The Top 10 Insider Stocks to Buy Right Now

Everyone in the stock market is looking for a “magic signal” – a single factor that indicates an unequivocal “BUY” with guaranteed profits ahead.

The honest truth is that there is no magic signal. You won’t find one by drawing lines on a chart. You won’t find one with a mathematical formula. And you certainly won’t find one by using the ratings of the big brokerage houses.

However, if you could follow the signals of the people “in the know,” it seems logical that you would dramatically increase your chances of making a profit.

What Is Insider Investing?

It is the trading of a public company’s stock or other securities (such as bonds or stock options) by individuals with access to nonpublic information about the company.

The fact of the matter is, there are always people who know more about a company than you can glean from months of reading financial statements and industry reports… People with more knowledge than the most highly paid and qualified professional analysts… Individuals who are privy to a treasure trove of information that is not available to the public…

In other words, the corporate officers and board members who head up every single company.

Think about it. When a CEO sees that their company has developed a new product that can and will revolutionize that industry, they’ll call their broker and buy more shares. If the CFO sees a huge backlog of orders that will push corporate earnings well beyond analysts’ forecasts, they’ll do the same. When members of the board see the early stages of a surge in demand on their “private sales reports,” they’ll pile in too.

The Ultimate Indicator That a Stock Is Poised for Blastoff

This may seem unfair. How can an outsider stand a chance in the stock market when all the real money is made by the bigwigs and corporate insiders? There’s actually a way for outsiders to find out what the insiders are up to. It’s called a Form 4.

The Securities and Exchange Commission (SEC) requires a Form 4 filing for every insider transaction. Those “in the know” have to report exactly what transactions they’ve made. The SEC files them all away in a huge database and monitors them closely.

In the meantime, all the moves of all these insiders are sitting there like an open book… telling you exactly which companies to buy. Research shows that sound companies with widespread insider buying tend to outperform the market by a substantial margin. Some of the most successful investors of our era attribute part of their success to following this signal.

Legendary fund manager Peter Lynch believes there is no better tip-off to the probable success of a stock. George Soros, one of the most successful hedge fund managers ever, has also used the strategy to earn double-digit returns annually. And this is one of many arrows in the quill of our own Bryan Bottarelli, who has used this technique with great success with Monument Traders Alliance’s .

In fact, insider buying is one of the investment world’s crown jewels – certainly the purest and simplest way to make money in the stock market. Furthermore, it’s important that you understand that you can also take advantage of this information.

Your Inside Guide to Profits

Following the insiders seems easy enough. On the surface, it seems like a simple two-step process:

- Just look at the Form 4 listings and simply buy what the insiders are buying.

- Then take the plunge yourself and watch your profits multiply.

Unfortunately, it’s not that simple. First of all – although you might be able to get access to the Form 4s – there are literally dozens filed every day. Buying dozens of stock positions every day isn’t feasible… or likely very profitable. You have to know what you are looking for. Random insider transactions by themselves are not a strong enough signal to indicate a successful outcome. Looking at the Form 4s is just the beginning… Knowing what you are looking for is the trick!

To fully and safely exploit this enormous advantage, you need careful research, sharp instincts and unique expertise.

Before heading up Trade of the Day, Bryan cut his teeth on the floor of the Chicago Board Options Exchange (CBOE). He subsequently took what he learned there and founded his own research firm, Bottarelli Research. In the past 20 years, Bryan has made more than 5,400 live trades, with an average gain of X% every X days. In his long career, he has learned from experience which systems work and which don’t.

Fortunately for subscribers of Trade of the Day, Bryan has made a science out of studying Form 4s and charts and winnowing out meaningless purchases and weak buying signals by focusing on decisive factors.

- Insider buying, not selling: Insider selling is not nearly as powerful an indicator of a stock’s future performance. There are many reasons why insiders sell their stock. They could be exercising options. Or getting cash for a divorce settlement. Or putting a kid through college. Or buying a home. On the other hand, there’s one big reason for buying their company’s stock. It’s to take advantage of what they expect to be an upward surge.

- Significant buying: It counts much more if we’re dealing with six- and seven-figure investments. If the insiders commit enough money so that losing truly hurts, the purchase is an even more powerful testament of confidence.

- Insider buyers who have successful track records: Bryan studies the historical success rate of insider buyers. Have they been winners? Do stocks go up after their purchases? If so, their current transactions carry even more weight.

- Insider buying clusters: When “smaller fish” add their hard-earned money to the investments of the higher-ups, it’s yet another powerful signal that something good is about to happen.

- Insider buying at the high end of the price range: When a company is flying high, moving upward on heavy volume – and the insiders are still buying – that’s a very positive predictor of success.

- When certain key beneficial owners (an individual or firm that owns more than 10% of the company) are buying: There are certain management firms – hedge funds and individuals – that, because of their large stock position, can gain exclusive access (and influence) to corporate management. If these beneficial owners like what they hear, they’ll buy additional large blocks of shares… which is often a good sign of things to come.

When several of these factors coincide, and when our analysis confirms that the company is undervalued, profits can be enormous.

Betting on the Insiders for the Best Returns in Your Portfolio

No doubt, “riding the coattails” of the insiders is an outstanding way to improve your investment returns.

After all, insiders know their companies better than you or I ever could. They see things nobody else is privy to. They know what the numbers are going to be in advance of publication. They know about contracts and deals that are in the works. They have access to plans and predictions… new products and campaigns… data and reports. And if there’s something they don’t know, they have direct access to people who do.

So whether you have the time and the inclination to sort through the scores of insider transactions each day and follow each lead to form an in-depth analysis of the company, or whether you choose to let someone do the heavy lifting for you – saving you time you’d rather spend with your family and friends – following the insiders can give you the “unfair advantage” that you’ve been looking for to supercharge your portfolio.

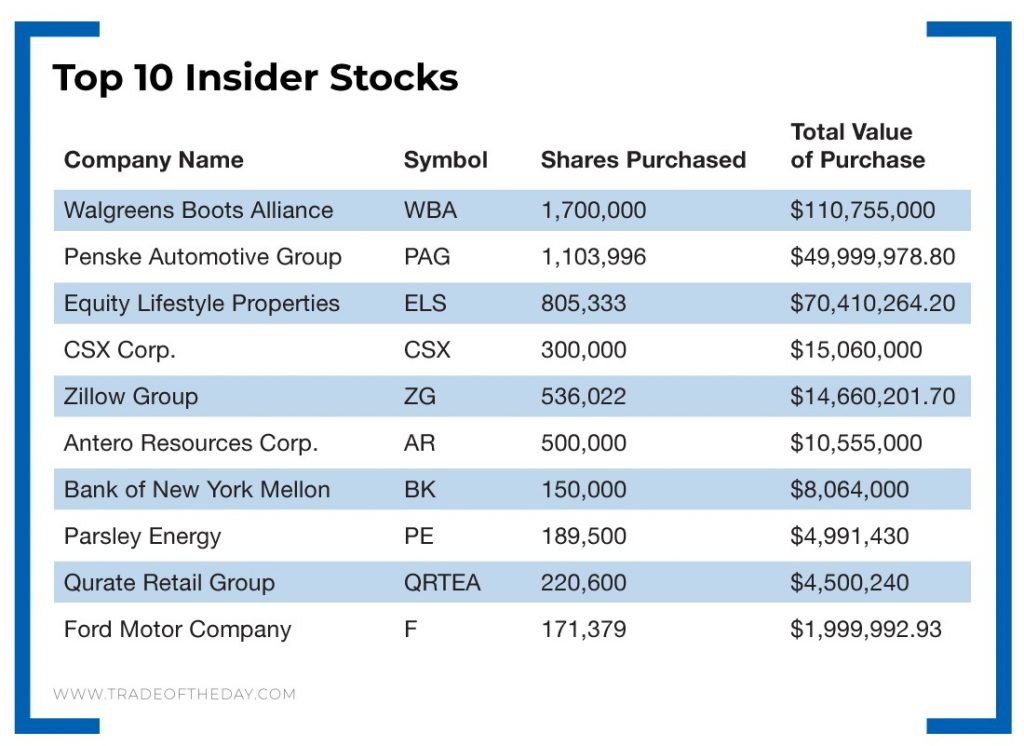

And to get you started, here are 10 of the top insider stocks available today…

* This chart reflects trades since January 1, 2019