5 Simple Trading Tips to GROW a Small Account

If you just opened a new Robinhood, E-Trade or TD Ameritrade account, this e-book is perfect for you.

It’s a NO-B.S. guide on how to properly get started trading and how to avoid some common mistakes.

This will set you up for success right from the start.

I’ve got five great tips, and they’re coming straight at you starting now.

#1. Trade What You Already Know

Occasionally, a friend or family member will come up to me and say that they just opened a trading account, and then they inevitably ask, “What stocks should I buy?”

My answer is always the same: Invest in a company that you already know.

Here’s what I mean. For my softball buddies, I tell them to buy a stock like Anheuser-Busch (NYSE: BUD) or Nike (NYSE: NKE).

And that way, when they notice more 21- to 25-year-olds drinking Bud Light Lime, or when they see their wives buying more Nike running shoes, they can learn how to turn those observations into profits.

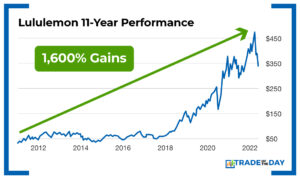

Or for all you ladies out there, imagine if you had bought Lululemon (Nasdaq: LULU) stock at the same time that you bought your first $100 pair of black yoga pants.

Over the last 11 years, Lululemon stock has gone from $20 up to $340.

That’s a 1,600% gain.

So, every $5,000 in Lulu would be worth $85,000 today.

It just goes to show you that when you’re starting out, you should invest in what you already know.

The last thing you want is to get some money tied up in a complex technology that you know nothing about.

I mean, for me, whenever some tech guy starts talking to me, it sounds like that teacher from Charlie Brown.

Here’s my rule.

When you have a $500,000 trading account, and you can just throw speculative money into 2,000 shares of some cloud space gizmo.com, sure, roll the dice.

But right now, when you’re first starting out with a small account, keep it simple.

And that means trade what you already know.

#2. Position Size Like a Pro

Alright, so the second you open your new trading account, I know you’re going to be super excited.

I mean, you’ve been on the chat boards.

You’ve seen the Reddit user saying they grew $1,000 into $20,000 in seconds, and you’re eager to ring the register alongside them.

But here’s the thing.

Trading is not a sprint, and it’s not a marathon either.

Rather, trading is a game that never ends.

I mean, each new day comes with new information, new opportunities and new ways to profit.

Therefore, you must always have some cash – or, as we call it, “dry powder” – on hand to move into the very best opportunities as they present themselves.

The way to do that is to position size like a seasoned Wall Street pro.

So, here’s my general rule for a small new account.

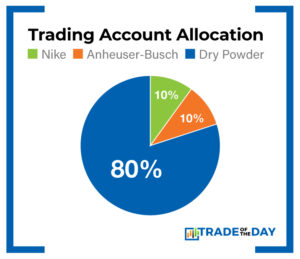

Allocate 5% to 10% of your total account value to each new play.

So, you might have a few shares of Nike and a few shares of Anheuser-Busch, and that’s 20% of your account.

And that leaves 80% of your trading account to play with.

So then if something juicy presents itself, if you happen to find the next Lulu trading for $20 a share, you have the ability to make that play as well.

Nothing is worse than missing out on an explosive winner just because you didn’t have the ability to jump in immediately.

If you miss those opportunities, that ship has sailed.

So please don’t be that guy standing on the dock, holding a suitcase with a sad face.

At the same time, you also don’t want to be that guy who sits down at the poker table, gets dealt his first hand, sees one ace, gets all excited and fired up, and shoves all in.

That sort of untamed aggression rarely pays off.

So as a new trader, stick to the allocation model of 5% to 10% of your total account for each new trade.

As you grow your account and grow more comfortable with investing, you could adjust those percentages, but to start out, it’s critically important that you position size properly.

As odd as it may sound, this will actually help you make more money with a much, much higher winning percentage.

#3. Define Your Risk Ahead of Time

Define your risk ahead of time – then don’t freak out.

Take a deep breath. I get it.

When you’re just starting off, especially with a small account, you really don’t have a lot of room for error.

You’re entering this new game, and it can be pretty stressful.

I mean, investing and trading – it’s all a new experience for you, and you have skin in the game. Your hard-earned money is now in play.

Here’s a common mistake I see that scares a lot of people off.

They make their first trade, and inevitably, it goes down.

So they see a trading account in the red and get scared, freak out, panic, sell at a loss and then never try it again.

Look, I know the feeling. It happens to everyone.

And in many respects, I’m convinced that Wall Street is designed for the sole purpose of kind of making you second-guess yourself.

But luckily, there’s an easy way to resolve this.

So, my message to you is simple.

If you define your risk ahead of time, you won’t freak out.

Here’s what I mean.

Say you buy $500 worth of Nike, and right away on Day One, you set your total downside risk at something you’re comfortable with.

I recommend 20%.

That way, if your $500 worth of Nike goes down to $400, you’re out.

No questions asked.

I mean, sure, you lost $100, which sucks, but that won’t bankrupt you either.

And I’ll be honest: Markets can be volatile.

So, there’s going to inevitably be one of those days where the market sells off and you’re showing a paper loss.

But again, don’t freak out.

Remember a couple of key things.

First, you haven’t officially lost until you decide to sell.

If you see a 5% drop on any given day and you’ve defined your total risk ahead of time, you won’t get caught up in making an emotional decision.

And second, if you know your total risk from Day One, you’ve already made the smart, disciplined move and planned ahead.

On that particular day that the market’s dropped because a tree happened to blow over in the woods – which, in some odd way, pushed the markets down – you won’t freak out because you’ve already prepared ahead of time.

This tip will help eliminate decisions based on emotion – that alone puts you well ahead of every other new trader.

#4. Never Second-Guess Taking Profits!

Never, ever, ever, ever, ever second-guess taking profits.

Here’s a little secret.

Nobody in the history of Wall Street can consistently buy at the exact bottom and sell at the exact top. Nobody.

Don’t ever beat yourself up because you didn’t pinpoint the exact bottom or the exact top.

However, I’m sure we can come pretty darn close, and being in the general vicinity is good enough.

Let’s say you got in around a bottom and your stock is rising.

Things are going well and you’re happy with your profits.

Soon enough you’re going to find yourself asking:

“How long can this party last?”

“Should I sell to lock in a gain?”

“Could there still be a lot more upside ahead?”

Again, I’ve been there. I get it.

When it comes to taking profits, you’re always going to find yourself with an angel on one shoulder and a devil on the other, each talking in your ear.

The angel is saying, “Don’t be greedy, take your profits, be smart!”

Of course, the devil on the other side is saying, “You idiot, you’re leaving money on the table, hold for more!”

How the heck do you resolve this?

Luckily for you, I have a solution.

Whenever you find yourself with this dilemma, sell half.

This accomplishes two things:

- It locks in profits, something that you should never, ever second-guess

- It still allows you to be positioned for further possible upside.

It’s the best of both worlds.

In trading, tricks like these are invaluable to have in your back pocket.

Sell half, then let the second half continue to run.

Now, if that remaining half starts to dip back down, say, 10% below your first exit, then close the rest out entirely, because nothing is worse than watching a winning position turn negative.

Don’t let greed take a hold of you.

Stay disciplined, stay smart, sell half and never second-guess taking profits.

#5. Get Access to Good Research

Investing without having good information or research is a critical mistake when working with a small account.

There is a ton of information for new traders out there, but it’s not all the same quality.

Anyone with a webcam and a brokerage account can provide trading advice.

But if you want the best chance for success, find the very best advice.

I’ve been actively trading the markets for decades.

Back in 1999, I started trading in the Apple Computer trading pit on the Chicago Board Options Exchange.

And today, it’s my job to keep track of every stock, anticipate every event that’s influencing the current market conditions… and distill it all down into the most potentially lucrative investment recommendations possible.

Finding the precise moment to make your trade could be the one and only difference between a sizable profit and a frustrating loss.

That’s why my new “idea-sharing” research service is perfect for you.

I call this idea-sharing research service Trade of the Day Plus.

It’s simple… it’s accurate… and it’s very inexpensive.

It takes you just five minutes per week to review.

Every day the markets are open, I carefully observe what’s going on in the markets, the world news and specific investment vehicles.

I filter through it all weekly, and I cherry-pick the one idea that I consider to be the best-timed recommendation to share with you given the current market conditions.

Then, I’ll make a video recording of that pick – telling you the exact play to make at the exact time, along with all of my analysis – and send it to you after the close of trading every Wednesday.

Each week… this is the one idea that you can act on immediately – above everything else.

Whatever strategy offers the best-timed entry that week, I’ll share it with you.

No matter what the pick is, you’ll get all of my research as well as the exact details of that specific recommendation – including the ticker symbol – every single Wednesday afternoon.

It takes you only a few minutes to watch… plus a minute or so to place your trade for the next day (if you choose).

This allows you to get the full details of that week’s opportunity and get on with your day… confident you have the best-timed trading idea to help you succeed in current market conditions.

And since we launched this trading system with our Trade of the Day Plus service, there is no other way to say it… The results have been badass.

Last year, we took the top prize for the best financial newsletter track record amongst our peers – outperforming the S&P 500 by more than 41%!

And we’ve been able to hand our members an 83%-plus win rate with our weekly Wednesday picks.

If you want to up your trading game with one easy-to-digest trade idea once a week, click here to sign up for Trade of the Day Plus now.

Now Go Grow Your Account!

Whether it’s going with what you know, defining what is at risk or simply never second-guessing profits, you are now better prepared than ever.

Take your time, prepare a portfolio strategy, plan ahead as much as you can (especially regarding your exit plan) and make sure you are getting the very best information!

Above all… we look forward to sharing our ideas and strategies with you as you begin this journey into the markets!

Yours in smart speculation,

Bryan Bottarelli