Our Overnight Trade Strategy Rings Up 44% on Wells Fargo

Lately, we’ve been getting a lot of “buzz” about our Overnight Trading methodology.

And no wonder…

The strategy is so simple.

First, you make one simple trade before the markets close at 4 p.m. ET.

(I’ll tell you exactly what trade to make and will do all the due diligence beforehand.)

Then you do whatever you want for the rest of your afternoon. Go to the gym. Watch a game. Grab a beer with your drinking buddy Stu. Maybe even binge-watch The Morning Show on Apple TV.

The point is… you do whatever you want.

And then, go to bed…

Sleep like a baby…

And the next morning, you can wake up richer.

In theory, it sounds fantastic. But in reality, does it really work?

Well, let me walk you through our latest Overnight Trade on Wells Fargo (NYSE: WFC) – and you be the judge.

Here’s how it worked…

It began this past Monday when I outlined the Overnight Trade candidates that I was tracking in The War Room.

When it came to Wells Fargo, I wrote…

Let’s get positioned to play any sort of oversized financial earnings reaction – starting tomorrow morning – by moving into WFC. Do they have any more skeletons in their closet? We’ll know tomorrow. But for now, let’s get positioned for a move in either direction. For just above $1 total, this one’s just too cheap to let pass.

For a total of $1.11, War Room members entered a call and put combination on Wells Fargo that allowed them to profit no matter which way the stock moved in reaction to earnings. And then, we logged off.

The very next morning, you probably heard about what happened next…

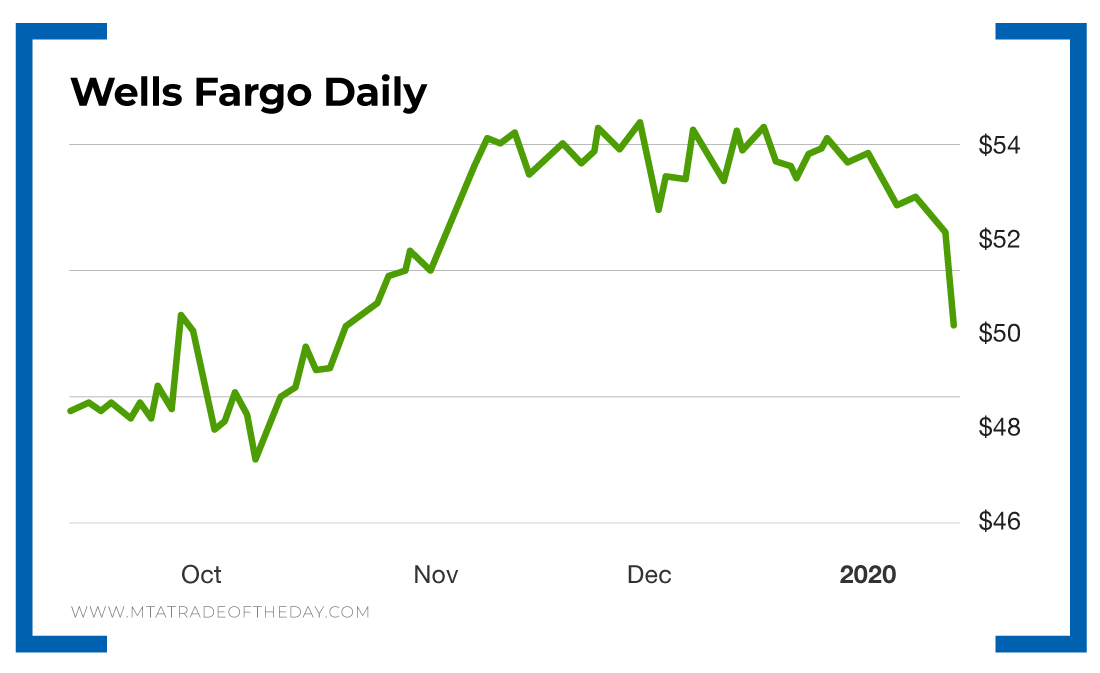

In Wells Fargo’s first earnings report after Charles Scharf took over as CEO in late October, the company reported earnings per share (EPS) of $0.93 on revenue of $19.86 billion – both of which were below the consensus estimates of $1.12 in EPS and revenue of $20.14 billion.

On the news, shares of Wells Fargo dipped below $50, which allowed members to sell their call and put combo for $1.60. All told, it was an overnight winner of 44%.

Action Plan: Bank of America is the next financial company to report earnings. After that, Charles Schwab reports before the open on Thursday – and I believe this is the company’s first earnings report after its market-altering decision to eliminate trading commissions.

Could either of these names lead to an overnight trading opportunity? Join us in The War Room – and you’ll know the answer in real time!

Want to experience your own Overnight Trades? Click here!