The Top 3 Inflation-Busting Energy Dividend Stocks

Bryan Bottarelli

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely make their way outside the CBOE to individual traders.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely make their way outside the CBOE to individual traders.

Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created, The War Room.

How to Pocket Dividend Yields 32X the Average National Savings Account Yield

Right now, you have an urgent opportunity to profit from an inflation-induced energy trend and collect big dividend payments in the process.

It’s becoming evident that the Biden administration’s aggressive mandates and goals for renewable energy use are simply not feasible – and are overtly dangerous – for our modern industrial economy.

We only need to look at Europe’s aggressive dismissal of fossil fuels to realize the potential for a similar impact on the United States. Europe’s dependence on Russia for natural gas was a colossal policy mistake.

Nevertheless, the Biden administration continues to advance a heavy dose of green energy legislation, as well as a host of new regulations, fees and restrictions on the fossil fuel industry.

Add Biden’s executive order banning U.S. imports of Russian oil, natural gas and coal…

Not to mention the OPEC cartel countries’ decision to cut their oil production quotas…

Plus out-of-control, misdirected government spending…

And you have an energy crisis in the making.

It’s Déjà Vu…

This is starting to look like the period of rampant inflation of the late 1970s… but worse! The federal government’s debt load is much larger, and the Biden administration’s anti-fossil fuel policies are creating an economic crunch.

Let’s be perfectly honest. The rise in oil prices in 2022 was much more than a Russia story… Before Russia’s attack, the price of oil was already well over $90 per barrel.

And the thing is… nobody should’ve been surprised. President Biden himself guaranteed before he entered office that he would restrict the use of fossil fuels.

When he took office, gasoline cost only $2.38 a gallon. But he shut down the Keystone pipeline on his first afternoon in the Oval Office, and then he stopped all drilling permits on federal lands. By February 2022, before Russia had even invaded Ukraine… gasoline was already $3.53.

The war in Ukraine didn’t create the rise in gas prices. It only accelerated it.

The Biden administration authorized the release of more than 125 million barrels of oil from the Strategic Petroleum Reserve, which temporarily lowered prices. But now that program has concluded, and those reserves need to be replenished… further adding to demand.

The sharp move upward in oil is a story of fundamentals. The supply and demand relationship has tightened dramatically… a problem that is NOT transitory!

Add in inflation due to decades of easy money policy for the Fed… and you have a recipe for rapidly rising prices – especially in the energy sector.

But amid the chaos, we can use higher-income-producing assets to position ourselves for profits.

Oil was a wonderful investment in the 1970s. The price kept rising the entire decade. It went up over 1,000%.

And we expect to see a huge run-up in oil once again!

From an investor’s standpoint, it’s clear that solid, well-run energy plays are profitable places to be. You should look for oil and gas plays as well as refiners.

Energy stocks with stable and sizable dividends are great investments to own in an environment of rising oil prices and inflation.

Here are three of our favorites…

#1: Plains All American Pipeline (8.1% Dividend Yield)

Based in Houston, Texas, Plains All American Pipeline (Nasdaq: PAA) is an oil and gas pipeline master limited partnership (MLP) with operations in the United States and Canada.

Plains is one of the largest oil and gas midstream companies in the U.S. Its crude oil business owns or leases more than 18,300 miles of pipelines. The natural gas business has approximately 1,620 miles of active natural gas liquid (NGL) pipelines.

The company’s pipelines stretch north from Louisiana to Illinois and extend from Midland, Texas, east to Houston and north to Alberta, Canada. They can transport more than 7 million barrels of oil and NGLs each day.

In addition to pipelines, the company has 140 million barrels of crude oil and natural gas storage capacity, four marine facilities for overseas shipping, four natural gas processing facilities, 23 oil and gas rail terminals, and thousands of rail cars, trucks and trailers.

Plains is in the most important energy basins in North America, including the Bakken Shale, the Permian Basin and the Western Canadian Sedimentary Basin.

Annual revenue soared 36% in 2022 to $57.3 billion, compared with $42.1 billion in 2021. Net income per unit – MLPs issue units instead of shares – jumped 116% in 2022 to $1.19, compared with $0.55 in 2021.

For the first nine months of 2023 (as of this writing, 2023 full-year results have not been released), revenue clocked in at more than $36 billion. Net income per unit jumped nearly 17%, from $0.89 to $1.04.

Management raised its 2023 guidance for gross profit to a range of $2.6 billion to $2.65 billion. Cash flow is so strong that the distribution – MLPs pay distributions, not dividends – for 2023 was increased 23% to $1.07 annually. Management intends to increase the distribution by an additional 19% per unit in 2024. This would increase the distribution by $0.20 per unit to $1.27 annually.

For 2024, that implies a healthy 8.1% dividend yield based on the current price. And you can count on that distribution to keep coming. Plains has been paying a distribution since 1999.

The outlook is extremely favorable – both for the oil and gas industry and for Plains.

Lofty Energy Prices

The price of West Texas Intermediate (WTI) crude oil has gone up by as much as 122% since Biden was elected. The price of natural gas in the U.S. hit a 14-year high in August 2022 and has increased by as much as 120% since Biden took office.

And, as we are all aware by now, thanks to misguided energy policies and Russian sanctions… the prices of both oil and natural gas are much higher in Europe.

We expect oil prices to soon rise above $100 per barrel for the foreseeable future, while the price of natural gas in the U.S. should also rise due to heavy demand, inflation and ongoing embargoes on Russian gas.

That’s bad news for consumers, but good news for the oil and gas industry. So if demand is constant or rising, which it will be, pipelines – the cheapest way to move oil and gas – are full.

Crude output from the Permian Basin, located in west Texas and southeastern New Mexico, increased by almost 1 million barrels per day in 2023. Plains transported more than 5 million barrels of oil a day from the Permian in 2023.

The company has not only extensive infrastructure in that basin but also excess capacity. That will allow it to meet increased production there with minimal capital expenditure.

Management clearly believes shares are headed higher. Eight insiders have purchased nearly 1.5 million units (shares) in the past six months. Only one insider has sold units.

And insiders own over a third of Plains’ outstanding shares. That’s the kind of management-shareholder incentive alignment we are always on the lookout for.

Plains shares are cheap, trading at slightly more than book value and only 10 times next year’s prospective earnings.

Given Plains’ healthy dividend yield, strong growth and discounted price… now’s the time to jump on it.

#2: Black Stone Minerals (11.7% Dividend Yield)

Black Stone Minerals (NYSE: BSM) is one of the largest owners of oil and natural gas mineral interests in the United States. The company owns mineral interests and royalty interests in 41 states, with a total land coverage of approximately 20 million acres.

Founded in 1876, Black Stone’s sole focus is on acquiring mineral and royalty assets. It employs experienced land- and business-development professionals who work to attract development capital onto the sites the company owns so it can extract the minerals.

Since 1992, it’s invested over $2 billion in acquisitions. The company has 60 productive properties with positions in the largest producing oil and gas basins in the U.S., including positions in the Permian, Haynesville and Bakken basins.

Those regions are coming more into play as the domestic producers increase drilling to make up for Russian exports that are now off the table.

Black Stone’s footprint covers both established and emerging plays that position the company to deliver long-term growth and returns to its shareholders. Its mineral assets are based everywhere from the northern parts of the United States (North Dakota) all the way down to Houston and the Mexican border. And they span from California to Pennsylvania.

Here’s what’s really attractive about Black Stone…

The company’s large, diversified asset base and long-lived, non-cost-bearing mineral and royalty interests provide stable and growing production and reserves for years into the future…

That’s going to allow the majority of generated cash flow to be distributed to unitholders. The current yield is an inflation-busting 11.7%.

More Profits Ahead

Black Stone reported record 2022 results. Revenue, net income and distributable cash flow all reached the highest levels in company history.

In 2022, revenue soared 85% to $663.6 million, net income jumped 183% to $455.5 million and net income per unit increased 183% to $2.18!

Now, that was partly because Black Stone added additional properties and was able to extract more minerals, but it’s also because the company could get more money for the minerals that it was extracting…

The company’s average realized price for a barrel of oil increased from $64.67 in 2021 to $93.65 in 2022, and its average realized price for natural gas increased from $4.16 in 2021 to $7.28 in 2022.

Prices for oil and natural gas have backed off in 2023, but due to increased production and improved operating efficiencies, Black Stone increased distributable cash flow.

For the third quarter of 2023 (as of this writing, 2023 full-year results have not been released), distributable cash flow grew by nearly 7% to $124.4 million. Black Stone has also been significantly reducing debt since 2018. As of October 2023, the company had no debt. That means it has the ability to return even more of its free cash flow to investors via distributions.

And that is exactly what it’s doing.

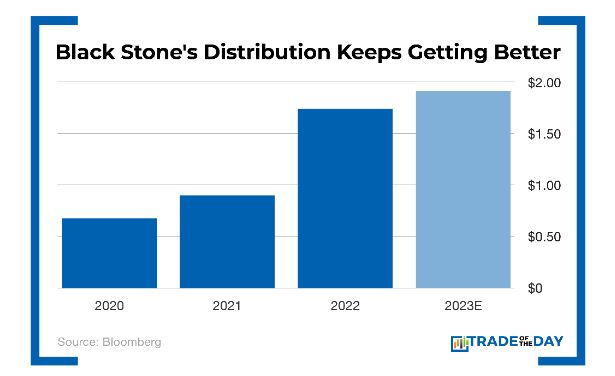

The distribution for the third quarter of 2023 was $0.475 per unit, which means the annual distribution should be at least $1.90 – more than double the $0.945 distribution in 2021.

The stock is trading at a forward price-to-earnings (P/E) ratio of only 7.4. That makes Black Stone look extremely cheap compared with the S&P 500, which has a forward P/E ratio of 22.2.

Insiders are also big holders of shares, with nearly 25% ownership.

Based on what’s happening in the oil and gas sector, there’s good reason for that high ownership level…

Management anticipates good times ahead.

That’s going to make Black Stone shareholders happy… You should join them.

#3: Sunoco (6.2% Dividend Yield)

Biden’s anti-fossil fuel policies and the ongoing war in Ukraine sent the energy markets into turmoil. The subsequent bans on Russian oil and gas imports here in the U.S. penalized Americans more than Russians.

You no doubt noticed higher oil prices at your local gas station when you filled up your tank.

In 2022, gas prices skyrocketed at record rates across the country and hit an all-time high. Gas prices went down in 2023 but still averaged $3.52 per gallon – way above the $2.17 per gallon average in 2020 before all the hostilities began.

While there’s not much you or I can do to lower the price of gas, we can do the next best thing: profit along with the oil companies.

One of the best ways to go about that is to invest in Sunoco (NYSE: SUN).

The company pays a very high distribution to help you offset the rising price of gas and protect your portfolio in a volatile market.

Sunoco’s business is easy to understand. It distributes and sells motor fuels in more than 40 states in the U.S.

Sunoco purchases motor fuel from independent refiners and oil companies and supplies it to approximately 10,000 convenience stores, independently operated dealer stations, commercial customers and distributors. The company also operates 78 gas stations under the Sunoco name.

Thanks to the supply-demand squeeze created by the Biden administration and global conflicts, Sunoco is poised to rake in profits from rising gas prices and the strong demand for oil.

And the company’s unique structure requires it by law to pass along the bulk of these profits to unitholders.

Time to Join ’Em

Each time you fill your tank, you’re contributing to the bottom line of an oil company. As they say, if you can’t beat ’em, join ’em!

Founded in 1886 in Pittsburgh, Sunoco has grown to become the largest motor fuel distributor in the entire United States, supplying over 8 billion gallons of fuel a year.

Sunoco is structured as an MLP. MLPs aren’t required to pay corporate taxes, but they are required to pass on the majority of their operating profits to unitholders.

As such, distributions from MLPs are typically much higher than the average dividend yield you’d get from other investments.

All in all, MLPs like Sunoco are great low-risk, long-term investments that pay out steady streams of income. With oil prices forecast to rise in 2024, Sunoco will have plenty of profits to pass on to investors.

An investment in Sunoco is uniquely positioned to help grow your income. That’s because the company is aggressively adding new customers to its roster of fuel service stations all the time.

Sunoco is also expanding the variety of products that it can offer to existing customers. Offering more products at higher prices is doing wonders for sales. In 2022, revenue climbed 46% to $25.7 billion, from $17.6 billion in 2021.

In April 2023, Sunoco raised the quarterly distribution to $0.8420 per unit, which equals just over $3.36 per unit annually. And the company has been paying a distribution for the past 11 years.

Right now, that distribution gives you a tremendous yield of 6.2%, which is more than four times the average dividend yield of the S&P 500.

Plus, there’s room for the company to raise the distribution. The payout ratio is slightly above 60%.

And Sunoco recently made a huge acquisition to ensure those healthy distributions keep coming. On January 22, 2024, Sunoco announced it is acquiring pipeline operator NuStar Energy. NuStar has approximately 9,500 miles of pipelines and 63 terminal and storage facilities.

Last but not least, the stock is cheap, selling at only 8.8 times 2024’s estimated earnings. The price-to-sales ratio is a minuscule 0.2.

Turn the pain at the pump into something positive.

A Paycheck You Can Always Rely On

Biden’s efforts to turn America “green” could put us in the same vulnerable posture as Europe. But don’t let his ill-advised policies destroy your portfolio…

With inflation still well above normal levels, having a stream of income you can rely on will be invaluable.

Owning these stocks will help you sleep at night because you’ll be winning on two fronts: You’ll know you have tremendous growth potential and a steady income all in one.

Forget Fusion… This REAL Nuclear Breakthrough Could Mean 10X Gains

|

A real nuclear miracle is about to take Wall Street by surprise…

Because an energy breakthrough could 10X this $5 stock over five years.

After a key announcement… you may miss your chance at a piece of the action.

Get the Details Here (Before You’re Too Late!)