My First Big Winner (What a Rush)

Editor’s Note: Today, our friend and Oxford Club Chief Income Strategist Marc Lichtenfeld talks about his first breakthrough options trade back in 1999. The strategies he used in his trade are still just as effective today. He’s also showing readers how they can invest in the world’s most profitable companies for pennies on the dollar.

Click here to learn more about Marc Lichtenfeld’s Penny Options Summit.

I stared at my computer screen in disbelief. My hands were shaking as I moved the mouse. I clicked “sell” and was suddenly $5,000 richer in less than a day.

This was back in 1999, and that $5,000 was big money. I was making about $40,000 a year at my job, so a windfall of five grand moved the needle on my finances.

I bought calls on Sun Microsystems right before earnings were to be released. The company easily beat analysts’ expectations, sending the stock sharply higher. My calls became an overnight 10-bagger. My $500 was now worth $5,500.

At that point, I had made hundreds of stock trades and done pretty well. But my position sizes were small, so I had never made thousands of dollars so quickly. Certainly not in one week, forget about one day…

I had recently started trading options, and I loved the potential for making big profits while reducing risk.

Many people think options are speculative – and they can be. Because they expire, you can lose money if your stock sits in place or trades lower. But when you speculate with options, you can actually reduce your risk.

Let me explain…

Many people trade options incorrectly. An options contract allows you to control 100 shares of stock, so if you were going to buy 100 shares of stock at $40, you would invest $4,000.

Options traders who don’t quite understand the power of options think that instead of buying 100 shares of stock for $4,000, they should buy $4,000 worth of calls (calls are a bet on the stock price going higher).

If the stock declines by 25%, or 10 points, the stock investor will lose $1,000 – but the options trader will likely lose most or all of their $4,000.

I approach an options trade by focusing not on the value of the underlying stock or how many shares the contracts will control, but on how much risk I’m willing to take.

Back to our $40 stock example. If, on a stock trade, I place a stop at 25%, that means I’m willing to risk 10 points on a $40 stock, or $1,000 on 100 shares.

Rather than buy $4,000 worth of calls, in which case I could lose the entire investment, I would choose to buy $1,000 worth of calls. If the trade didn’t work out, the most I could lose would be $1,000. I couldn’t lose more than my initial investment.

If the stock went up 10 points, I would make $1,000 on a stock trade, but I could make more than that on the calls.

The downside to trading options instead of stock is that there’s a greater chance of loss.

To sum up, when you buy calls instead of stock, you are risking less money and have the opportunity to make more profits. However, your chances of loss are higher, and your options are not suitable as long-term investments.

I recommend stocks for long-term investors – but for people who have a little play money or who like to make calculated speculations in the markets, options are a great way to bet on or against a stock’s direction.

Action Plan: If you’ve ever dreamed of owning the world’s most profitable companies for PENNIES on the dollar, you’ll want to check out my Penny Options Summit.

It is taking place at 2 p.m. ET on July 14, and I’ll reveal my quantitative strategy for nabbing returns as high as 400% in as little as 10 days.

Be one of the first 500 sign-ups to my NEW elite VIP Trading Research Service, Penny Options Trader, and you’ll receive a special discount, my No. 1 penny options pick and up to 36 chances to multiply your money in 12 months (plus plenty more).

Click here to see how to start living your best life at a discount, even in turbulent times!

Fun Fact Friday

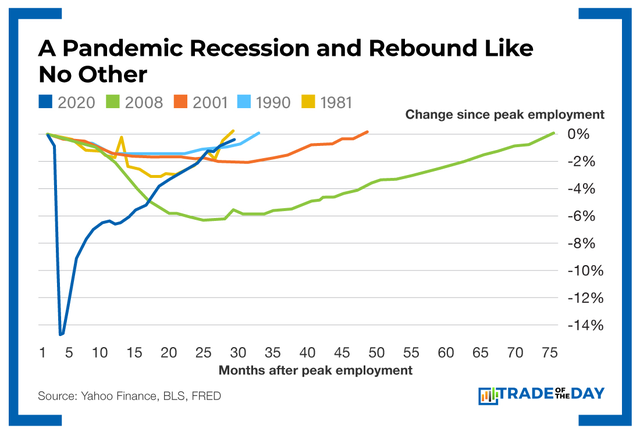

The job market recovery after the pandemic-induced recession in 2020 has been remarkably rapid compared with other notable recoveries in recent history. Last month, the labor market reported an increase of 390,000 jobs. So despite increasing recession concerns, the labor market is holding strong.