Poolcorp Stock: Why I Still Recommend It $100 Later

Back on May 20, I wrote a Trade of the Day, titled “You’ll Never Guess What’s Sold Out Across America Right Now!”

The article was on Poolcorp (Nasdaq: POOL).

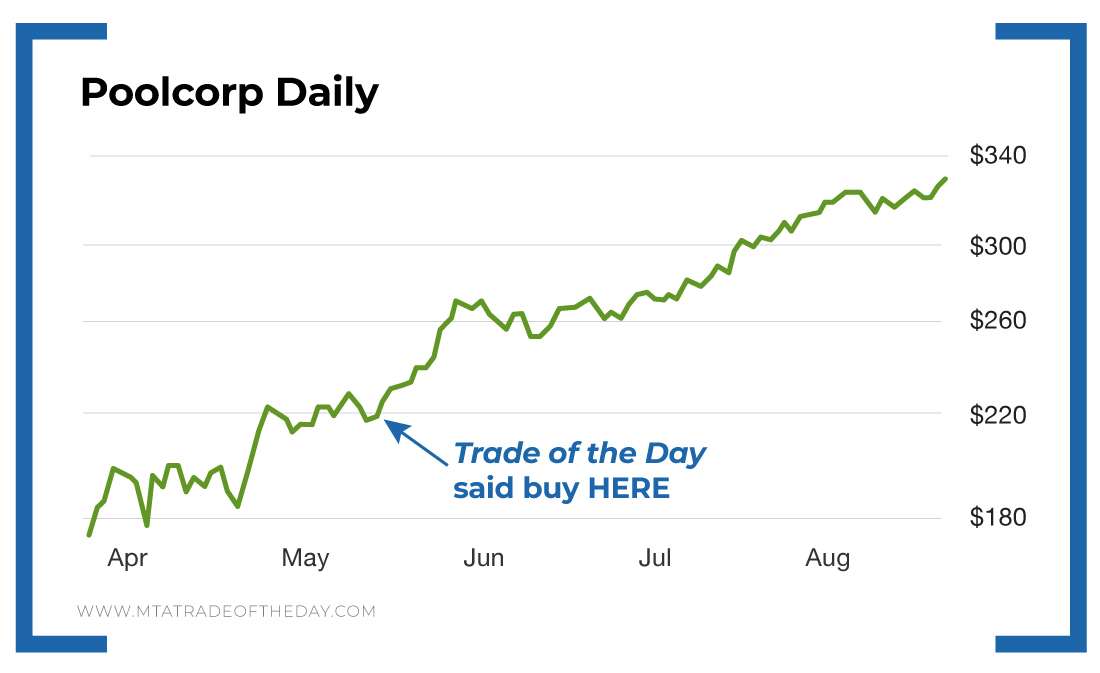

At the time, Poolcorp was trading around $230 per share.

Expensive?

Perhaps. But I still said to buy it (or even sell puts against it).

Specifically, I wrote the following:

Poolcorp is an expensive stock, which means that the options carry a big premium. However, this might make for a nice stock play – or even a put sell.

How has this recommendation performed?

Handsomely, to say that least.

Today, Poolcorp trades for just under $340 per share.

It’s gained $100 since my first recommendation in May.

And guess what? I still like it!

You see, this story continues to get stronger and stronger…

As I’m sure you’ve guessed, Poolcorp is a wholesale distributor of swimming pools and supplies. And when it comes to Wall Street, there’s really only one way to play this emerging trend of getting outside and swimming in your backyard pool.

Poolcorp has a 45% market share in the swimming pool sector, which is 10 times larger than its top competitor’s.

Over the past 10 years, it’s had a 7.6% compound annual growth rate – which is a number that I believe will only get stronger.

Even more upside? Yes, I believe so.

For a more detailed breakdown, please review my original Poolcorp alert by clicking here.

P.S. Do you want to get the one top pick from Karim and me – every single week? Better yet, do you want this one top pick to come to you in an engaging video where we tell you when to buy and sell? If so, then we have good news. Our brand-new Trade of the Day Plus service is coming this September. Keep a lookout!