Woah Mark Zuckerberg…

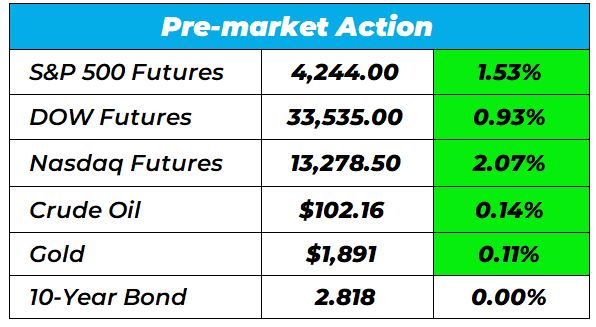

Good morning Wake-Up Watchlisters! While you’re sipping 3D coffee in a 3D universe (see more below) you’ll see stock futures are up as the market tries to recover from the recent sell-off.

Despite signs of recovery, there are still major headwinds (inflation, the war in Ukraine, and higher interest rates) that will likely keep the market volatile going forward. That doesn’t mean you should be fearful. There are still plenty of unique buying opportunities to be had.

Here’s a look at the top-moving stocks this morning.

Meta Platforms (Nasdaq: FB)

Meta is up 16.78% premarket after the Facebook parent reported better than expected quarterly earnings. Two key stats: The company’s daily active users exceeded exceptions (1.96 billion vs. 1.94 billion.) Meta is also lowering their expense forecast to $87 billion, so the platform won’t be as expensive to run in the future. Overall, this stock is looking strong.

Generac Holdings Inc. (NYSE: GNRC)

Generac Holdings is up 8.27% premarket as the company is set to report earnings on May 4. While Wall Street expects a decline in earnings on higher revenues, investors appear confident due to several factors. Extreme weather events are more common than ever, so demand for backup generators is high. Plus, Generac is also offering a PWRcell battery storage system, which gives them another revenue stream. Generac is a stock to keep an eye on going forward.

We’re pounding the table on Generac because of its massive potential due to climate change. Right now we’re showing Trade of the Day Plus members exactly how to play it. Click here to unlock this trade.

ServiceNow, Inc. (NYSE: NOW)

ServiceNow, Inc. is up 9.72% premarket after the enterprise software maker reported March-quarter earnings and revenue that topped analyst estimates. ServiceNow earnings climbed 16% to $1.76 per share on an adjusted basis. Revenue also rose 27% to $1.72 billion. ServiceNow is looking strong.

Teladoc Health (NYSE: TDOC)

Teladoc Health is down 41.95% premarket after reporting a big first-quarter loss. The telemedicine company took a noncash goodwill impairment charge of $6.6 billion, which dragged it down further. The stock already had slid 70% over the past 12 months as the company struggled to shake off concerns that it’s just a pandemic play. Teladoc Health is looking volatile right now.

Pro Trader Reveals Major Wall Street Tip-Off: Do You Know This One?

Do you know how to interpret this crucial ‘green-light’ stock indicator? Karim Rahemtulla, our Head Fundamental Tactician at Monument Traders Alliance, reveals how to play earnings reports to your advantage for massive gains in less than 24 hours. Click here to see how it works.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team ere…