The Basic AF Beginner’s Guide to Trading

Bryan Bottarelli

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely make their way outside the CBOE to individual traders.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely make their way outside the CBOE to individual traders.

Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created, The War Room.

The truth is profitable trading is quite simple – but only if you know what you’re doing.

Unfortunately, for many new traders, that’s the problem. Most new traders have NO CLUE what they’re doing, and as a result, they lose money – especially in volatile markets.

Here at Trade of the Day, we’re going to fix that.

In this report, we will teach you about “the lost art of smart speculation.”

We’ll give you a full breakdown of what options are, why we trade them (and why you should too!), how to identify them and how to leverage them for huge gains.

Then we’ll go over some more advanced strategies and even what to do if you step on a “land mine.”

You see, trading is an art form… a refined skill… and we’re here to teach you the most important principles of consistently winning.

Many traders think they can trade, but most of them soon realize that they’re wrong – and they’re broke.

With our guidance, you’ll receive calculated, elegant, well-thought-out and extremely precise “smart speculations” that have proven to be successful and enormously profitable – for decades.

If you are ready to start trading on the stock market but you aren’t sure of the first steps to take, you’ve come to the right place.

At Trade of the Day, our purpose is to help you make “smart speculations.” Of course, not every speculation will pan out. But the ones that do hit will give you a toe-curling rush of adrenaline unlike anything you’ve ever experienced.

It’s this exhilaration that makes life worth living, and that’s what we want you to experience by following our unique and proprietary techniques.

Understanding “the Lost Art of Smart Speculation”

To make money trading, you need to change your approach to speculation. Most wealth managers will tell you to safely tuck away 90% to 95% of your money, earning a modest return that’s hopefully outperforming the S&P 500 while also outpacing inflation.

That’s smart, that’s safe, that’s secure – but it’s also boring.

We’ll help you put the remaining 5% to 10% of your wealth to work by speculating intelligently.

Let’s be crystal clear – this isn’t reckless trading. Far from it. Rather, you’ll receive calculated, precise speculation strategies that have proven successful and enormously profitable for decades.

A big part of smart speculation is being properly positioned ahead of time for a future market move. There’s no point hearing about all the “big winners” on CNBC after they’ve already run up. We want to be the ones buying ahead of the hoopla surrounding a newsworthy move or event.

If your trade is executed properly – and your speculation hits – you’ll be the one cashing in when other traders are just hearing about the payoff.

What Are My Options?

Smart speculation is also about leverage. When trading on the market, you should always be asking this question: “How can I get the most bang for my buck?”

The answer to that question is often options.

Not options as in choices, but rather the investment vehicles known as options contracts.

An options contract offers the holder the opportunity to buy or sell – depending on the type of contract they hold – a stock.

Options can be awesome tools in the hands of a smart speculator.

They’re more volatile than stocks, so outsize triple-digit gains are much more frequent.

They’re cheaper than stocks too. Buying options contracts will often give you exposure to big-name companies at a fraction of the cost of their shares.

Understanding the Bid, the Ask and the Spread

Two of the most important parts of options trading are…

- Knowing what an option should sell for

- Getting it for what it’s really worth.

This requires knowledge of the bid, the ask and the spread.

The bid price is what people are willing to buy the option for.

The ask price is what owners of the option are willing to sell it for.

The spread is simply the difference between the bid and ask prices.

Most transactions in the options market will take place in the spread.

For example, let’s say shares in ABC Inc. are trading at $15.50. You want to buy July call options, and you see this…

Bid: $0.40 | Ask: $0.55 | Last trade: $0.55

Here’s why 90% of people trading options lose money…

A rookie looks at those numbers and immediately dives in and pays $0.55 for the option. Since the option is worth only the bid price, they’re already down 37% before they’ve even started.

Unless you must get in immediately, never pay the ask. Always try to split the difference between the bid and the ask to eliminate the market maker’s edge.

In this case, enter a bid at $0.45 and see if they bite. If not, then try $0.50.

More often than not, you’ll get filled without paying the full ask price.

What Makes Up the Price of an Option?

What Makes Up the Price of an Option?

- The premium is the price you pay to open a put or a call. The premium is the sum of an option’s intrinsic value and extrinsic value, or time value. Premiums are arrived at through the open competition between buyers and sellers.

- Intrinsic value is the portion of the premium representing real value. An option has intrinsic value if the difference between the market price and strike price would make the option profitable if exercised.

- Extrinsic value is the portion of the premium representing time and volatility as opposed to the option’s real, or intrinsic, value.

How to Enter an Options Trade

When you’re trading options, prices can move fast – so here’s the trick. While we don’t advocate chasing prices, we also don’t want you to miss out on a profitable trade.

As a general rule, if prices are above our listed buy price, give the trade 10 to 15 minutes. If prices dip back down, then enter the trade.

If prices DO NOT come back down, then feel free to pay 5% above our listed buy price – just to ensure that you’ll be able to enter the trade.

That way, you don’t allow a dime to prevent you from participating in a strong gain.

If prices are higher than the 5% buffer zone, then you must let it go. You missed it.

This will ensure that you don’t chase the price and pay too much.

But don’t worry, there will be plenty of other profitable trades coming your way.

How to Read an Options Symbol

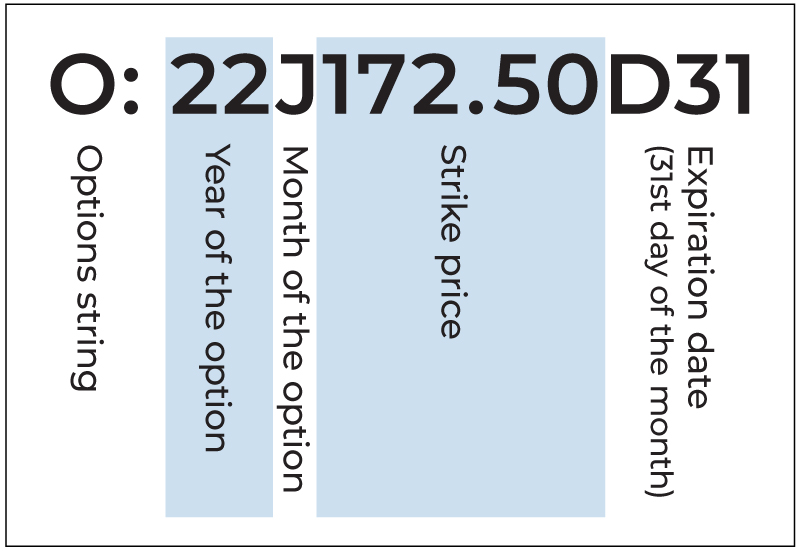

Let’s use this options symbol as an example: (O: 22J172.50D31).

- The “O” means that this is an options string.

- “22” stands for the year of the option, 2022.

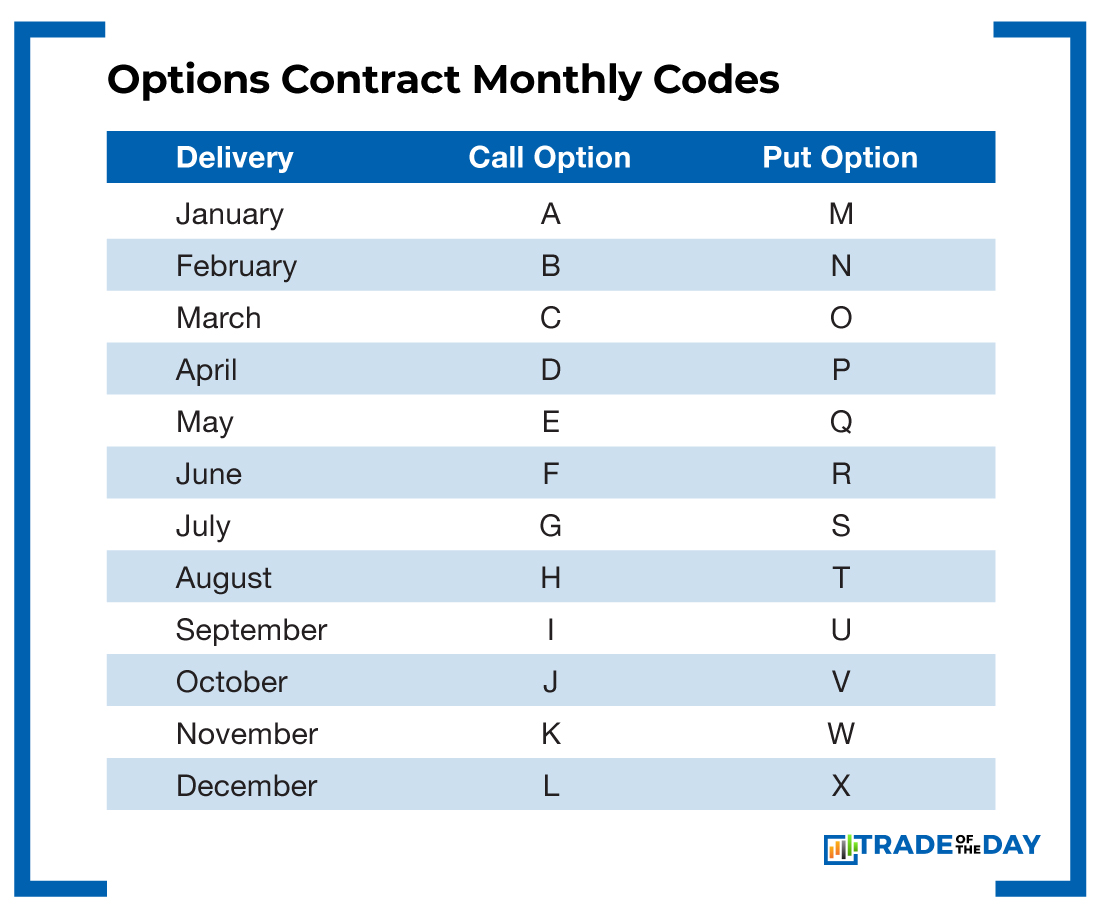

- “J” refers to the month of the option, which in this case is October, and that it’s a call option. See the table below for more info.

- “172.50” is the strike price of the option.

- “D31” signifies the expiration date. “D” stands for “day,” and 31 means the option expires on the 31st day of the month (in this case, October).

Pro Tip: When it comes to our recommendations, we mostly buy and sell call or put options, and a Level 2 brokerage account meets the trading requirements.

We also trade spreads – which you can also trade with a Level 2 account. Put selling requires a higher-level account.

But as a first step, start with a Level 2 account and go from there.

Lining Up a “Sniper Sell”

![]()

“Sniper sell” is a term we coined to represent our automatic, no-questions-asked sell price.

For example, we may recommend an option for $2 and set a sniper sell at $4. Let’s say that around lunchtime, news is released that pushes the option up to $4, but you don’t see an alert advising you to sell. In this case, do not wait.

With the sniper sell already in place, you know when to sell and take your profits.

This is a safeguard that works in your favor to maximize your profits on any quick moves.

Most traders put in stop limit orders to protect their downside. But you can also set a sell order ahead of time… at a higher price than you paid.

That way, if some news item triggers a price jump while you’re away from your computer, you can still lock in the profits.

The “Earnings Strangle” aka “Overnight Trade”

This is an options trading strategy used just prior to a company reporting earnings.

A balanced position of calls and puts is established on the same underlying asset and maturity (expiration date), but at different strike prices.

In simple terms, getting positioned on both sides of a trade is called a strangle.

Executing this maneuver ahead of an earnings announcement is known as an “earnings strangle.”

By entering a call – and also a put – on a stock before an earnings release, you can make money no matter whether that stock moves UP or DOWN in reaction to an earnings release.

As long as the move is large enough, you can make money either way.

How to Deal With a “Land Mine”

In the trading world, you will at some point step on a “land mine,” which is a term used to describe a completely unforeseen event that moves a particular trade against you. It could be one of literally hundreds of things – all of which are utterly unpredictable.

Land mines happen to everyone.

They’re part of the game.

When you do happen to step on a land mine, chalk it up as an unlucky loss and move on.

Don’t fight against it, thinking, “I’m right, and the market is wrong!” That rarely ends the way you want.

Rather, just realize that you did nothing wrong – the news flow just went against you that day.

Don’t let it ruin your speculative spirit!

Close the trade and move on to the next!

Thank you for your interest in Monument Traders Alliance. I’ll hopefully see you very soon inside The War Room.

Yours in smart speculation,

Bryan Bottarelli, Head Fundamental Tactician

Monument Traders Alliance