Is This Industry Ready to Take Off?

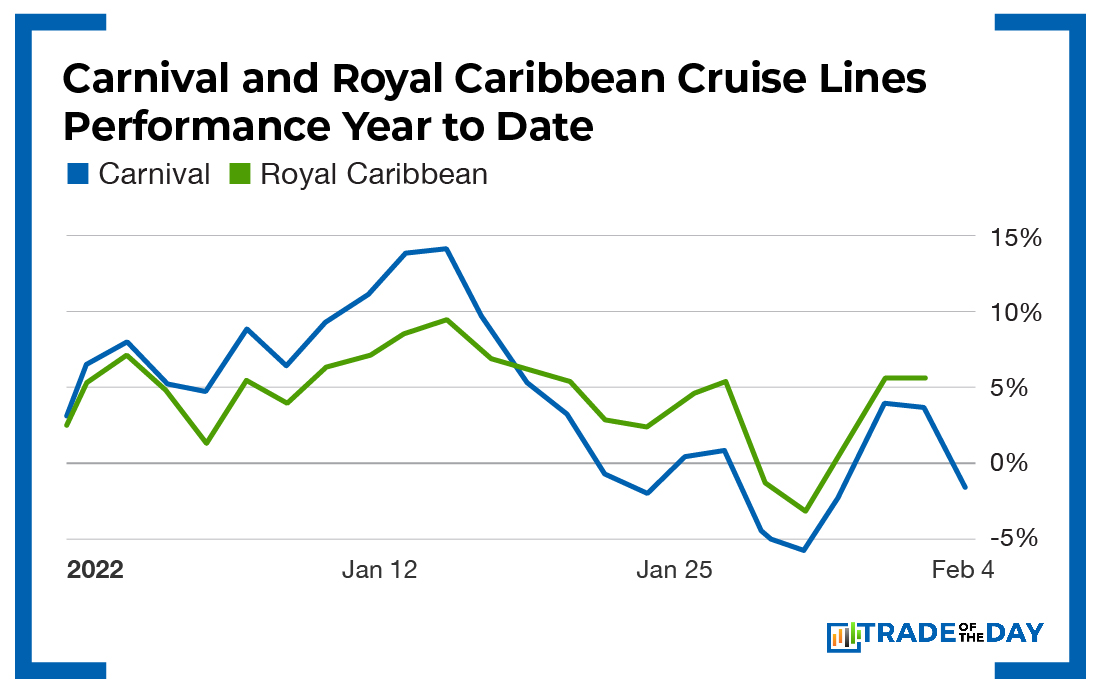

We’re not cruisin’ for a bruisin’, but it does look like the omicron variant has dampened demand in the near term for the cruise industry.

Check out what Royal Caribbean Cruises (NYSE: RCL) had to say today:

Due to the impact from the omicron variant, the company experienced some service disruptions and cancelled several sailings in the first quarter of 2022. Service disruptions have recently abated as COVID cases have declined. Despite these service disruptions and cancellations, the overall trajectory of the return to service remains unchanged. By the end of the first quarter of 2022, the Group expects that 53 out of 62 ships will have been brought back to service, with the rest of the fleet returning to operations before the summer season. Wonder of the Seas was delivered in January 2022 and expanded the Group’s fleet size to 62 ships. Australia is anticipated to open for cruising for its summer season. China remains closed, and the company has redeployed ships planned for China to other core markets for the time being to capitalize on strong pent-up demand, while it remains optimistic to capture long-term growth opportunities in that market. First quarter load factors are expected to be lower than initially anticipated due to the omicron impact on bookings and cancellations, particularly on January sailings. As such, the Group anticipates load factors on core itineraries of approximately 60% during the first quarter of fiscal year 2022 with sequential monthly improvement. The company anticipates approximately 7.7 million Average Passenger Cruise Days for the first quarter. The Group expects total cash flow from ships in operation in the first quarter to be positive.

Then Disney Cruise Line announced that the maiden voyage of one of its new ships will be delayed until July 14.

This sounds like bad news, right?

But have no doubt, cruisers are back!

Cruise lines’ fundamentals are horrible, with debt out the ying-yang, but investors don’t care.

Once they see the weather warming and COVID-19 cases dropping, they’ll jump right back into this sector. You should beat them to it while this stream of bad news is coming out and the market is getting hammered.

Action Plan: People love vacations, and they are tired of being cooped up. On top of that, cruise lines are offering great deals to induce people to get out of the house.

The two I would focus on are Royal Caribbean Cruises (NYSE: RCL) and Carnival Corp. (NYSE: CCL) – two pure plays for the industry. If you like picks like these, it’s time to level up and join Trade of the Day Plus. Our unique portfolio strategy and killer picks have us guaranteeing an insane 83% win rate this year. Upgrade your subscription now to take advantage!

Friday Fun Fact

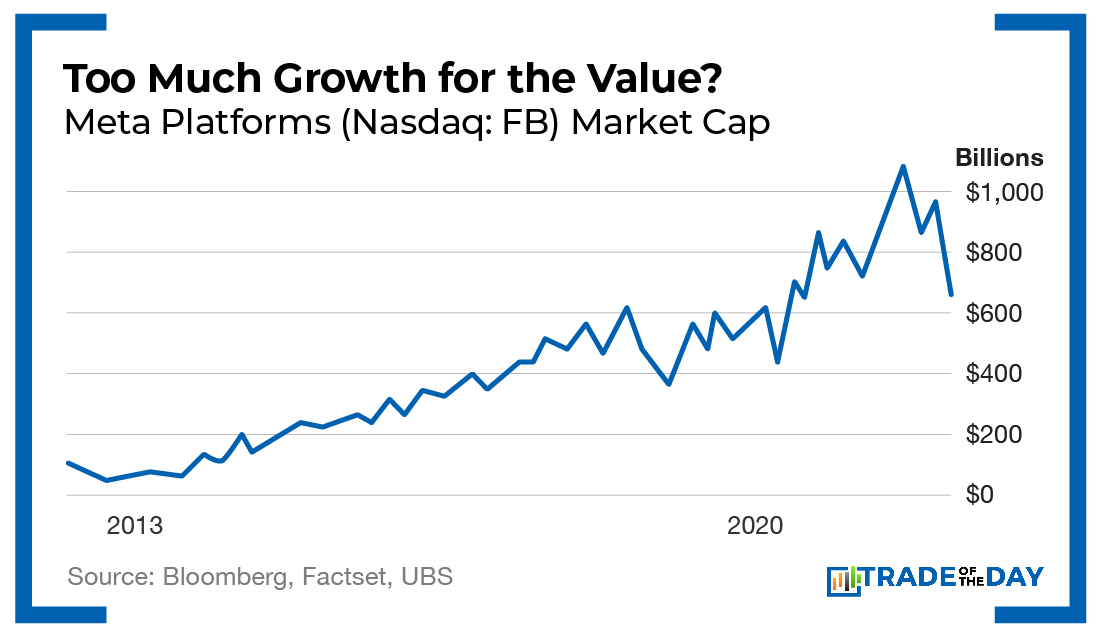

This past Thursday, growth stock poster child Meta Platforms (formerly known as Facebook) lost more than $230 billion in value, the largest drop in a single day. Ever. We weren’t surprised. Heck, we warned you weeks ago that the growth era is over and value stocks are on the rise. If you want to get our best value pick for 2022 (yet to be released) – which held strong during Meta’s massive sell-off – sign up for Trade of the Day Plus now!

More from Trade of the Day

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024

“My Playbook For Election Week”

Oct 29, 2024