the U.S. and Europe could soon find themselves transitioning away from geopolitically risky sources of oil and natural gas.

This means that U.S.-based shale producers could become more “in play” than ever before.

So today, I’d like to highlight two U.S.-based shale producers that could be beneficiaries of this transition.

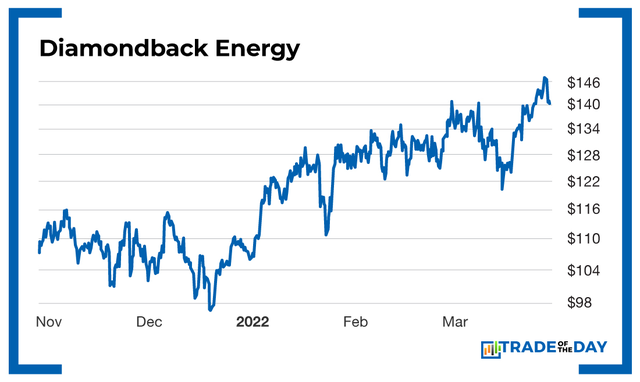

The first is Diamondback Energy (Nasdaq: FANG).

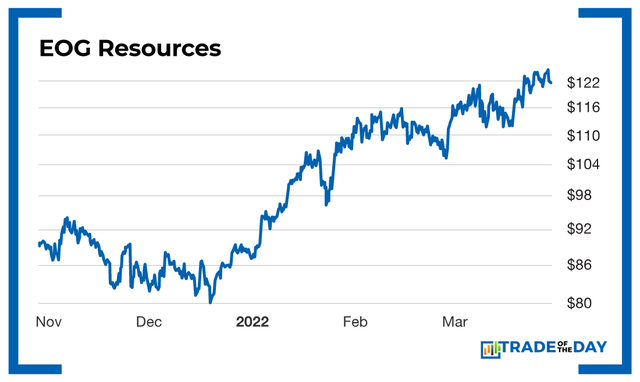

The second is EOG Resources (NYSE: EOG).

The second is EOG Resources (NYSE: EOG).

Here’s a brief description of each company…

Here’s a brief description of each company…

- EOG Resources explores for, develops and produces crude oil and natural gas in New Mexico and Texas. As of last December, it had estimated net proved reserves of 3,747 million barrels (MMBbl) of oil equivalent, including 1,548 MMBbl of crude oil and condensate reserves; 829 MMBbl of natural gas liquid reserves; and 8,222 billion cubic feet of natural gas reserves.

- Diamondback Energy focuses on the acquisition, development, exploration and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas and New Mexico. As of last December, it had estimated proven oil and natural gas reserves of 1,788 MMBbl of crude oil equivalent, plus working interests in 5,289 gross producing wells.

Action Plan: Both Diamondback Energy (Nasdaq: FANG) and EOG Resources (NYSE: EOG) could be fantastic ways to position yourself if the Russian invasion marks the beginning of the end of globalization. Of the two names, I like EOG the best because of its technology. For example, Investor’s Business Daily just called EOG the “Apple of oil” because over the last two years, EOG has developed 20 mobile apps that allow workers to stay connected to data from 5,000 horizontal wells day and night. EOG’s chief information and technology officer, Sandeep Bhakhri, said that this technology is “a major game changer. We call it having a control room in your pocket.” Of course, oil companies have been collecting drilling data for nearly 30 years, but in just the last two to three years, EOG has developed the ability to access real-time data, which allows the company to steer drill bits into the most productive parts of the rock. That’s why the “Apple of oil” should now have a place in your portfolio.

Want in on the action? See how we’re helping War Room members make major gains in the red-hot energy sector. In fact, just last week, Bryan made a trade that resulted in a 25.17% total return.

Click here to unlock those trades.

P.S. Karim thinks that a value stock he’s uncovered – which trades for less than $2 – should also have a place in your portfolio. In his newest presentation, he shows you exactly why this stock could trade for $50 – and still be undervalued! Check it out here.

Monday Market Minutes

- Cleveland-Cliffs (NYSE: CLF) has seen its price target raised to $46 from $37. B. Riley analyst Lucas Pipes believes the growing shortage of quality metallics will greatly benefit producers like Cleveland-Cliffs. Tracking.

- FreightCar America (Nasdaq: RAIL) went up 49% last week. The North American maker of railcars and railcar components is on track to double its annual railcar production capacity to between 4,000 and 5,000 units during 2023.

- Kitchen Sink Market: Consider what the stock market has had to deal with over just the last month… a war in Ukraine, a surge in oil prices and the highest interest rates in decades – yet it’s still been resilient. Dip-buying still looks like the play (at least until something can actually break this market).

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024