Is It Time to Short This Sector?

If a shift from working at home to going back to the office is occurring…

And everything that worked in the market during the height of the pandemic is now reversing…

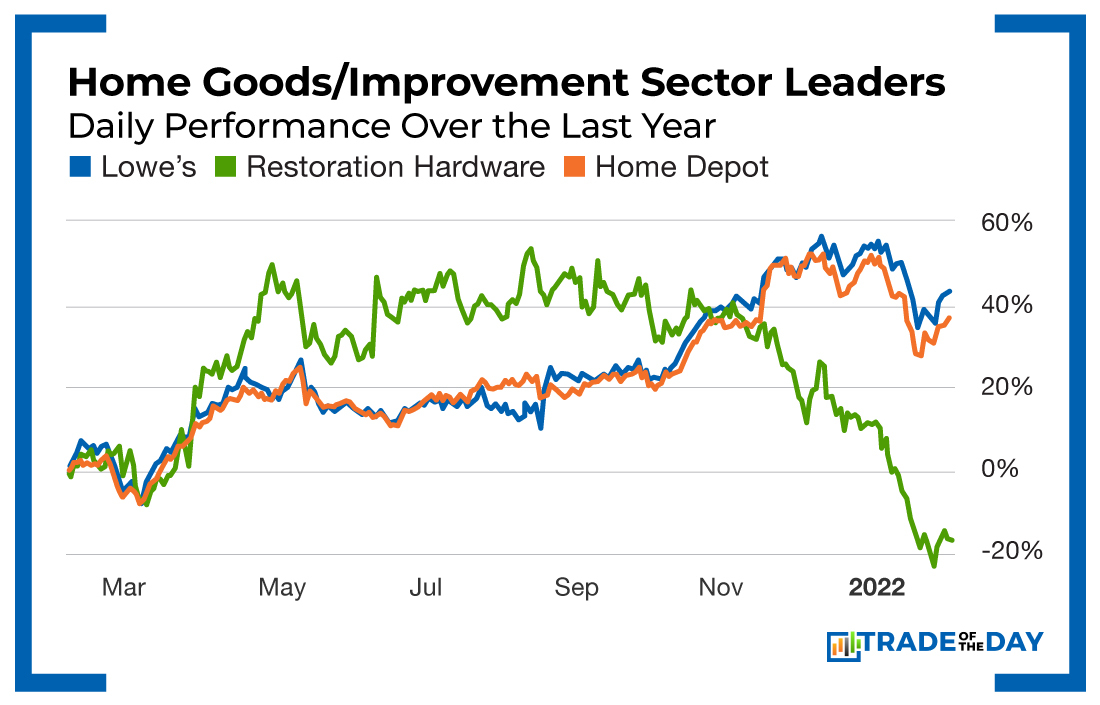

Then one company is really going to feel the pain. That is Restoration Hardware (NYSE: RH).

The stock is already down more than 50% from its highs.

Formerly a darling of the market, the company’s growth had accelerated during the pandemic as people stayed at home and spent money on furniture. And not just money from their regular paychecks, but money from their stimulus checks too.

After all, where else could you spend money?

Travel was out, eating out was out… The list of where you could spend was very concise!

I know this for a fact because my family ordered some stuff from Restoration Hardware last year. It took six months from ordering to delivery.

However, more recently, we had to return one of the items we ordered, and the replacement time was only two weeks. That tells me that some of the problems are being resolved in terms of inventory and the supply chain. There is likely less demand than there was a year ago as well.

In the same vein, last week, I got an email from an automaker explaining that production of particular models, which had been suspended as a result of chip shortages, was now back on. Another sign that supply chain issues are resolving.

If there is a thawing in such issues, in a year, the world will be very different from how it is now. And it would be wise to expect a shift in the market too.

Interest rates are rising, and in turn, mortgage rates are rising as well. They’re already at their highest level in two years.

What do you think people will do when it comes to buying a house?

If mortgage payments go up, that money will have to come from somewhere.

Will it be from their health insurance? I doubt it.

Could it come from spending less on home improvement? Much more likely.

Action Plan: Restoration Hardware (NYSE: RH) is an expensive stock, but it has already crashed.

If you are looking to play the short side of the home goods/improvement sector, you may want to consider another company. There are many to choose from.

In fact, the ones that are most at risk right now are Home Depot (NYSE: HD) and Lowe’s (NYSE: LOW). And that is where I would look for opportunities on the short side!

Every Wednesday, my partner Bryan Bottarelli and I bring winning opportunities to the table. What’s more, this year we are offering an insane 83% win rate guarantee with our Trade of the Day Plus service. Click here to find out how we are pulling this off!

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024